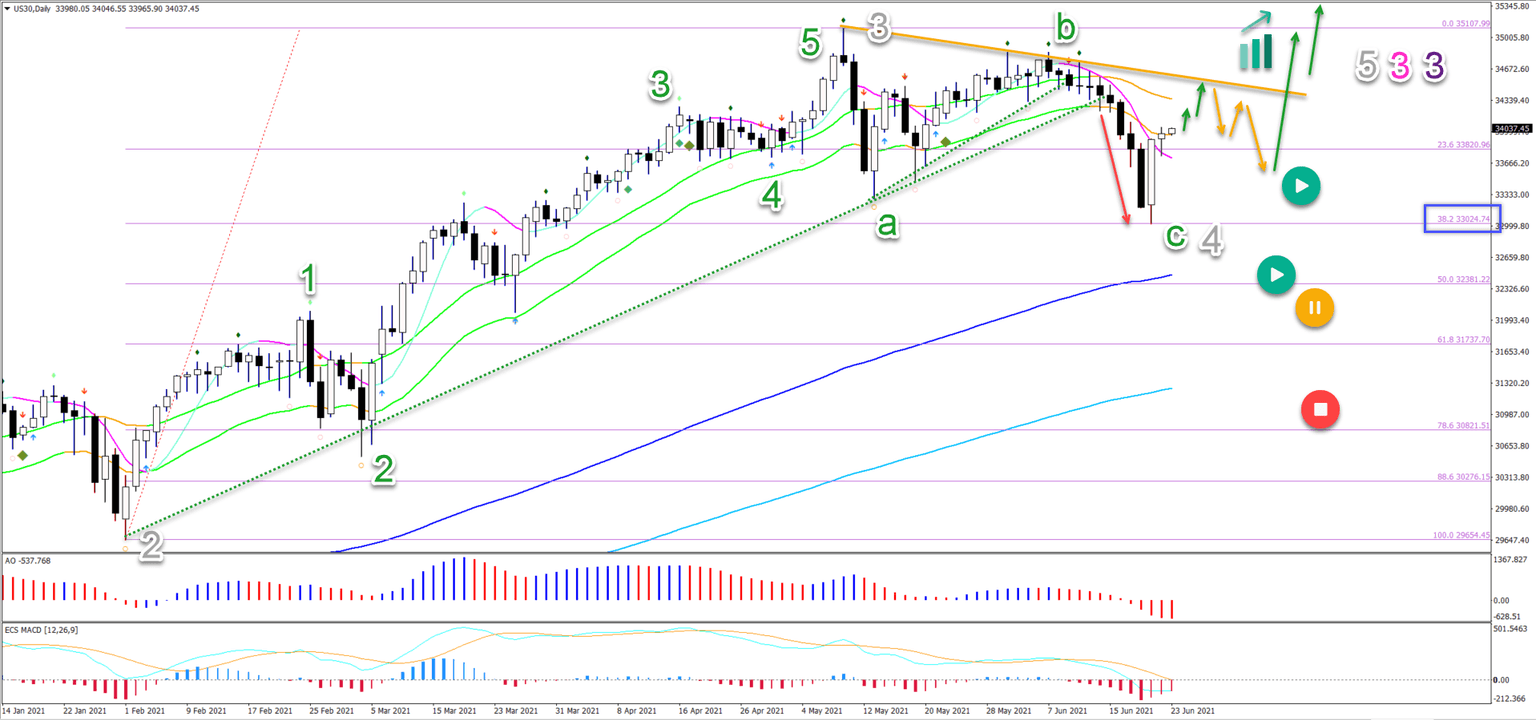

Dow Jones Index completes bearish wave C at shallow 38.2% Fib

-

US 30 (Dow Jones Index) daily chart made a bearish pullback and bullish bounce at the 38.2% Fib - as expected in our previous Elliott Wave analysis.

-

A strong bullish engulfing twins daily candlestick pattern appeared at the 38.2% Fib. The main target is the -27.2% Fibonacci target at $36,573.

-

A bearish ABC (green) seems to be completed and price action is now testing the 21 ema resistance zone.

This article will analyse whether a wave 4 pattern has been completed at the 38.2% Fibonacci retracement level.

Price charts and technical analysis

The Dow Jones Index (DJI) broke below (red arrow) the 21 ema low and support trend line (dotted green) for a bearish price swing and a wave C (green):

-

The bearish price swing bounced at the 38.2% Fibonacci retracement level (blue box), which is typical for a wave 4 (grey) pattern.

-

A strong bullish engulfing twins daily candlestick pattern appeared at the 38.2% Fib.

-

A bearish ABC (green) seems to be completed and price action is now testing the 21 ema resistance zone.

-

A bullish breakout above the resistance trend line (orange) could confirm the uptrend.

-

A bullish bounce at the 50% is still usual for a wave 4 but a pullback (orange circle) below the 50% Fib places it hold and a deep retracement invalidates it (red circle).

-

The main target is the -27.2% Fibonacci target at $36,573.

On the 1 hour chart, price action completed a bearish 5 waves (blue) in wave 5 (orange) of wave C (green):

-

Now price action seems to be building 5 bullish waves (blue) in wave 1 (green).

-

A bearish break (orange arrows) below the 21 ema low could confirm a bearish ABC in wave 2 (green).

-

A bullish break (green arrows) could see price action test the resistance zone (orange box).

-

A bullish bounce is expected (blue arrows) at any of the Fibonacci support levels within wave 2 (green).

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.