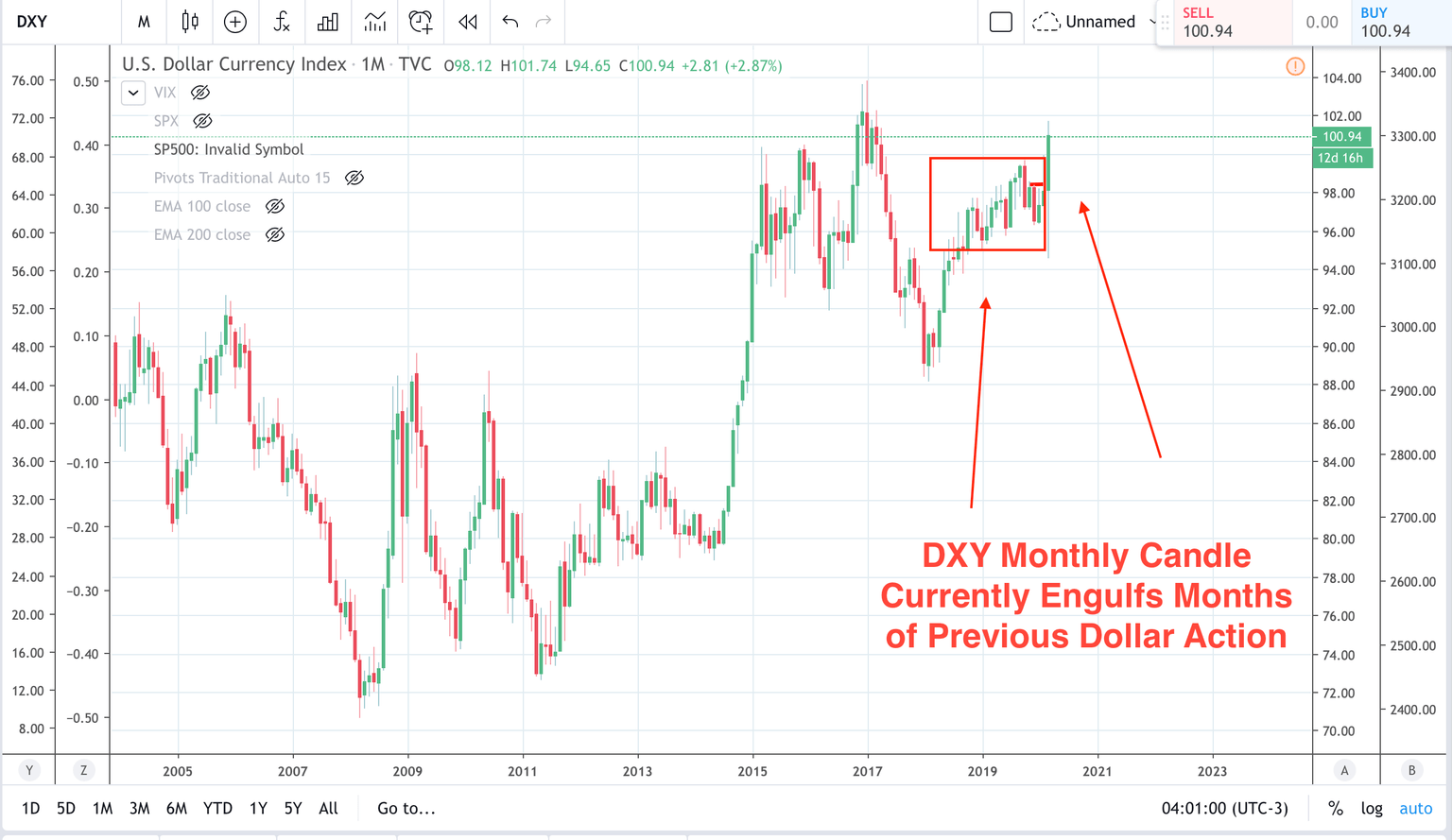

DXY looks set to break out of recent highs on monthly chart

The end of the world as we know it, but the USD feels fine...

I took my normal constitutional walk yesterday after breakfast and was greeted by our new post apocalyptic landscape. An eerie silence lingered in the air as there was a distinct lack of activity. REM's song immediately sprung to mine as I occasionally passed the odd dog walker who shuffled past me keeping a good distance, of course, from the potential that I was a COVID19 carrier. Welcome to our new coronavirus landscape.

And so returning to my terminal and more strange behaviour, albeit financial in nature this time, I was reminded of the USD as the king of currencies when it comes to a big crisis. In the 'sell everything' landscape the USD is being held as the most liquid currency. With 70% of all currency transactions involving the USD it is little wonder that the USD is attracting more and more bids. I have been explaining this for a few days now to traders and yesterday the USD was bid with a vengeance.

A look at the DXY

The Dollar Index is showing it all. The current monthly candle is engulfing around 14 previous months of dollar action putting in a strong potential bullish Engulfing bar on the monthly chart. For those who like to position trade there is an excellent option here to buy the DXY and come back next month. That will give you plenty of time to plan how you will survive the coming isolation as we try to ride out the coronavirus storm. I hope to meet you on the other side.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.