Cycle Trading: The miners and the 200 Day MA

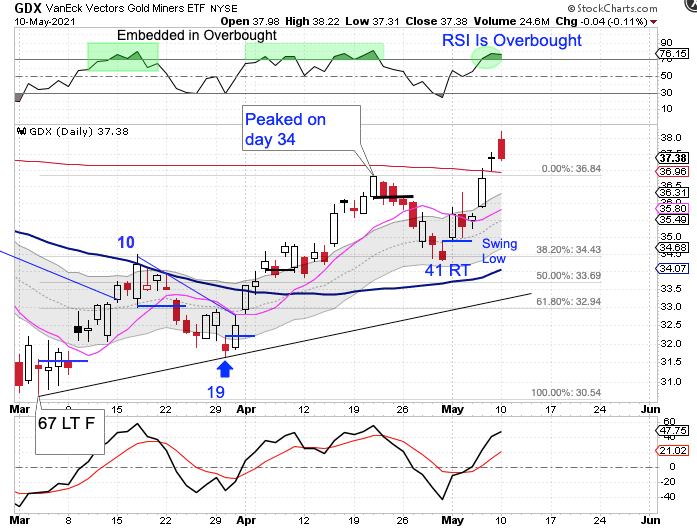

The Miners printed a bearish reversal on Monday. This calls into question if day 41 was the daily cycle low.

In April, the Miners peaked just below the 200 day MA on day 34. Major resistance levels, like the 200 day MA usually will cause a reversal if the cycle is in its timing band for a daily cycle low. And if there is a breakout late in the daily cycle, there is rarely any follow through due to the lateness of the cycle.

The Miners formed a swing high off of the day 34 peak then closed below the 10 day MA to signal the daily cycle decline. The decline into the day 41 low caused the 10 day MA to turn lower and even retraced to below the 38 fib level. So it looked in real time that day 41 was the DCL. And with a fresh "set of downs" the Miners closed above the 200 day MA on Friday to signal a new daily cycle low. Then the Miners printed a bearish reversal on Monday.

The Miners are stretched above the 10 day MA and may need to consolidate along the 200 day MA to allow the 10 day MA to catch up to price. And if that is the case then we will maintain our labeling of day 41 as the DCL. However, if the Miners close below the 200 day MA and deliver bearish follow through that would indicate an extended daily cycle scenario making Monday day 48 with the DCL is still in front of us.

What is certain is that the Miners are in a daily uptrend that is characterized by highs forming above the upper daily cycle band and lows forming above the lower daily cycle band. The Miners will remain in their daily uptrend unless they close below the lower daily cycle band.

Author

LikesMoney

Independent Analyst

Assets (such as stocks, gold, and the dollar) have identifiable cycles.