EUR/CAD faces selling pressure as short-term uptrend breaks

Market overview

The EUR/CAD pair is under increased selling pressure as market sentiment turns cautious toward the euro. Investors remain wary ahead of Germany’s upcoming elections and U.S.-Russia negotiations in Saudi Arabia, which could influence geopolitical stability, particularly regarding the Ukraine conflict. Meanwhile, the Canadian dollar is finding support from rising oil prices, which has further strengthened its position against the euro.

As the week progresses, inflation data from Canada and consumer confidence figures from the Eurozone are set to influence price action. Expectations of a rebound in Canada’s monthly inflation rate could reinforce hawkish sentiment, supporting the CAD and maintaining downward pressure on EUR/CAD.

Technical analysis

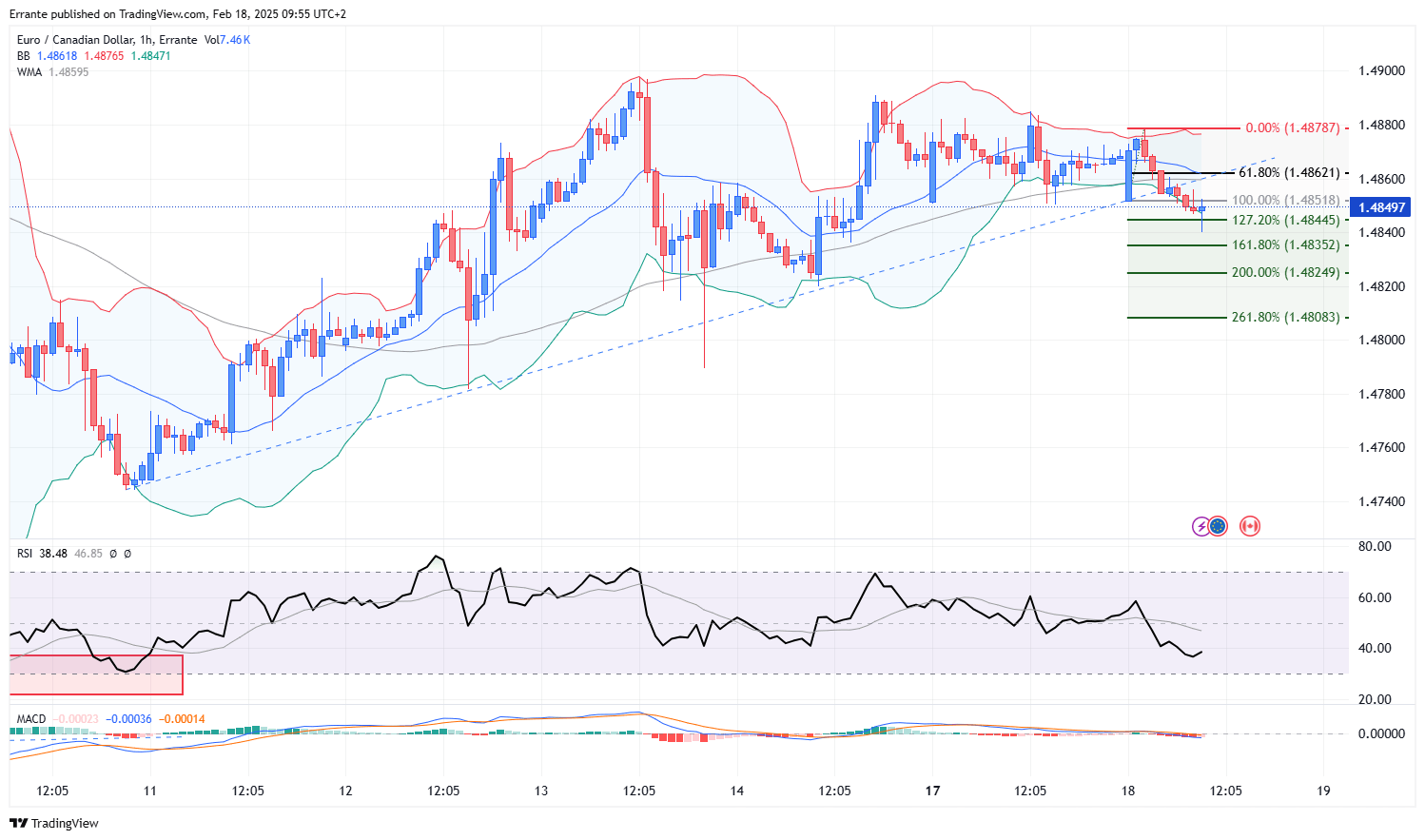

EUR/CAD has broken below its short-term ascending trendline on the four-hour chart, signaling a shift in momentum. Sellers have successfully pushed the price below the critical support level of 1.48518, accelerating bearish sentiment. The next immediate target is 1.48445, which, if breached, could open the door to further declines toward 1.48352, 1.48249, and 1.48082.

The Bollinger Bands are diverging after a squeeze near the previous high, indicating volatility expansion to the downside. At the same time, the RSI has turned lower, confirming a rise in selling momentum. MACD also remains in negative territory, suggesting a continued bearish bias.

However, if buyers regain control, a move back above 1.48621 could shift sentiment in favor of a rebound. A breakout above 1.48787 would invalidate the current bearish setup and re-establish an upward trajectory.

Key technical levels

-

Resistance levels: 1.48518, 1.48621, 1.48787.

-

Support levels: 1.48445, 1.48352, 1.48249, 1.48082.

Fundamental drivers

-

Eurozone Consumer Confidence: Investors will closely watch sentiment data, which could shape expectations for future European Central Bank (ECB) policy decisions.

-

Canada Inflation Data (Tuesday): If monthly CPI figures rebound as expected, it could strengthen CAD by reducing the likelihood of aggressive rate cuts from the Bank of Canada (BoC).

-

Geopolitical Uncertainty: Ongoing U.S.-Russia discussions and the outcome of Germany’s elections could drive risk sentiment, indirectly influencing euro demand.

Conclusion

EUR/CAD remains under bearish pressure, with sellers aiming for a sustained break below 1.48445 to extend declines toward 1.48082. Technical indicators confirm a weakening bullish structure, while Canada’s inflation data and geopolitical developments will be key catalysts for further movement in the pair.

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).