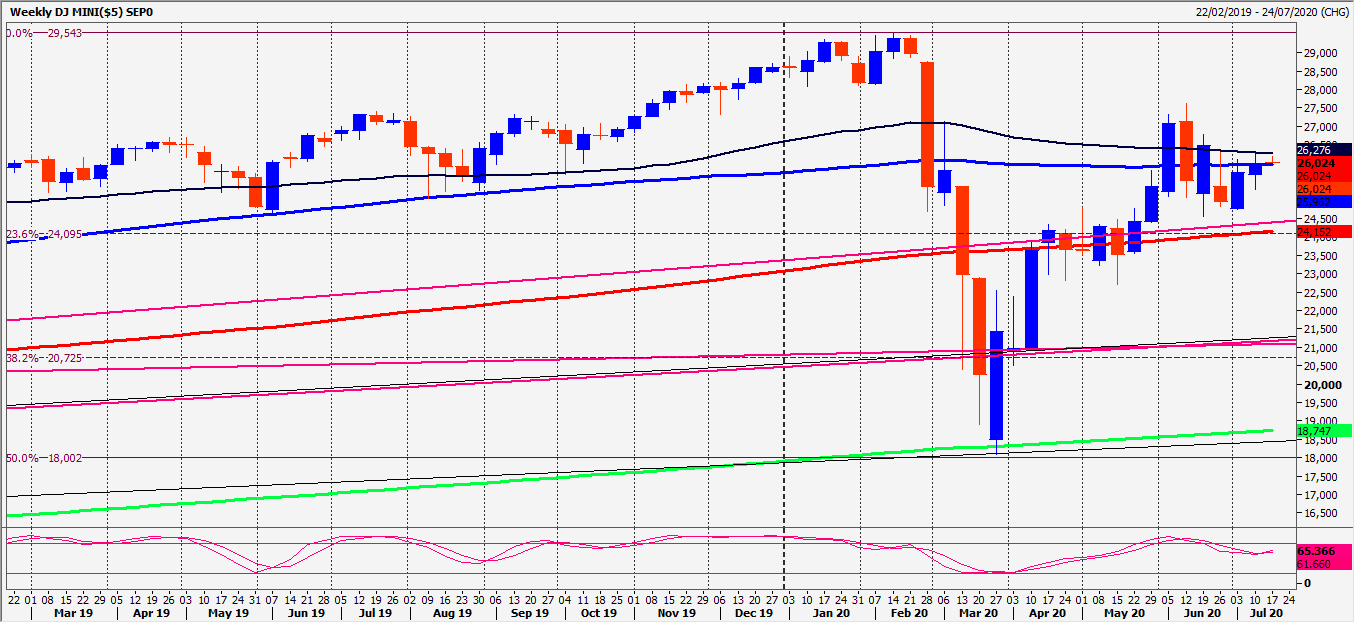

Emini Dow Jones: Be ready to buy a break above 26280

Emini Dow Jones – Nasdaq

Emini Dow Jones September Futures initially over ran first support at 25430/380 but then held on the next 2 tests before we shot higher through resistance at 25680/720 & as far as resistance at 25890/920 in to the close. Over night we are higher again to 26080/100 before a retest of 26250/280.

Nasdaq September Futures bulls remain in full control of course. Unfortunately we missed the buying opportunity at 10600/590 by just 25 points before we shot higher to all our targets to 10880/90.

Daily Analysis

Emini Dow Jones hits the next target of 26080/100 on the open, before a retest of important resistance at the 200 day moving average at 26180/200 in the sideways trend. Shorts need stops above last week's high at 26280. Be ready to buy a break above here targeting 26450/480, 26610/630 & perhaps as far as the 4 week high at 26750/780.

Holding the 200 day moving average at 26180/200 targets 26000. On further losses look for 25900/870 with strong support at 25830/780. Try longs with stops below 25700. A break lower is a short term sell signal targeting 25540/500.

Nasdaq new all time high just above our 10880/90 target at 10909 as I write. Bulls do not care that we are severely overbought. Further gains target the big 11,000 number.First support at 10780/760 then 10700/670. Longs here need stops below 10620.

Trends

Weekly outlook is positive.

Daily outlook is positive.

Short Term outlook is neutral.

Author

Jason Sen

DayTradeIdeas.co.uk