Dow Jones bulls attempt to post new record highs [Video]

![Dow Jones bulls attempt to post new record highs [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/dow-jones-industrial-average-on-iphone-4-stocks-app-16978003_XtraLarge.jpg)

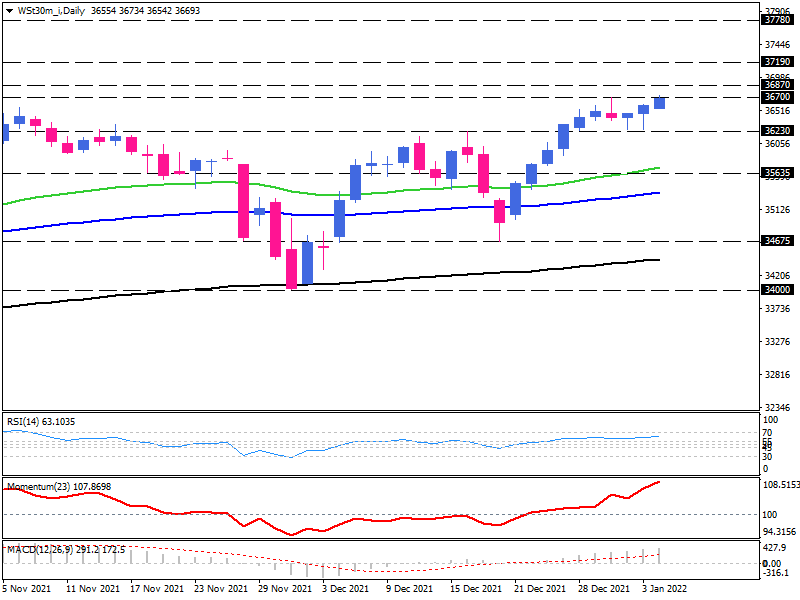

Dow Jones industrial futures index has been trading upward above 200-day EMA since July 2021.

Buyers have already started the new year so fresh being in charge after rebounding from the 200-day exponential moving average in early December 2021. They are currently struggling to break the 36700-major-barrier in order to run the bull market higher.

In the event that they continue to drive the market, the index may find its initial resistance around the 36870 level. Pushing above this hurdle, a higher level of interest will emerge around the 37190-stretch. Gaining positive momentum can let the bulls push further and target the 37780 resistance area.

On the flip scenario, if sellers win the battle around the 36700-Hurdle, the immediate support may come from the previous resistance of 36230. A sustained break below this latter can lead to further losses towards 35635. In the case that 50-day EMA can't offer support to the price, bears are expected to aim for the 34675-handle.

The momentum oscillators indicate a bullish bias. RSI is trending upward in the buying region, and the momentum is ascending sharply. At the same time, the MACD bar is rising above its signal line in positive territory.

Dow Jones bulls attempt to post new record highs

Author

Ali Mortazavi

Errante

BEc, CMSA, Member of IFTA - International Federation of Technical Analysis, Associate Member of STA - Society of Technical Analysis (UK).