ETHUSD breaks out as bulls-eye key resistance at 4,500

The FTSE 100 index declined slightly as commodity prices and stocks declined. The index also declined after the latest data on public debt. Data by the Bank of England showed that the US public sector borrowing jumped from 16 billion pounds in August to 21 billion pounds in September. This increase was better than the median estimate of 14 billion. The index also fell as worries of a new lockdown in the UK emerged as the number of Covid cases rose. Mining stocks like Rio Tinto, BHP, and Glencore were among the worst performers. Barclays shares also declined even after the company published strong quarterly results. The FTSE 100 index fell by 0.35% while the DAX and CAC 40 indices fell by more than 0.30%.

US futures declined as investors focused on the ongoing earnings season. Yesterday, Tesla announced strong quarterly results even as the auto industry faced significant challenges. The biggest challenge in the industry is the shortage of computer chips. On the other hand, IBM reported relatively weak results as its legacy IT business dragged results. Other big movers in the futures market were PayPal and Pinterest. Media outlets like Bloomberg and Financial Times reported that PayPal was considering making a $45 billion purchase of the social media company. The futures declined after Evergrande announced that a deal to sell its property management business had fallen through.

Cryptocurrency prices remained in the green as investors cheered the new Bitcoin futures traded fund. Bitcoin rose to more than $66,000 while Ethereum rose to more than $4,300. Other altcoins like Bitcoin Cash and Litecoin have also been in a strong bullish trend. As a result, the total market capitalization of all cryptocurrencies tracked by CoinMarketCap has jumped to more than $2.6 trillion. Ethereum has also been propelled by the strong performance of decentralized finance (DeFi) and the NFT market.

ETHUSD

The ETHUSD made a bullish breakout as demand for cryptocurrencies rallied. The pair is trading at 4,300, which is substantially higher than the July low of less than 2,000. On the four-hour chart, the coin is above the key resistance level at 4,000. The bull run is also being supported by the 25-day and 50-day moving averages. Therefore, the pair will likely keep rising as bulls target the key resistance at 4,500.

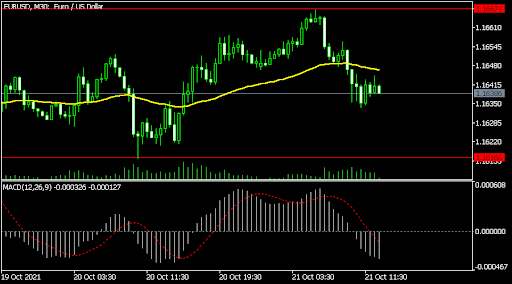

EURUSD

The EURUSD pair has been in a bearish trend this week. On the 30-minute chart, the pair formed a double-top pattern at 1.1667 whose chin was at 1.1615. A double-top pattern is usually a bearish sign. The pair has also formed a bearish pennant pattern and is slightly below the short and longer-term moving averages. The MACD has moved below the neutral level. Therefore, the pair may keep falling as bears target the key support at 1.1600.

NDX100

The Nasdaq 100 futures retreated slightly today. It is trading at $15,362, which is slightly above the intraday low of $15,310. On the four-hour chart, the index is slightly above the 61.8% Fibonacci retracement level. The MACD has formed a bearish crossover while the Relative Strength Index (RSI) has moved below the neutral level. Therefore, the index will likely remain under pressure today.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.