Dramatic year for Silver: Market on pace for fifth straight supply shortfall

The silver market is on track for its fifth straight structural market deficit.

The recent silver squeeze that pushed the silver price to a record high was partly due to a displacement of metal. There was too much silver in New York and not enough in London and India. However, the situation underscored a more fundamental problem in the silver market.

There isn’t enough metal being produced to meet demand.

A dramatic year

Metals Focus called 2025 a "dramatic year" for the silver market, citing "record metal prices, an unprecedented liquidity squeeze resulting in record-high lease rates, record volumes being delivered into CME vaults as a reflection of tariff concerns in the U.S., and silver being officially designated as a critical mineral by the U.S. government."

"These developments coincide with elevated macroeconomic and geopolitical risks, including US trade policy, prompting investors to lift allocations to precious metals for portfolio diversification. As a result, investment demand has strengthened noticeably, comfortably offsetting the weakness across all key areas of silver demand."

The silver price has gained over 74 percent this year and set a new record of $54.48. That compares to a 52 percent price increase for gold and a 14 percent gain for the S&P 500.

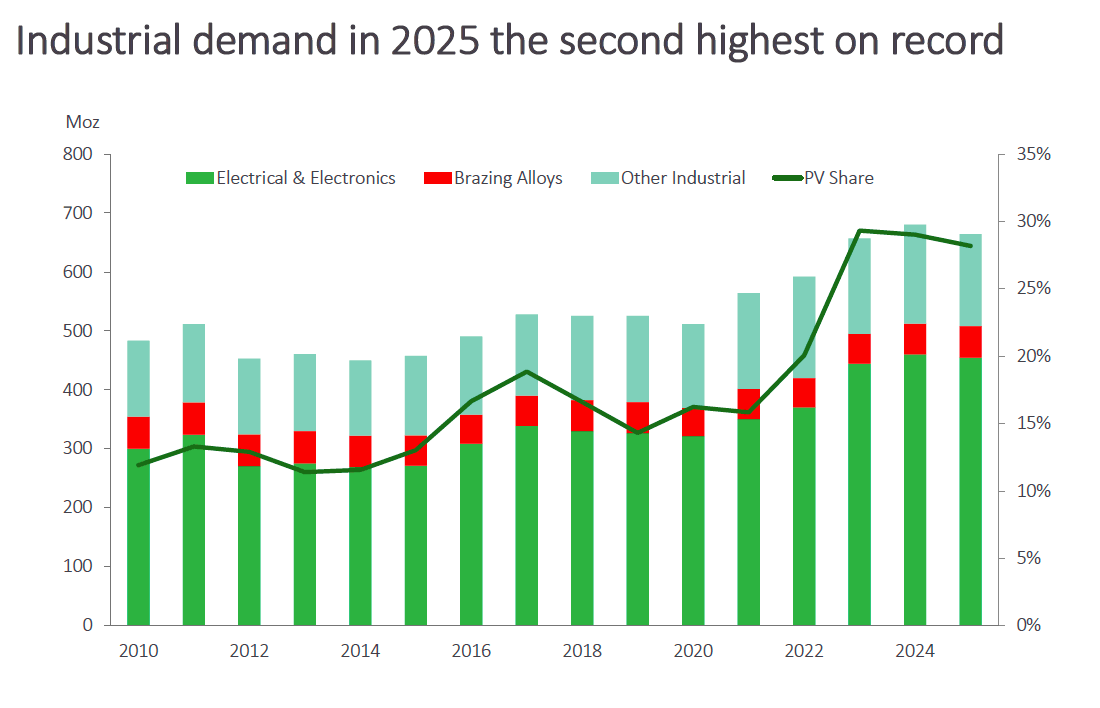

According to projections by Metals Focus, overall silver demand is forecast to decline by 4 percent year over year, driven by a 2 percent decline in industrial offtake.

According to the Silver Institute, industrial demand softened this year due to “global economic uncertainty stemming from tariff policies and geopolitical tensions, as well as a more rapid pace of thrifting due to soaring silver prices.”

However, despite the modest drop in demand, 2025 will still likely come in with the second-highest silver industrial offtake on record.

Jewelry demand is also soft due to higher prices. Metals Focus forecasts the use of silver in jewelry will fall by 4 percent, with a more significant 11 percent decline in silverware.

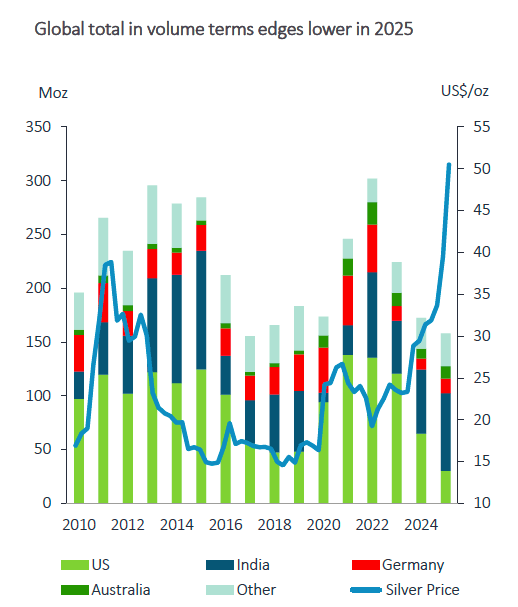

While silver bar and coin buying are up significantly, there are also higher levels of selling as some investors seek to book profits. This is especially evident in the U.S., where selling is exceeding buying. Weakness in the U.S. market is offsetting gains in India, Germany, and Australia.

Meanwhile, silver held by ETFs was up by 18 percent as of November 6.

Mine supply is projected to remain flat this year at 813 million ounces. With recycling, global supply is expected to rise by a modest 1 percent.

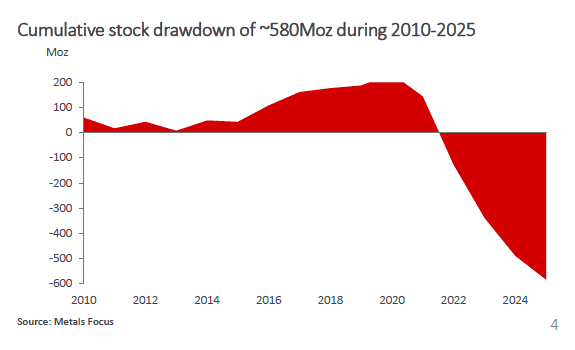

Given the forecast supply and demand levels, Metals Focus projects demand will outstrip supply by 95 million ounces. That would bring the cumulative 5-year market deficit to 820 million ounces, an entire year of average mine output.

Since 2010, the silver market has accumulated a supply deficit of over 580 million ounces.

Even with higher prices, it is unlikely that mine supply will quickly grow to erase the supply shortfall.

Silver mine output peaked in 2016 at 900 million ounces. Up until last year, silver production had dropped by an average of 1.4 percent each year. In 2023, mines produced 814 million ounces of silver.

It appears that for the next few years at least, we will have to depend on drawdowns of above-ground stocks to meet the silver supply deficit.

This is fundamentally bullish for the silver market, and why many analysts believe the silver bull run is just getting started.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.