EUR/GBP outlook: Pullback needs to register close below key supports to validate reversal signal

EURGBP eases for the second day, with fresh weakness from new multi-month high being boosted by the latest threats that the US would impose 200% tariff in imports of wine from the EU, if the union does not ease tariffs on US whiskey.

The latest rhetoric adds to growing fears that escalating trade war would cause strong negative impact on global economy.

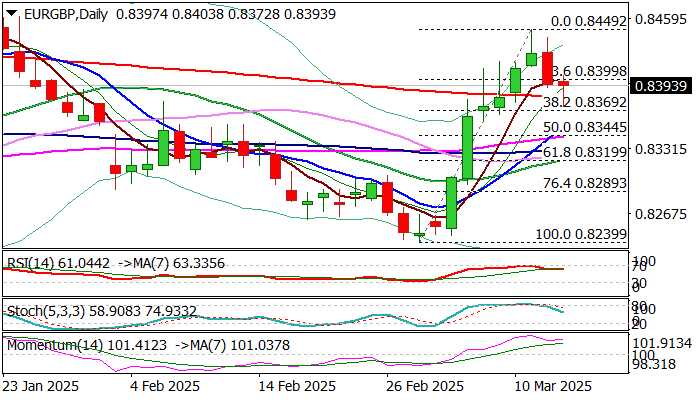

There is interesting situation on daily chart where reversal signal is developing.

Wednesday’s large red daily candle (the first bearish candle after six consecutive green candles) formed bearish engulfing pattern.

Today’s extension lower broke below 200DMA (0.8382) and pressured Fibo support at 0.8369 (38.2% of 0.8239/0.8449 upleg), with daily close below these levels needed to confirm reversal signal and open way for deeper correction.

However, bounce back above 200DMA sidelines immediate hopes of reversal and signals potential alternative scenario on formation of bear trap under 200DMA.

Predominantly bullish daily studies favor scenario of limited dips before larger bulls regain full control.

Look for reaction on 0.8382/69 levels for fresh direction signals.

Res: 0.8417; 0.8449; 0.8473; 0.8500

Sup: 0.8383; 0.8369; 0.8344; 0.8330

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.