Emini Dow Jones December retests and holds last week’s high at 30000

Emini Dow Jones – Nasdaq

Emini Dow Jones December retests & holds last week's high at 30000 in overbought conditions which risks a small double top sell signal.

Nasdaq December volatility is decreasing & we are establishing a sideways range. We held minor resistance at 12050/090 this week to hit the downside target of 11880/840.

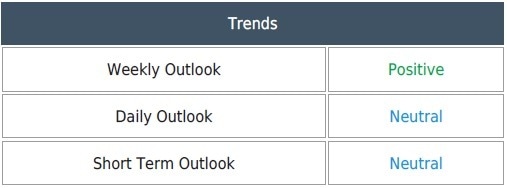

Daily Analysis

Emini Dow Jones meets 200 hour moving average support at 29350/320.A break below 29300 risks a slide to strong support at 29050/29000. Try longs with stops below 28900.

Minor resistance at 29560/590. Above 29600 allows a recovery to 29800/820. Obviously bulls need a sustained break above 30000. Above 30100 look for 30220/250 & 30400/450.

Nasdaq holds the 11880/840 target but if we continue lower today look for a buying opportunity at 11700/650 with stops below 11600. A break below lower is a sell signal targeting 11500/450 & 11350/300.

Minor resistance at 11925/960 then strong resistance at 12050/090.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk