Dollar rebounds as Federal Reserve sticks to its guns

Key highlights

-

Dollar rebounds as FOMC sticks to its guns.

-

ECB’s Lagarde warns over impact of tariffs.

-

BoE holds rates steady, delivers hawkish twist.

-

Fed officials continue to pencil in just two cuts in 2025.

-

Markets await more US tariffs from April.

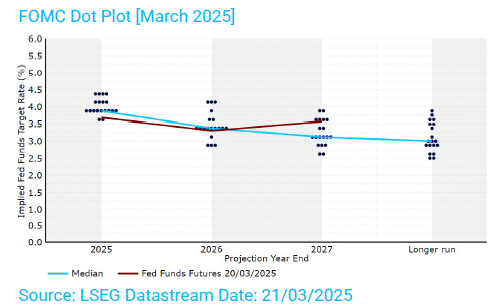

A relatively hawkish set of communications from the Federal Reserve on Wednesday has provided the dollar with some tailwinds. Futures markets continue to price in almost three full 25bp cuts from the FOMC this year. Yet, fears over the impact of Trump’s tariffs on US inflation means that policymakers are reluctant to validate these expectations, with the March “dot plot” suggesting that most members favour a gradual approach to policy easing.

We think that investors will be cautious to sell to the dollar too hard ahead of President Trump’s 2nd April tariff deadline, at which stage we’ll hear more details on his plans for reciprocal trade levies. In the last few weeks, market participants have been focusing largely on the impact on the US economy from the tariffs, but it will be interesting to see whether global growth fears return to the fore should trade restrictions be enforced more broadly, rather than merely limited to America’s largest trading partners.

As expected, the fed funds rate was held at a range between 4.25-4.50% in a unanimous vote on Wednesday. In its statement, the Fed continued to describe the US economy and the labour market as “solid”, although Powell did flag the uncertainties stemming from Trump’s tariffs on numerous occasions. The Fed’s 2025 GDP growth projection was slashed, with the core PCE inflation forecast for this year also upped. Yet, the median “dot” for 2025 remained unchanged, with officials continuing to see just two 25bp cuts during the remainder of the year, which is marginally more hawkish than current market pricing. We continue to see the recent dollar sell-off as overdone. Macroeconomic figures, while slightly disappointing, have not been disastrous - yesterday’s data on initial jobless claims, existing home sales and manufacturing sentiment all surprised to the upside. At the same time, inflation remains stubbornly high, and upside risks to consumer prices from Trump’s tariffs (while likely temporary) should not be overlooked. The next big milestone will be the unveiling of a new round of reciprocal tariffs, which are expected on 2nd April. We expect the dollar to remain well bid as we approach this critical date.

The common currency eased from its recent highs on Thursday, with market participants perhaps doubting whether there was enough ammunition in the euro rally to send the EUR/USD pair through the key physiological 1.10 level. Speaking yesterday, ECB President Lagarde warned over the complicated impact of US protectionism on the Euro Area economy, saying that while a trade war could have negative ramifications for growth, it could also push up inflation in the bloc by as much as half a percentage point. Markets are still largely pricing in another cut from the ECB in April, but a lot will depend on the extent of the upcoming tariffs and the bank’s view on recent fiscal stimulus measures, particularly in Germany. Today bodes to be a relatively quiet day in the Eurozone. We will be looking ahead to Monday’s preliminary PMI figures for March. Any signs of a deterioration here could ramp up call for an April cut from the ECB, and there appears plenty of room for a retracement in the euro from current levels.

The MPC held rates steady on Thursday, as expected, with a mild hawkish twist in the communications suggesting that the bank is in no rush to cut. The 8-1 vote on rates was marginally more empathic than anticipated (7-2), with Catherine Mann (who favoured a 50bp cut last time out) rejoining the hawks. Policymakers warned over the downside risks posed by President Trump’s tariffs, although this was not enough to cause panic or elicit a dovish tweak in the MPC’s forward guidance, which continues to stress a “gradual and careful” approach to cuts. UK inflation is seen peaking at a higher level than previously anticipated, while the MPC also sees slightly stronger near-term growth (+0.25% in Q1). At the margin, a slightly more hawkish announcement that is consistent with our view for no more than just two 25bp cuts from the MPC during the remainder of the year (in line with market pricing). A cut at the May meeting remains possible, but we would probably need to see something drastic in the data between now and then to force the bank’s hand.

Author

Matthew Ryan, CFA

Ebury

Matthew is Global Head of Market Strategy at FX specialist Ebury, where he has been part of the strategy team since 2014. He provides fundamental FX analysis for a wide range of G10 and emerging market currencies.