Crypto is more of a threat to gold than to the dollar

Outlook

We get retail sales, and industrial production today, along with PPI. Retail sales is the important one but even so, with the $1.9 trillion recovery money still to come, not decisive. Retail sales fell 0.7% m/m in Dec, and is forecast up 0.9% by TradingEconomics.com. The WSJ has a more optimistic 1.2%.

Later in the day we get the Fed minutes, following comments from the three regional Fed presidents yesterday and ahead of Powell’s congressional testimony next week. All three regional Fed presidents downplayed inflation fear and Daly (San Francisco) mentioned preventing unwarranted inflation fear to avoid premature tightening. There is also talk about how the Fed feels towards cryptocurrencies and the wild rise in bitcoin. The Fed is not indifferent, but crypto is more of a threat to gold than to the dollar.

The elephant in the room is yields rising so far, so fast and not just in the US–"everyone’s yields are at least a little higher.

For the US, one interpretation of this yield gain is revived confidence in government competence–"for the first time in a long time. Despite crippling winter storms over half of the country, the government is doing what a majority want it to do–"fixing real and urgent problems. The public approves of Covid relief funding, the improved vaccine rollout, and even infrastructure spending (for the long overdue railway tunnel under the river dividing New Jersey and New York, something the previous administration would not approve, and thanks, Pete).

Pres Biden has a 62% approval rating in one poll, far higher than anything the previous guy ever achieved. We can even say that Republicans might be a little more willing to work with the Dems on pragmatic projects and leave the Trumpy sore losers behind at the state and local level.

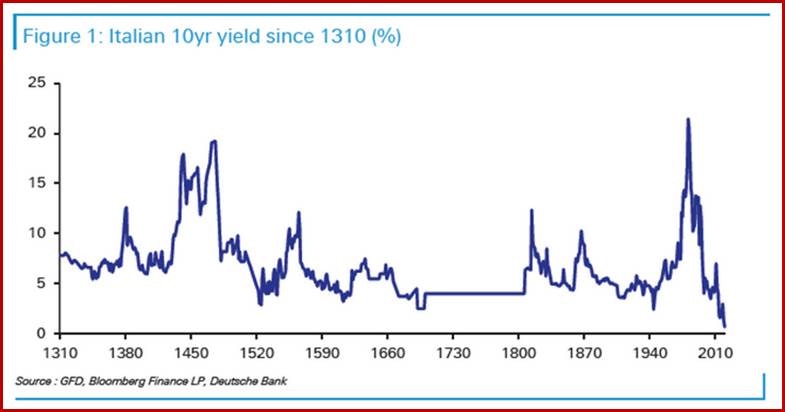

Here's the question: is it stretching the point and say that the rise in yields is a vote of confidence in the new government getting robust activity going again, even if it may bring inflation with it? If we attribute falling Italian yields to expected competence from PM Draghi, it seems only fair to credit the new American government with a hike in yields that means “recovery.”

For fun, see the chart prepared by a clever guy at Deutsche Bank showing Italian yields since 1310. The yield is lower today than at any time since the early middle ages, before Italy was even a country. The designer used proxies for overall debt from city-states like Naples. The point is that having Draghi as leader is a Very Big Deal. He will announce some of the spending plans and structural reforms he has in mind this morning. The FT is calling it a “unity government;” we don’t know if the Italian press and people see it that way.

The rise in yields is built on sand. We have no evidence of inflation yet, and even growth figures are still spotty. And yet the effect on currencies is very real. We can’t think of any other reason for the dollar/yen to have reversed direction so abruptly. And it’s likely the rally in AUD ran into a brick wall yesterday for that reason. Both the AUD and NZD are hanging on by a fingernail, technically speaking, and the peso lost all its upward momentum. Bloomberg reports some say that we might expect “verbal intervention” from the Fed to cap the rise if yields go much over 1.30%. Some say equities will be in trouble if it goes to 1.5%.

We doubt the verbal intervention forecast. It’s not the Fed’s style, and besides, the underling issue is inflation, not recovery. To the extent rising yields signal recovery, it’s just what the Fed wants. The Fed will just keep soldiering on, denying that any rise in inflation will be long-lasting. Market players prefer to go with the flow rather than the data or any institutional assurances, however, so this can get out of hand and PDQ, too. At a guess, 1.5% will become the new expectation and get priced in.

That means the new dollar firmness will be a temporary correction rather than a reversal.

Politics: Okay, we can’t resist and some non-US Readers have asked us to continue commenting on US politics. This time for the first time in a long time, it’s really very good: despite crippling winter storms over half of the country, confidence is returning in government competence–"Pres Biden has a 62% approval rating in one poll, far higher than anything the previous guy ever achieved.

This is due to approval of Covid relief funding, the improved vaccine rollout, and even infrastructure spending (for the long overdue railway tunnel under the river dividing New Jersey and New York, something the previous administration would not approve, and thanks, Pete). We can even say that Republicans might be a little more willing to work with the Dems on pragmatic projects and leave the Trumpy sore losers behind at the state and local level. Even the rise in yields is a vote of confidence in the new government getting robust activity going again, even if it may bring inflation with it.

Then there’s the fun stuff, like the NAACP suing Trump (and Giuliani) under an old law nicknamed the Ku Klux Klan law. State lawmakers in Georgia are rushing to change the state constitution to make requesting falsification of election results no longer a crime, as the country attorney general continues to prepare an indictment against Trump. That presentation would be short and sweet, since we have the telephone recording.

There is also an issue surrounding Trump’s Justice Dept doing his bidding instead of what it’s supposed to do, like interfering in a Trump rape case. We don’t have the new Attorney General confirmation yet so nobody knows what old cases may get revived or heads will roll.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat