Daily outlook: XAU/USD is testing $1,796 resistance level

Although the November FOMC Minutes points out the "early rate hike" statement, Gold was not much volatility as investors had previously digested the rate hike expectation.

Early entry into the rate hike cycle can effectively curb inflation for a short period, but the key factors that bring inflation down are supply&demand and employment targets reaching stability. At the same time, the possibility that new confirmed Covid-19 cases will increase in the winter poses additional potential risks to economic growth.

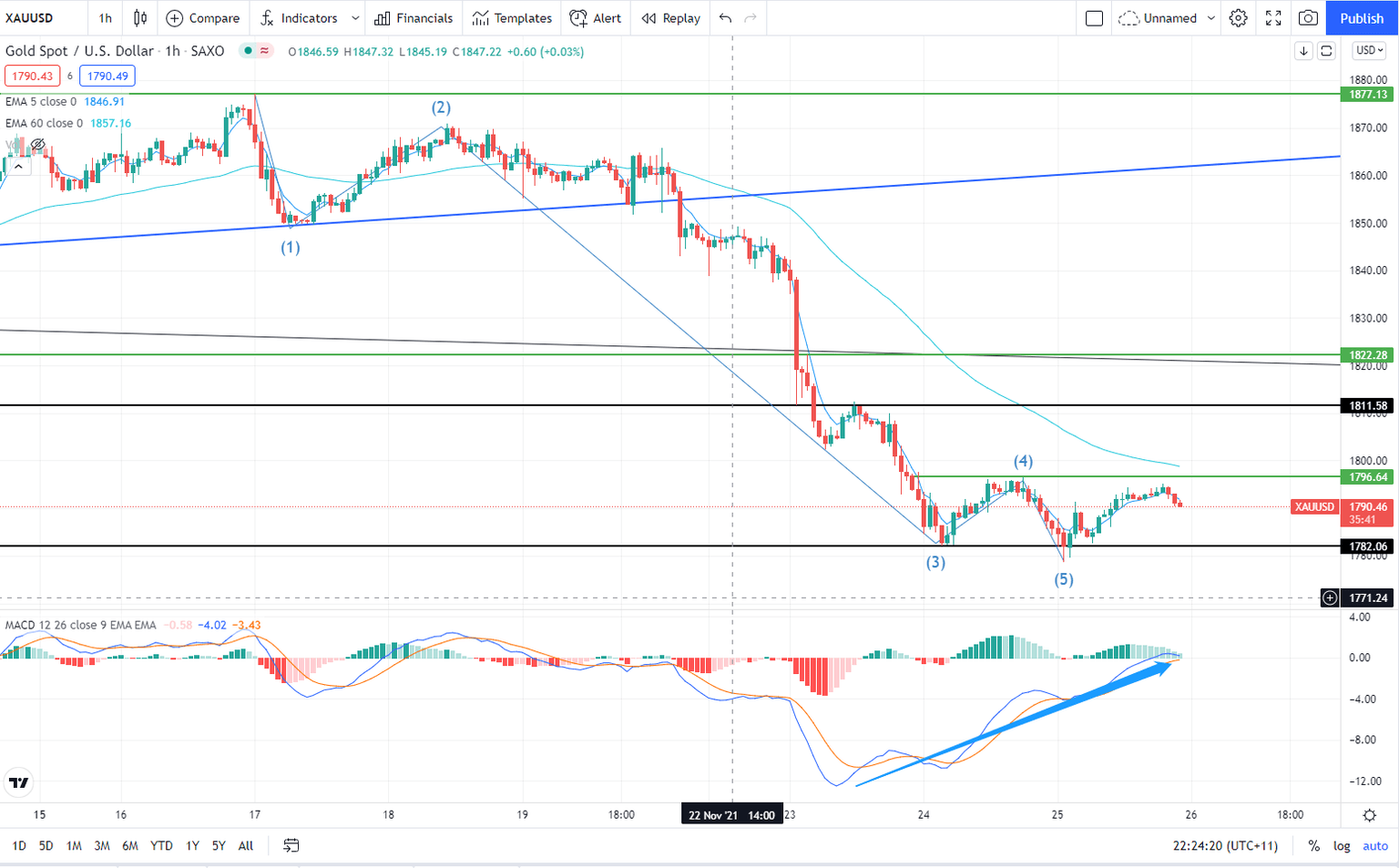

Gold has completed its Elliott 5 wave decline since its decline from $1,877, and the price is effectively supported at the 55-period weekly EMA around $1,788. Due to the lack of market liquidity in this Thanksgiving holiday, it is difficult for Gold to start a new trend immediately. From the 1-hour chart, Gold has rebounded from $1,778 to $1,790, and the oscillator MACD has shown that the downside force is gradually weakening; the price has a rebounding demand now. Traders can watch for the price to test the $1,796-97 resistance level again, and further above resistance levels are $1,811 and $1,822-$1,839 area.

Once yesterday's lows of $1,778 can not stop the sellers, traders need to wait for the price to reach the 1738-1755 area to have a more solid buy opportunity.

Author

Brian Wang

Independent Analyst

Based in Melbourne, Brian joined Capital.com in 2022 as a Dealer.