Crude oil didn’t like Thanksgiving Turkey this year

It appears that the US markets didn’t find the Thanksgiving turkey very tasty this year.

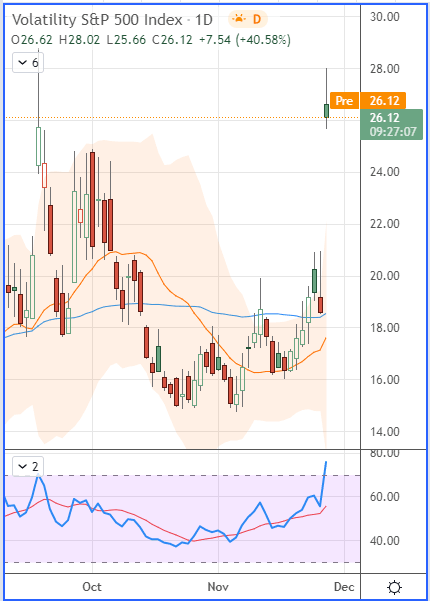

CBOE Volatility S&P 500 Index (VIX) Futures (daily chart)

With the “indicator of fear” (also known as the VIX or Volatility Index) spiking over 13.5 % in the European session, propelling some precious metals (gold and platinum) and natural gas to the roof, while sending the crude and petroleum products to the lower ground, the volatility has just clearly reached a higher level.

(Source: FINVIZ)

Most of our premium subscribers enjoyed a last ride on the long side for WTI crude oil this month while following our trade projections. For more details of the last oil trading position provided last week, I have just released that trade as it got very close to reaching its projected target on Wednesday (Nov. 24).

WTI Crude Oil (CLF22) Futures (January contract, daily chart)

The main fears on the oil market come from the possibility of a demand slowdown starting from Q1 2022. Additionally, that timing happens when the United States, along with a larger group of countries (including China, India, Japan, Republic of Korea, and the UK) have made the decision to release some of their strategic oil reserves on the market, aiming at artificially increasing the supply, and thus lowering oil prices. Well, this may represent one driver of prices indeed, although a more general economic slowdown associated with a non-sustained demand as we are getting into the winter, maybe the main concern now.

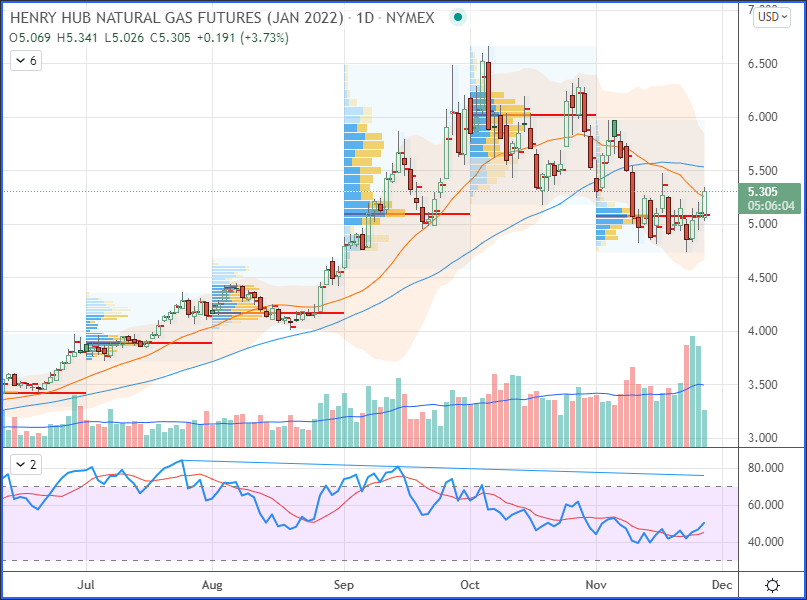

On the other hand, the winter – expected to be colder in certain regions – is also supporting the gas prices, hence the recent surge on the Henry Hub futures, along with sustained US exports of Liquefied Natural Gas (LNG) that are also supporting natural gas prices.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Sébastien Bischeri

Sunshine Profits

Sebastien Bischeri is a former Reserve Officer in the French Armed Forces (Navy), and began his career in computer science and engineering, prior to move into banking, finance, and trading.