Durable Goods Orders Preview: Upside surprise set to trigger next leg up in the dollar

- Economists expect Core US Durable Goods Orders to have remained flat in February.

- Strong demand opens the door to an upside surprise.

- The dollar, already buoyed by the Fed and the war, is likely to react positively to an upbeat figure.

Will the Federal Reserve front-load its rate hikes? That is the main question for currency traders – at least while war headlines are calm – and Durable Goods Orders figures for February will help provide an answer to the question.

Investors focus on nondefense Durable Goods Orders excluding aircraft – aka the "core of the core." That filters out one-time orders of planes and other developments which can skew the figures and provide an inaccurate picture of the economy. This core figure jumped by 0.9% in January, beating expectations of 0.5% at the time.

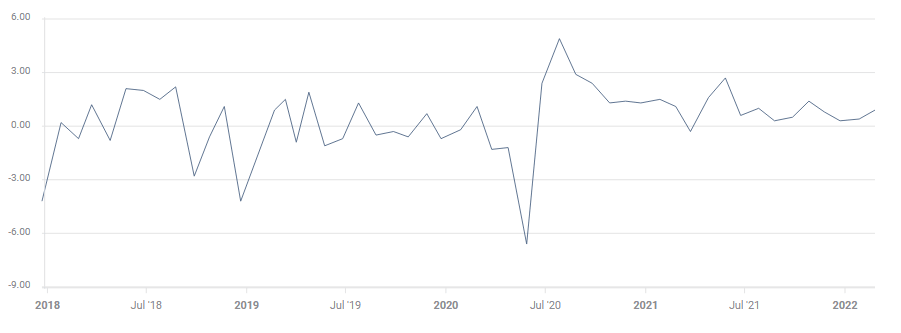

Recent core orders figures have been upbeat:

Source: FXStreet

However, the consensus for February is for a flat figure – no change in core orders. Given other economic statistics such as employment, inflation, and retail sales, these expectations seem modest. That means there is room for an upside surprise.

Market impact

In case this core figure beats estimates, the dollar would have room to rise as it would increase the chances of a faster path of rate hikes from the Federal Reserve. The bank already announced its "lift-off" with a 25 bps rate hike in March, but may ramp up the pace of increases in its next two meetings. Bond markets are unsure if the Fed will announce a 50 bps, double-dose hike in May, in June, or in both decisions.

This figure – which is critical for first-quarter Gross Domestic Product calculations – will help shape expectations for the Fed's next moves. Shortly after the release, Christopher Waller, a governor on the Fed's board, is set to speak. He will likely react to the data, and if it is positive, he may push for quicker rate hikes.

Moreover, the trend is currently with the greenback. Apart from the bank's increasingly aggressive path of rate hikes, the ongoing war in Ukraine is keeping the safe-haven dollar bid. Therefore, a positive Durable Goods Orders number would have more impact than a downside surprise, which would go against the broader trend.

Conclusion

Durable Goods Orders figures for February are eyed by the Fed and markets for the next interest rate decisions. Given the strength of the US economy, expectations for a flat read on the all-important core figure seem low, opening the door to an upside surprise and a bump up in the US dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.