Czech policymakers still hawkish as inflation remains strong

Czech headline inflation was unchanged in March, flying above the central bank's target. The main contributor to the overall price gain was the strong dynamic in food prices. Although the growth in service prices has slowed, it remains high. Policymakers are maintaining a hawkish stance as inflationary pressures build amid rising uncertainty.

Food prices maintain growth momentum

Czech annual inflation remained unchanged at 2.7% in March, with the headline price index gaining 0.1% since February. Both growth rates in the preliminary estimate came in marginally stronger than markets had expected, yet in line with our projection.

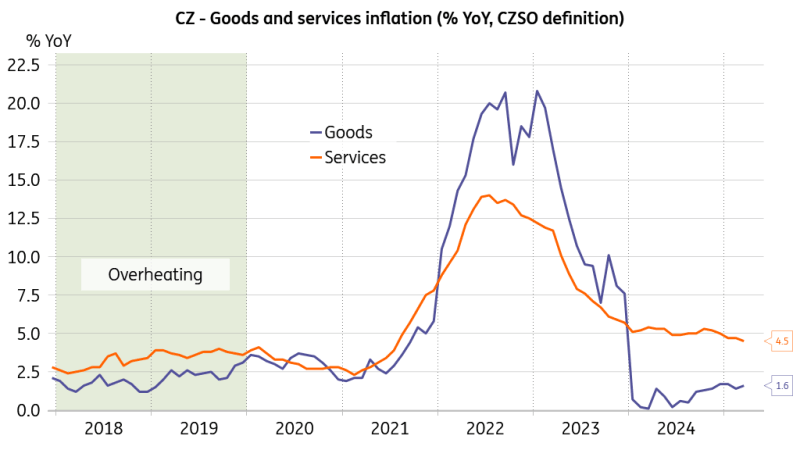

The disinflationary trend in services is ongoing

Source: CZSO, Macrobond

Food prices seem to be the driver of overall price gains in the annual and monthly dynamics, while energy prices declined. Price growth in the services sector eased to 4.5% annually in March from 4.7% the previous month, which is in line with our theory of a considerable price growth saturation in the segment following multiple quarters of nonnegligible price gains.

However, the annual dynamic remains elevated and well above 3.5%, which is consistent with inflation hitting the target. Meanwhile, annual price growth in the goods segment gained pace in March. We estimate that annual core inflation decelerated marginally in March but will likely gain pace in April.

CNB maintains a hawkish bias as uncertainty mounts

The central bank board left interest rates at 3.75% in March, with all members voting in favour. The Czech National Bank (CNB) minutes suggest that policymakers take the price growth inertia in the service sector seriously, which could be further driven by strong wage increases. At the same time, new US tariffs and the higher potential for escalation will likely contribute to the cautious stance of the bank board. We interpret the communication that the CNB generally perceives tariffs and a reshuffling of the international trade landscape as rather pro-inflationary in the near term while anti-inflationary in the medium term.

Consistent with the updated inflation outlook is a continued decline in interest rates followed by their approximate stability from the middle of this year. The board assessed the risks to the outlook as overall pro-inflationary. Governor Ales Michl stressed the necessity to theme the growth of money in circulation, to remain hawkish, and to beware of the inflationary risk of a permanent fiscal deficit and upbeat wage gains. Most of the risks identified at the February meeting remain relevant, especially for the domestic economy, but the downside risks to inflation have weakened.

There is still space for rate cuts

Source: Macrobond, RBNZ, ING

Board members Eva Zamrazilova and Jakub Seidler pointed to the dichotomy of the domestic economy, with consumer demand recovering but no turnaround in investment so far. The domestic economy seems stable, with the interest rate settings deemed adequate and not representing a significant source of constraints while keeping credit activity at an acceptable level. In contrast, the global situation is very opaque and requires a wait-and-see approach.

The bank board sees consumers in good shape, given the relatively upbeat sentiment regarding larger purchases, while household demand supported by brisk wage growth gradually shifts towards services. The structure of inflation shows that inflationary pressures in services may persist. This all translates to uncertainty about well-anchored inflation expectations. Accelerating real estate prices were also mentioned among the upside risks to inflation, as Zamrazilova and Kubicek do not consider their current dynamic compatible with price stability.

The central bank governor mentioned that it is reasonable to keep policy rates stable for now, as the outlook for core inflation is still relatively potent. According to Kubicek, the stop-and-go approach reflects well on the current situation, as it allows the interest rate to land softly and reach the neutral level, which he sees around 3.5%. Kubelkova believes that leaving the base rate unchanged or reducing it by 25bp does not represent a risk to financial stability. The relative proximity of the estimated neutral level encourages caution while the easing process is not yet complete.

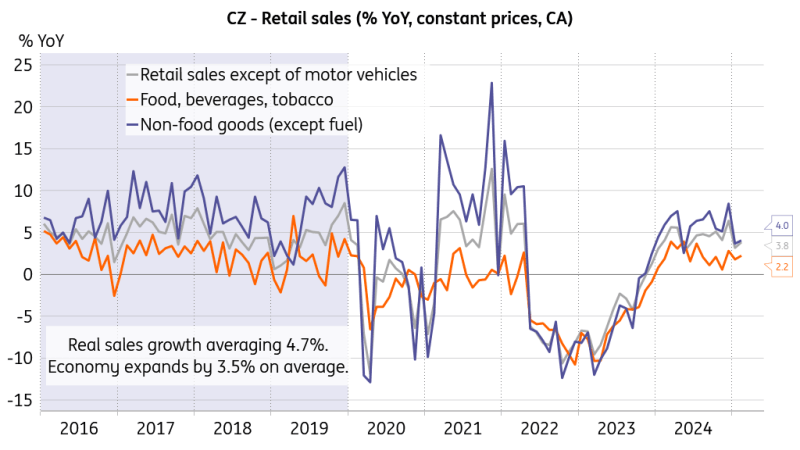

Spending continues at a solid pace while new risks arise

Real retail sales added 3.8% YoY and 0.4% MoM in February, beating market expectations. Retail sales increased in February across most sectors, suggesting that the consumer still has enough resources to drive spending and contribute to the economic rebound along with the recovering construction sector.

Consumers are in good shape

Source: CZSO, Macrobond

We are currently facing more immediate inflationary risks from external factors, such as tariffs and Germany's more relaxed fiscal policy, as well as domestic factors, including strong household spending and the potential for increased defence spending. Nevertheless, we see the medium-term risks to growth performance stemming from the elevated global uncertainty that could reduce investment appetite and motivate households to precautionary savings. We believe there is still some scope for monetary policy to support the Czech economy in reaching its full potential, particularly in light of the current risks to global economic growth.

The tariffs and potential retaliation will make expansion towards the US for Czech manufacturers more difficult. At the same time, there is a major risk stemming from cheap Chinese goods flooding Europe, thus also making life harder for the Czech industrial base. This clearly poses a negative risk to domestic economic expansion when looking ahead. We see the negative direct impact on Czech growth as rather moderate for now, however, it can compound with the indirect impact via German overseas exports being hit hard and the uncertainty effects that could postpone investment decisions and incentivise precautionary savings among households. Thinking about the downside risks to economic performance, we expect CNB rates to be pushed to 3.25% in two moves in the May and August meetings.

Read the original analysis: Czech policymakers still hawkish as inflation remains strong

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.