Elliott Wave structure: Gold targeting final leg of wave five [Video]

![Elliott Wave structure: Gold targeting final leg of wave five [Video]](https://editorial.fxsstatic.com/images/i/gold-march-03_XtraLarge.jpg)

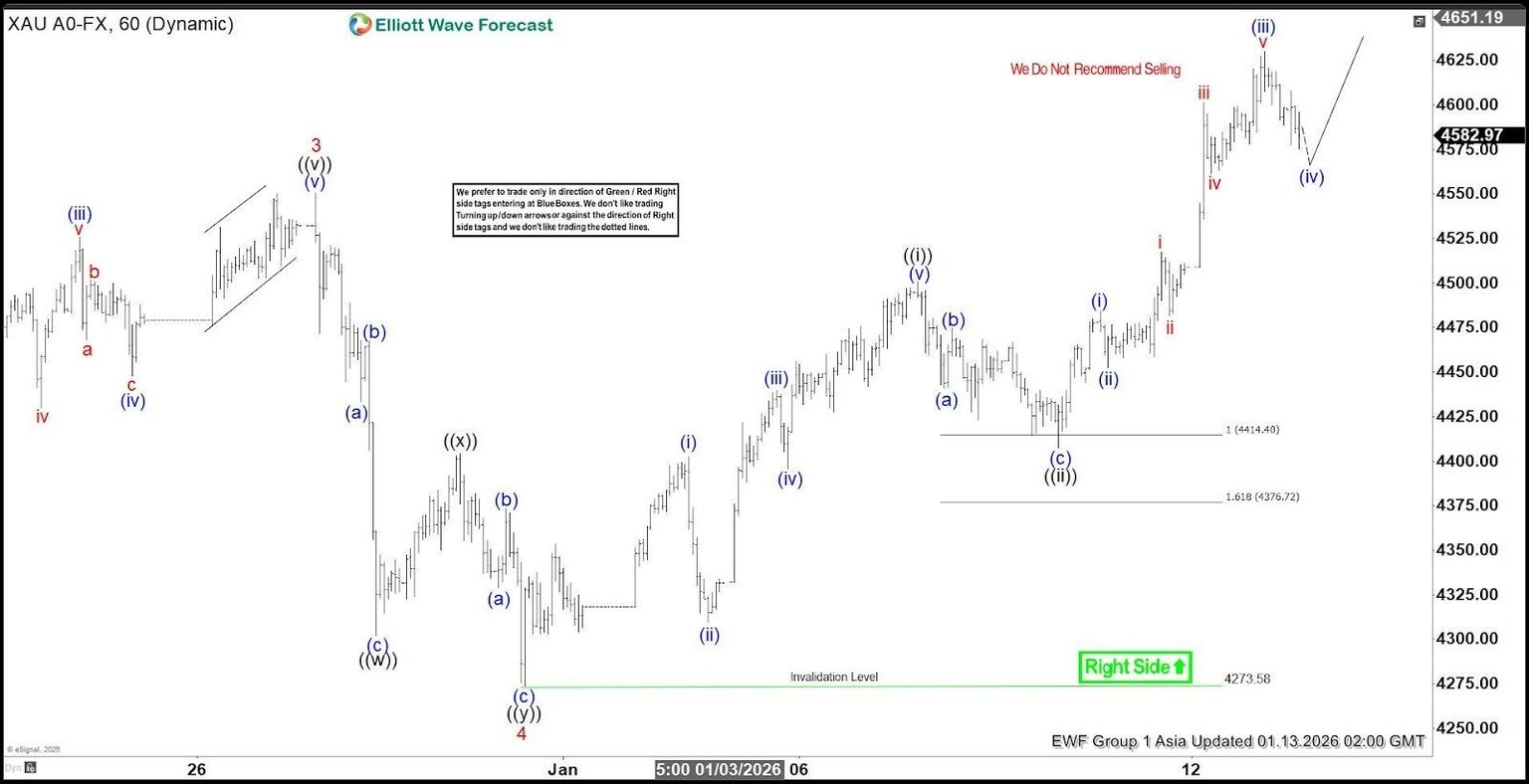

Gold (XAUUSD) continues to advance to fresh all‑time highs, reinforcing a firmly bullish trend across the broader market. The metal is now progressing toward the completion of wave 5 within the Elliott Wave framework. The rally to $4550.52 marked the termination of wave 3, after which a corrective phase unfolded. Wave 4 developed as a double three structure, reflecting a complex but orderly consolidation. From the peak of wave 3, wave ((w)) concluded at $4301.79, followed by wave ((x)) at $4404.41. The final leg, wave ((y)), ended at $4273.58, thereby completing wave 4 at a higher degree.

Following this correction, gold resumed its upward trajectory in wave 5. The current advance is unfolding as an impulsive sequence in lesser degree. From the base of wave 4, wave (i) finished at $4402.35, while the subsequent dip in wave (ii) reached $4309.42. Momentum carried wave (iii) to $4439.90, before a modest pullback in wave (iv) ended at $4395.92. The final push in wave (v) reached $4500.64, completing wave ((i)) of higher degree. A corrective zigzag in wave ((ii)) then ended at $4407.44.

The metal has since resumed higher in wave ((iii)). From that point, wave (i) concluded at $4483.99, while wave (ii) retraced to $4452.58. Strong buying pressure lifted wave (iii) to $4630.24, confirming renewed bullish momentum. In the near term, as long as the pivot at $4273.58 remains intact, dips are expected to find support. These supports typically emerge in three, seven, or eleven swing sequences, offering traders opportunities to align with the prevailing upside trend.

Gold 60 minute chart from 01.13.2026 update

Gold Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com