Emerging markets are recovering: Is risk appetite blooming?

Outlook

The Bank of Canada meets today with no action expected, although at least one analyst (Chandler) thinks a mini-cut is possible. Tonight the BoJ meets, also with no change expected, followed by the ECB tomorrow.

While central banks are the single most important institutional override of both fundamental and technical factors, the absence of action or strong words likely means no change in risk assessment. (A possible exception is Australia’s jobs report, which has a habit of moving the AUD seemingly disproportionately and has the muscle to restore the AUD’s upswing.)

That pretty much leaves the bucket of American initiatives coming today and then one big initiative per day from the Biden administration, most prominently the gigantic stimulus/recovery package. That’s the biggie. If opposition from deficit hawks gets too noisy and/or Biden can’t get bipartisan support, we could see a reprise of risk-off and dollar recovery. Ironically, Biden’s commitment to bipartisan support can backfire in this context.

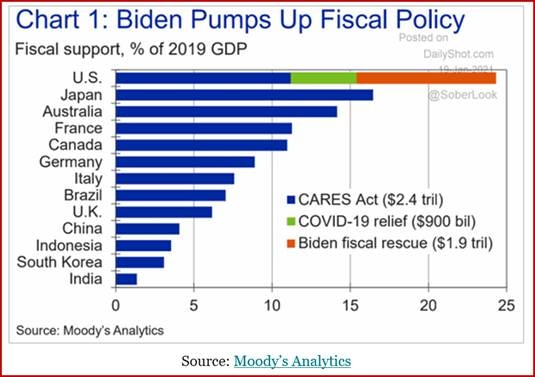

The Economist magazine wonders if the Biden initiatives can overheat the US economy. To be fair, wages and prices are rising in the service sector even as output and employment continue to fall. See the chart from Moody’s via the Daily Shot. Services includes not just bars and restaurants, but also banking, insurance and other non-food services. Yesterday the NY Fed reported “Activity in the region’s service sector declined at an accelerated pace.” WolfStreet reports “The current business activity index dropped 5 points to -31.8, the worst assessment of the service sector since June, which has now been on the decline for the 11th month in a row; and the decline has steepened over the past three months.”

Worse, “Job cutting continues at these companies in the service sector. The index for the number of employees fell to -17.6, indicating a decline at the fastest clip since July, with only 11.8% of the companies reporting that the number of employees increased in the month, and with 29.4% reporting that the number of employees fell. This was the second month in a row…”

New York (includes part of New Jersey and Connecticut) is not the whole country, but you don’t have to extrapolate much to deduce that the recovery may well be stalling. Then the question becomes whether the small business lending and personal checks can overcome the stall, especially given the restructuring of all kinds of service sector businesses that is underway under the radar.

This data from the NY Fed should give everyone pause, although the stock market is able to ignore pretty much anything pointy that threatens the bubble. Depending on new data for the first quarter, those rosy increases in forecasts for the US economy in Q2 and Q3 may have to be revised. This does not necessarily affect the FX market, which is focused on the spending amount rather than whether the spending actually works.

Weirdly, even as the UK struggles with the new EU trade conditions, sterling is the recipient of the booming risk-on sentiment. The UK economy is proving more resilient than anyone expected, probably including 10 Downing Street and Whitehall. Sterling also likely gets a boost from the UK doing far better on the vaccination front, too. The UK is delivering 7.07 doses per 100 persons, according to the Bloomberg tracker, vs. 4.75 for the US (with Israel leading at 29.78).

Finally, the emerging markets are recovering, again. This is one of our best canaries in the coalmine to illustrate blooming risk appetite.

Politics: Trump released his pardon and clemency list in the wee hours—143 names, including the toxic Bannon and fundraiser Broidy, three crooked Republican politicians, the crooked ex-mayor of Detroit, and various others—but not himself, family or Giuliani. The reason for withholding pardons is apparently due to that removal of the Fifth Amendment right once a person is pardoned. So, for example, if Giuliani had been pardoned, he could be called to testify against Trump and to have lost the right to remain silent (and face jail for contempt of court). This is no longer news but rather gossip.

The phrase being heard most often today is “sigh of relief.” Trump will be back in the spotlight, notably for the Senate impeachment trial, but we are safe for a while. The Senate has 24 hours to initiate the trial once it receives the Article of Impeachment from the House, and Speaker Pelosi is being cagey about when she will send it over. It takes a 2/3 majority to convict, or 17 Republicans added to the Dem pile, unless they choose to abstain by not showing up.

Senate leader McConnell caused a stir yesterday by saying Trump (and others) “provoked” the seditious riot on Jan 6, setting off a mad scramble among analysts to figure out what that implies. “Provoke” means the same thing as “incite,” but is not the exact same word. In other words, McConnell can weasel out of voting to convict. It’s almost certain that the Senate will vote to bar Trump from public office permanently, since that takes only a majority and the Dems have it. Everyone decried McConnell’s obstructionism but it won’t be long before we decry incoming Senate leader Schumer, who is not half as smart or shrewd and buys into every new cockamamie idea that comes along.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat