Debt black hole putting increasing stress on american consumers

A giant Debt Black Hole dominates the U.S. economy, and Americans are feeling the stress.

In the third quarter, LegalShield’s Consumer Stress Legal Index (CSLI) hit the highest level since March 2020, the onset of pandemic-era government lockdowns of the economy.

The CSLI ticked up to 71.2 in September, climbing from 68.3 in July and August. It was the seventh straight month without any easing in the index. According to LegalShield, the index signals “continued financial strain among American households.”

The index is up 26.3 percent from its December 2021 post-COVID low of 56.4.

LegalShield bases its Consumer Stress Index on “a dataset of over 35 million consumer requests for legal assistance dating to 2002. The index examines findings from approximately 150,000 calls received monthly from U.S. consumers seeking legal help.”

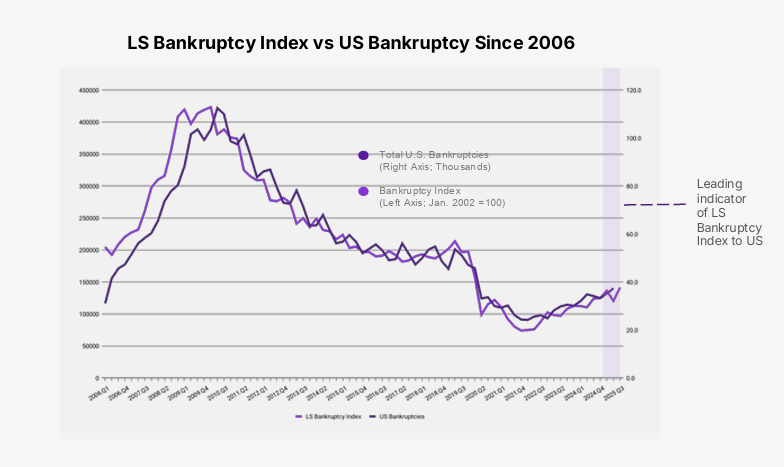

The CSLI was pushed higher by a 17 percent surge in bankruptcy inquiries. Since July, the Bankruptcy Index has increased from 34.7 to 37.7.

Bankruptcy inquiries historically lead filings by about two quarters. The subindex is now 13.9 percent higher than a year ago, continuing its upward trend since the initial Fed interest rate hike in March 2022.

“If current trends continue, actual bankruptcy filings are likely to rise in early 2026. While a recent Federal Reserve rate cut offers modest relief, elevated debt levels and ongoing delinquencies suggest that consumer stress will likely remain high heading into the holiday season.”

A LegalShield spokesperson said the surge in bankruptcy inquiries indicates families are hitting “crisis mode” heading into the holiday season.

“The question now is whether this consumer legal stress translates into a pullback in spending in the final quarter of 2025."

A Kansas City attorney who provides services for LegalShield said that the increase in non-mortgage debt is straining Americans, and many are at the breaking point.

“People are drowning in this economic state we’re in – so much to pay for with prices constantly increasing and credit cards with exorbitant interest rates, everyday Americans are running out of options. Bankruptcy is their last lifeline.”

LegalShield's Bankruptcy Index has served as a good predictor of actual bankruptcies.

As inflation surged in the wake of the monetary malfeasance of the pandemic era, Americans blew through their savings. Then they turned to credit cards. It wasn’t that people were buying more. They were just paying more, trying to keep up with surging price inflation. Once they blew through their savings, consumers were forced to finance life using Visa and Mastercard. Consumer debt surged from $4.15 trillion in 2020 to over $5 trillion today.

Now they are struggling to pay the bills.

We’re also seeing this consumer stress in a slowing of credit card spending. It appears many consumers have maxed out the plastic.

The growth of revolving debt – primarily reflecting credit card balances – has been slowing all year. It contracted in May and June, after a one-off surge in April, before suddenly surging once again in July. But in August, revolving debt contracted by 5.5 percent.

KPMG recently reported that the slowing growth of revolving credit likely reflects a drop in borrowing and spending by the bottom 80 percent of U.S. households “that are increasingly stressed.”

“The top 20 percent now account for nearly two-thirds of all consumption. The top 3.3 percent have increased spending the most. Spending has stagnated, adjusting for inflation, among the bottom 80 percent.”

The double whammy of rising debt and interest rates exacerbates the debt problem. The average annual percentage rate (APR) currently stands at 19.98 percent, with some companies still charging rates as high as 28 percent. The average is only slightly down from the record high of 20.79 percent set last August, despite Fed rate cuts.

The New York Fed reported that overall delinquency rates remained “elevated” in the third quarter, with 4.5 percent of all debt in some stage of delinquency. Credit card and student loan delinquencies have increased at the fastest rate.

Overall debt flow into serious delinquency was 3.03 percent in the third quarter, up from 1.68 percent year-on-year.

Credit card delinquencies are rising, even among consumers with strong credit scores. According to VantageScore, there was a 47 percent year-on-year increase in late payments by people in the prime segment.

None of this bodes well for an economy that depends on consumers buying stuff to keep limping along. It also underscores the impact the Debt Black hole is having on the economy. Not only are consumers levered to the hilt, but governments and corporations are also buried in record levels of debt.

This is precisely why the Federal Reserve is cutting rates despite persistent, sticky price inflation.

In a sane world, the central bank would be keeping monetary policy tight to rein in the inflation it created during the Great Recession and the pandemic.

But we don't live in a sane world. We live in a world with a Debt Black hole that requires even more easy money -- inflation be damned.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.