DXY – I am a turning into a USD bull

For most major changes in trend we need a catalyst. I am looking at the US Dollar as a whole, or should I say, single currency.

The catalyst could well be the non-farm payroll figures tomorrow although we are starting to see a change in sentiment this morning

In my trading plan and analysis, I have a large emphasis on a single currency. I look for changes across the board. So, in his scenario I want a bearish view on EURUSD, GBPUSD, NZDUSD, AUDUSD and Bullish view on USDCAD (buying the USD)

Note: I have not mentioned USDJPY and USDCHF. This is because I am looking at the change in sentiment of the USD to be driven by risk. In other words, the USD moving higher as indices move lower (risk off). The CHF and JPY are also risk currencies. This means that as the USD moves higher both CHF and JPY will be competing in the same direction. I want a single currency that wants to go in the other direction (BASE one direction / COUNTER the opposite)

Lets looks at the charts

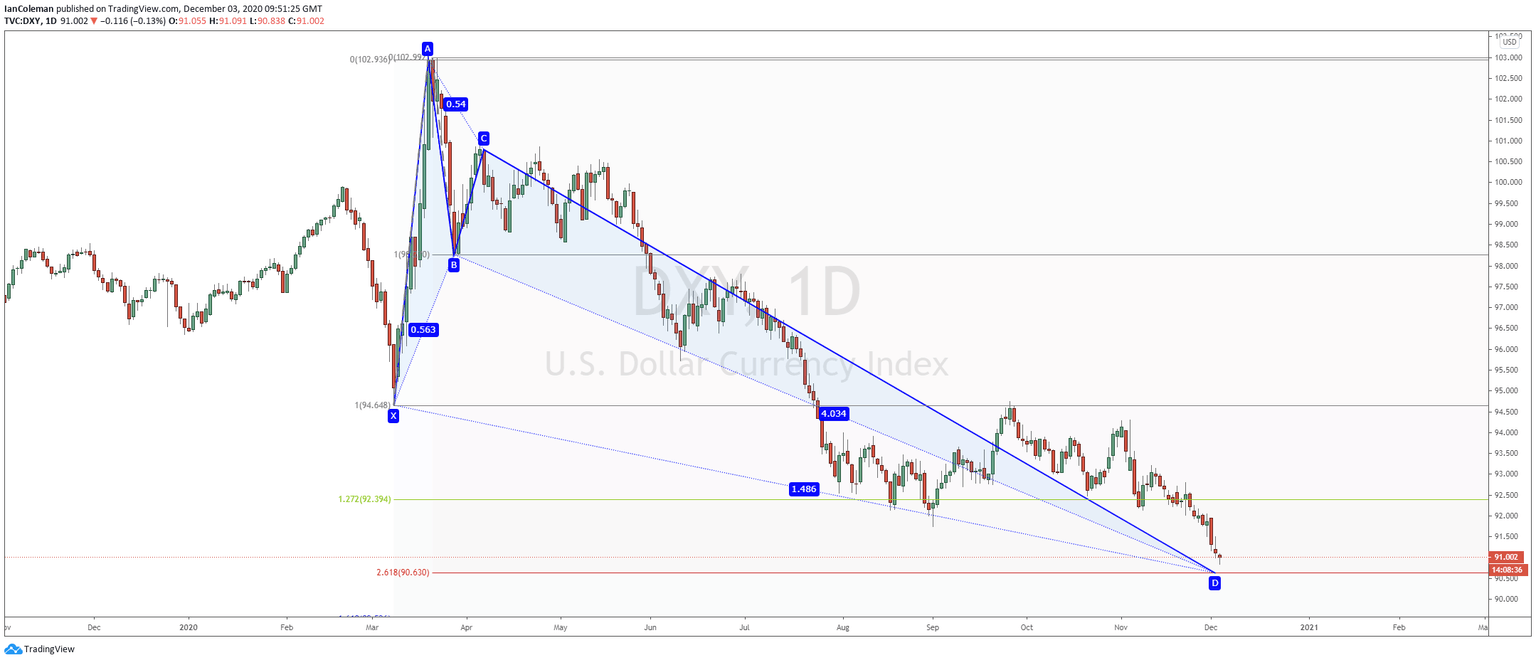

DXY (USD Index)

