ECB Preview: Three scenarios for Lagarde to loosen policy, not necessarily lower the euro

- The European Central Bank is set to leave its policy unchanged and express some concern about rising yields.

- Hints about measures to keep returns on debt in check would be welcomed by markets.

- The euro would receive a shot in the arm if the ECB surprises with immediate action.

Is Christine Lagarde ready to loosen the purse strings? While fashionistas may focus on the European Central Bank President's prestigious Louis Viton handbags, investors are keen on her institution's purchasing powers. The upcoming ECB meeting on March 11 comes on the backdrop of rising bond yields in the old continent – something the bank is eager to curb.

But how? That is the critical question for EUR/USD.

When Lagarde's colleague Jerome Powell, Chair of the Federal Reserve, dismissed the increase in returns on US debt, the dollar soared. If he had talked it down, the greenback would have fallen. The same logic does not fully apply to the ECB and the euro. Here are three scenarios for the ECB decision and the euro.

1) Rinse-repeat – EUR/USD continues struggling

The ECB is set to leave its deposit rate at -0.50% and its bond-buying scheme – the Pandemic Emergency Purchase Program (PEPP) – at its current size of €1.85 trillion. The last increase in the program occurred in December 2020, so another increase seems unlikely now.

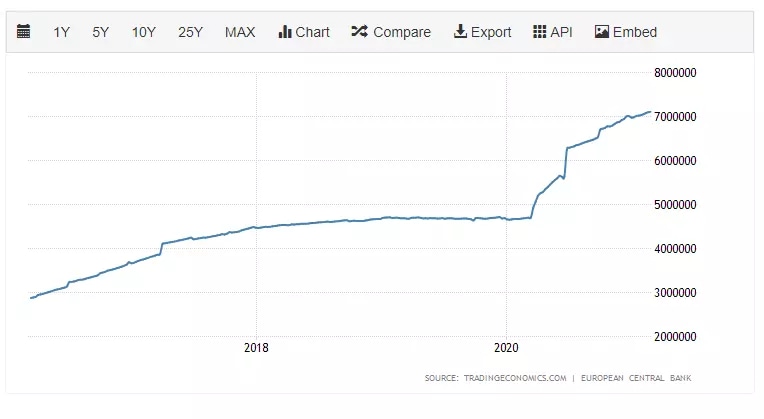

How the ECB's balance sheet grew during the pandemic:

Source: TradingEconomics

Lagarde will likely repeat her previous messages that the rise in yields is undesired – and that would be insufficient to lift the euro. In this scenario, yields on German, French, Italian, and other bonds would receive a green light to march higher. Even under the assumption that elevated return on European debt makes the euro more attractive, yields in the old continent lag behind those in the US.

Solely musing about the damage incurred by dearer borrowing costs would likely trigger investors to continue selling bonds and expecting less monetary support to the suffering eurozone economies. With limited fiscal nor monetary firepower, growth prospects would remain subdued and the euro could fall.

This outcome has a high probability and would send the euro down.

2) Strong vigilance – a bounce in the euro

While Lagarde has mostly voiced discontent from higher yields, some of her colleagues called for action. However, the Frankfurt-based institution is split between doves who want more money-printing and hawks – led by Germany, where the bank is based – that think the ECB has done enough.

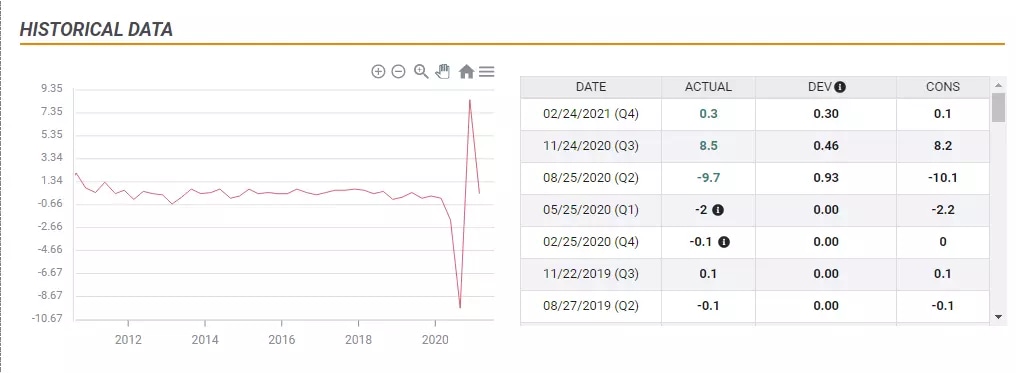

The German economy continues growing, but only just:

Source: FXStreet

One potential compromise is to upgrade the warnings of the bank and give the market one last chance to push yields down. Lagarde could promise action in the upcoming April meeting if returns debt costs remain burdensome.

Lagarde could use "strong vigilance" – the code words of Jean-Claude Trichet, ECB president between 2003 and 2011. That would send a strong message.

In this scenario, which has a medium probability, the euro could rise on prospects of more money injected into the economy – at least by keeping the government's borrowing costs low.

3) Imminent action

Similar to December, the ECB staff publishes new macroeconomic projections. If these remain low due to the EU's sluggish vaccination campaign and slow-moving deployment of the EU's recovery plan, that could convince hawks to act now.

Europe is lagging behind the US and the UK in vaccination:

Source: FT

If the ECB announces a surprising increase of some €500 billion to its bond-buying scheme – and especially if this buying is mostly done imminently – it could turn the picture in favor of the euro. An injection of funds would provide some calm, especially for Italy, where Prime Minister Mario Draghi – Lagarde's predecessor at the ECB – has the most ambitious fiscal stimulus plans.

Channeling Draghi, will Lagarde do whatever it takes? In previous PEPP episodes – and contrary to pre-pandemic logic – creating more euros out of thin air boosted the common currency rather than hurting it. The logic is that these funds boost the economies, and thus underpin the underlying currency.

In this scenario, which has a low probability, the euro would soar.

Conclusion

The ECB's March meeting comes as rising yields are threatening the recovery. The bank's response to this development is critical to the euro – with bulls urging money printing, and the sooner, the better.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.