Dollar sinks off the back of Chairman speculation

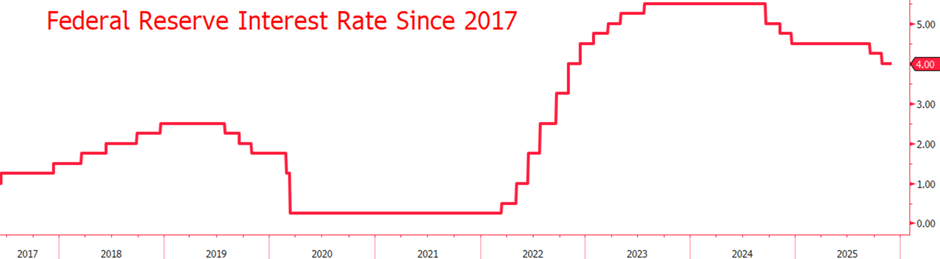

Trump’s discontent with the decisions of Federal Reserve Chairman Jerome Powell has been clear for over a year, with the President firing regular salvos at the Fed and Powell for holding rates too high. Of course, it’s salient to remember that it was Trump who nominated Powell for the position way back in 2017, marking yet another U-turn from the President.

Powell has presided over the Fed during some of the most changeable times in recent memory, possibly beyond even the 2008 GFC, but his term ends in May of 2026. Powell will not run for a third term and so eyes turn towards Trump to pick the next Chairman to lead the Fed and possibly mold it to his policies, if not in his image.

That’s where this most recent run of Dollar bear bets has come in, with Trump stating in a Press Conference on Tuesday that the race for the next Chairman “is down to one”, Kevin Hassett was present in the room when Trump further commented that “the potential future Chair” was present in the room.

High praise indeed, but it they were words that crippled USD’s recovery in the short term given Hassett’s dovish inclinations regarding monetary policy. Hassett, the 63 year old present Director of the National Economic Council is a Republican and a supporter of the Presidents tax policies contained within the “One Big Beautiful Bill”. He would likely lean more dovish than the outbound Powell.

This has led to a dive in yields, especially at the short end of the curve as traders increase bets of a lower Fed base rate next year. Indeed, as Hassett’s chances of being the next Chairman leaped from 35% to 85% on various aggregators, estimates of the Fed’s 2026 rate by December slipped from 3% closer to 2.75%, suggesting traders anticipate nearly 4 cuts from the Fed between now and next year.

Naturally, this paints a poor picture for the Fed next year, with the BoE estimated to maintain a higher rate at 3.25% in December and the ECB cutting the differential in half with the Fed. Furthermore, with the Chair likely wanting to start off with the support of the Whitehouse, I suspect more cuts could be possible than the 3 already anticipated next year (if you remove the likely December cut this year).

Trump stated that he would announce the new Chair in early 2026, so we wait, but given his recent statements, the President seems to have made up his mind, just as the market seems to have made up theirs.

Author

David Stritch

Caxton

Working as an FX Analyst at London-based payments provider Caxton since 2022, David has deftly guided clients through the immediate post-Liz Truss volatility, the 2020 and 2024 US elections and innumerable other crises and events.