Currency market: EUR/USD vs CAD/ZAR

In the January 2020 article, EUR predicts EUR, I revealed how to factor by calculator how all EUR/USD roads lead to EUR/GBP by either EUR/USD reciprocals or as EUR/USD seen by most as 1.2250 for example.

And for interested, from November 2019 to January 2020, located on site is GBP Predicts GBP, AUD Predicts AUD, NZD predicts NZD, CAD predicts CAD and JPY predicts JPY.

Traders learn how to trade true exchange rates by exchange rates using a calculator. Not only simple and highly profitable but its all mathematically correct. And takes 2 seconds.

EUR/USD perfect opposite currency pair is CAD/ZAR. Peter Wadkins wrote over many years, CAD/ZAR is the true commodity currency. due to the combination and CAD/ZAR derivation as USD/CAD and USD/ZAR.

Find CAD/ZAR price by divide USD/ZAR by USD/CAD. Today CAD/ZAR trading price is 11.36 by USD/ZAR 14.5777 divide USD/CAD 1.2823.

CAD/ZAR big high / Low break is located at 11.86 and EUR/USD 1.1974.

CAD/ZAR as EUR/USD perfect opposite currency is the same as saying CAD/ZAR is the perfect opposite to EUR/USD because CAD/ZAR is actually a USD currency Pair. If EUR/USD is transformed to its reciprocal as USD/EUR then CAD/ZAR and USD/EUR become the same exact same currency pair. See the first chart below.

CAD/ZAR traditionally moves far wider than EUR/USD.

Strategy. If CAD/ZAR breaks above 11.86 then it trades higher and EUR/USD trades lower. Much lower.

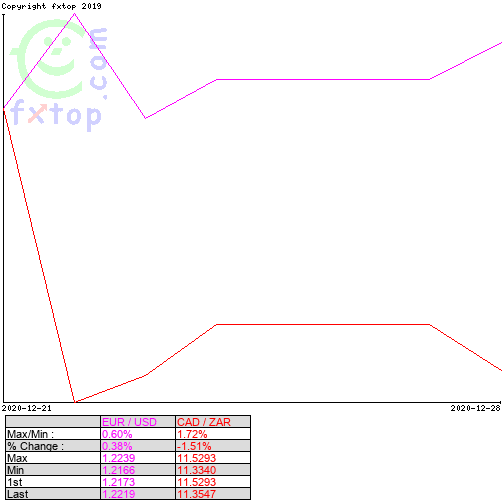

Below 1 week USD/EUR Vs CAD/ZAR

Below 1 week EUR/USD Vs CAD/ZAR. EUR/USD to high and CAD/ZAR to low

EUR/USD Vs CAD/ZAR 1 month

EUR/USD Vs CAD/ZAR 3 months

EUR/USD Vs CAD/ZAR 1 Year and the Big Crossover

EUR/USD Vs CAD/ZAR 2 years

EUR/USD Vs CAD/ZAR 4 Years

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.