DXY Daily – 261.8% exhaustion at 90.63

DXY one-hour 261.8% exhaustion at 90.82

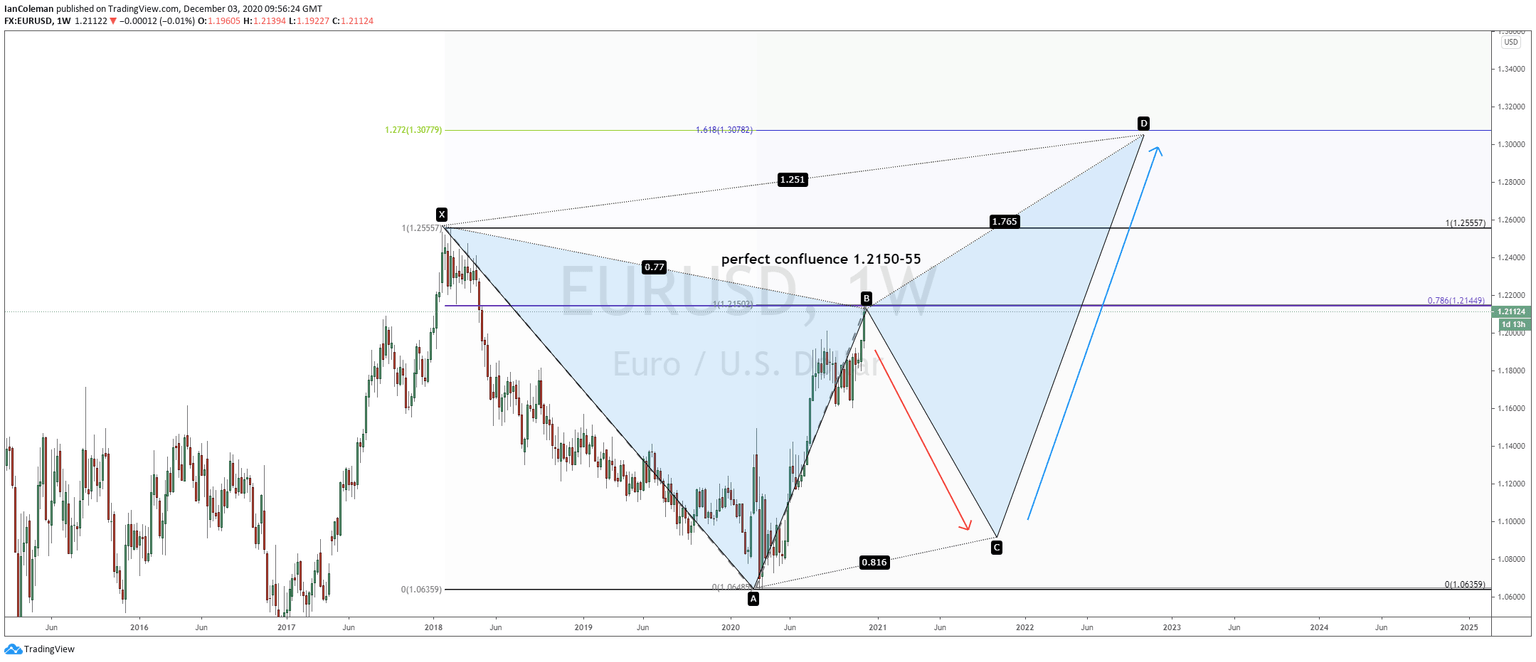

EUR/USD Weekly 1.2150-55 offers perfect confluence

GBP/USD Monthly confluence at 1.3550

USD/CAD eight-hours perfected confluence @ 1.2878 - 1.2871

AUD/USD one-hour perfected confluence at 0.7425-26

NZD/USD eight-hours 261.8% @ 0.7078

Author

Ian Coleman

FXStreet

Ian started his financial career at the age of 18 working as a Junior Swiss Broker at Godsell Astley and Pearce (London). He quickly moved through the ranks and was Desk Manager at RP Martins at the age of 29.