EU and US reach a deal, Euro slips

The euro is busy on Monday morning. EUR/USD started the week in positive territory and rose as much as 0.30%, but has reversed directions in the European session and is trading at 1.1677, down 0.54% on the day.

EU and the US reach a trade deal

US President Trump can add another feather to his MAGA cap, with news that the European Union and the United States reached a trade agreement over the weekend. President Trump had threatened to hit the EU with 30% tariffs if a deal wasn't reached by Aug. 1 and the specter of a nasty trade war between the largest two economies in the world has been averted.

A deal is of course good news but it's important to keep in mind that the sides have agreed to a framework agreement, which is thin on details. Some contentious issues remain, such as the US tariff of 50% on steel and aluminum.

The deal mirrors the US-Japan agreement which was announced last week. The US will eliminate some tariffs, such as on aircraft parts and generic drugs, but most European products will face a tariff of 15%, which will make European imports more expensive for US consumers. The EU has also agreed to increase investment in the US by $600 billion and purchase $750 billion in US energy products.

The German auto industry is one of the deal's big winners, as the 15% tariff will be easier to swallow than the current rate of 27.5%. The US-Japan deal puts a 15% tariff on Japanese motor vehicles, which would have put European automakers at a major disadvantage without a EU-US deal.

Trump is moving ahead and reaching deals with major trade partners, which is removing uncertainty and raising risk appetite. Investors are hoping that other key nations, such as Canada and South Korea, will follow soon with trade agreements with the US.

EUR/USD technical

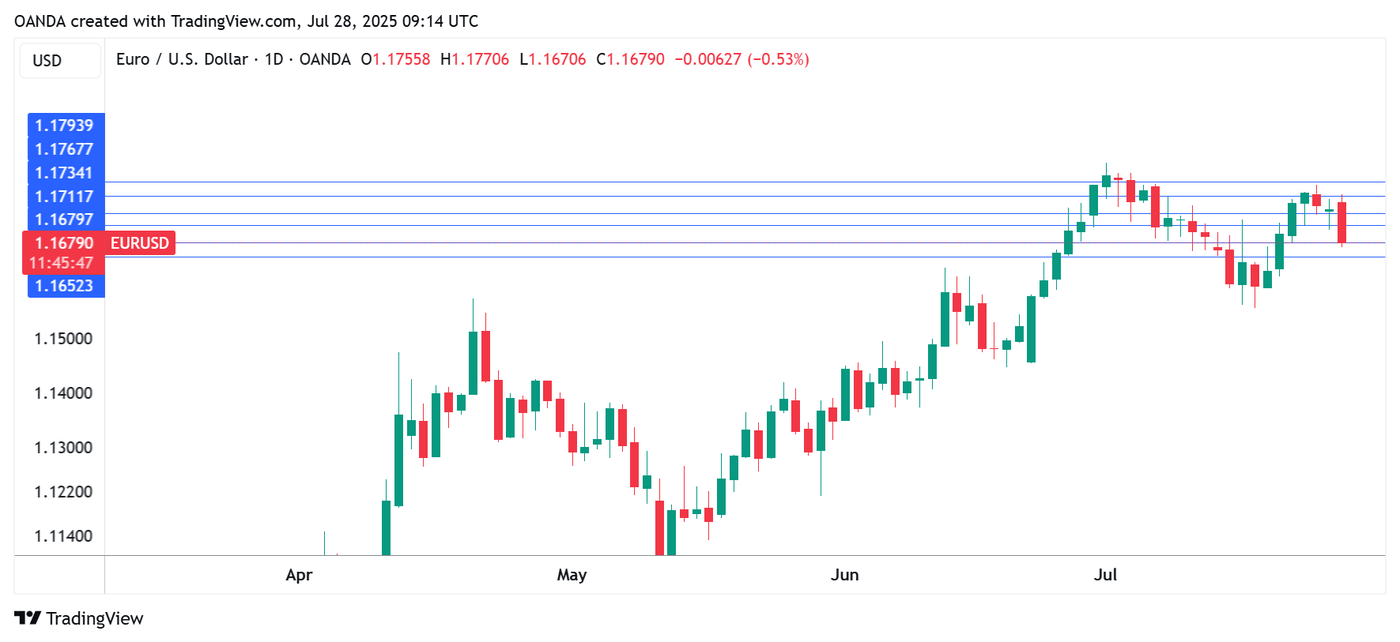

- EUR/USD has pushed below support at 1.1735 and 1.1710 and is testing 1.1677. Below, there is support at 1.1652.

- There is resistance at 1.1768 and 1.1793.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.