Crude Oil Drops Dragged by China's Exports

Crude oil is exchanged mostly bearish on Monday after weaker China's export data.

The Crude oil plummets 52.6 cents or 0.89% falling to $58.61 per barrel, and Brent oil drops 58.5 cents or 0.91%, easing to $63.63 per barrel.

Crude oil prices fall this Monday after China's export data fell for the fourth consecutive month. This situation caused concern among investors about the damage that the U.S.-China trade conflict could be causing.

In November, China's exports dropped by 1.1% compared to October, while the consensus of analysts expected an increase of 1%.

The increase in uncertainties stems from concerns about the realignment that could be taking place over the extended duration of the U.S.-China trade conflict.

Technical Overview

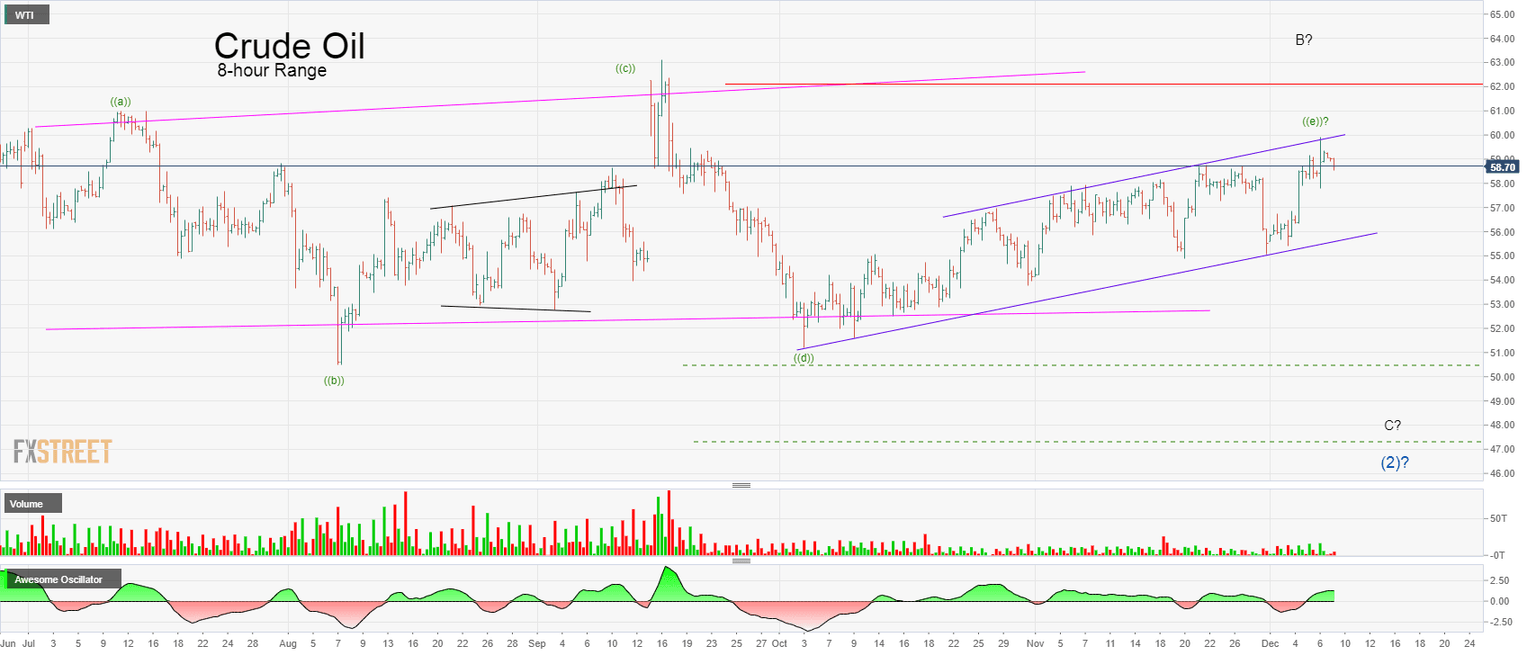

Crude oil, in its daily chart, reveals that its price continues moving in a consolidation structure as an ascending expanding triangle. At the same time, in the near-term, the price action runs in an ascending channel, which reached the $59.90 per barrel on December 06.

According to the Elliott wave theory, the triangle pattern is a corrective formation that follows a 3-3-3-3-3 sequence and brings the possibility of continuation of the previous movement.

The next chart shows the oil in its 8-hour range rejecting down the upper line of the ascending channel. However, the sideways movement still makes us suspect that the market's participants are undecided concerning the next path.

The 2-hour chart reveals the possibility of a limited bullish continuation in the short-term. The price action could drive to Crude oil to visit the zone of September's high.

In summary, despite the short-term structure reveals the probability of a new bullish movement, our long-term vision still expect a further decline.

However, the extension of the consolidation sequence started in the half of June 2019, which still is in progress, makes us expect a limited drop, probably to $50 per barrel as a psychological level.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and