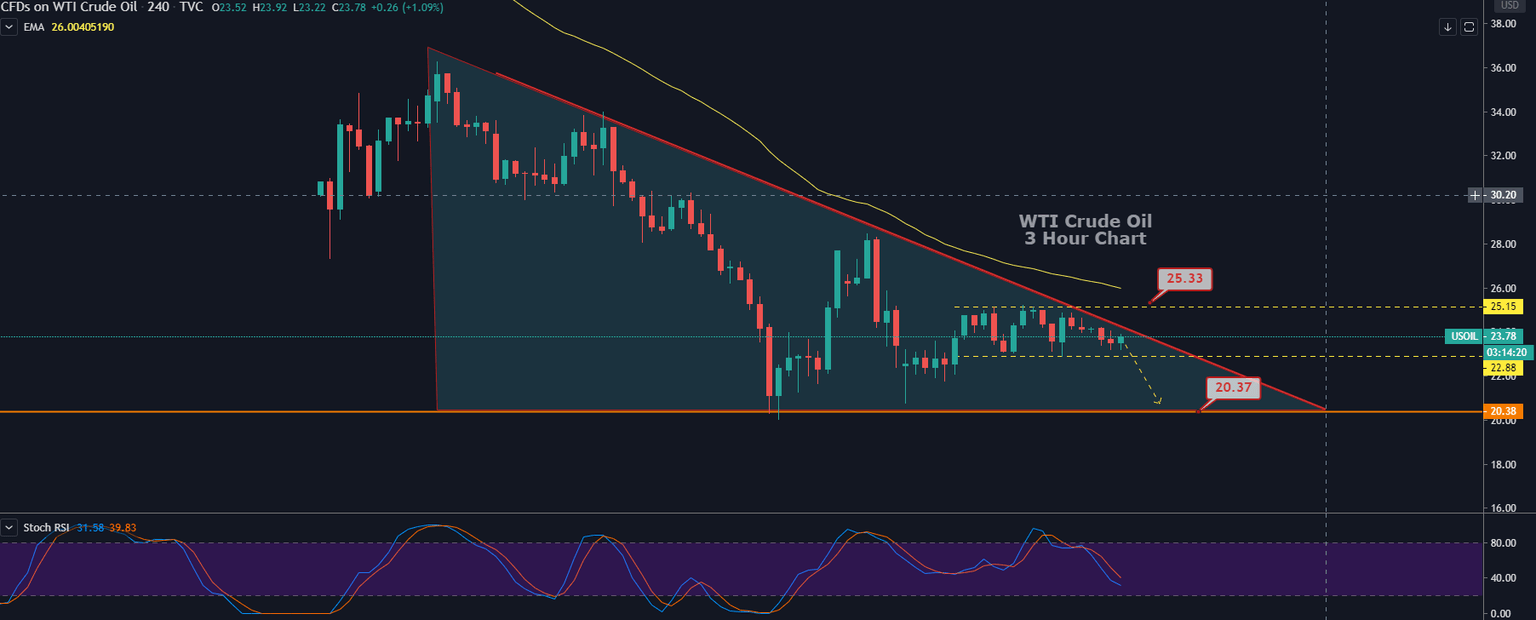

Crude Oil Descending Triangle Pattern - COVID 19 Continues to Play!

Oil prices kept trading on the upside. U.S. Nymex crude oil futures charged 2.0% higher to $24.49 a barrel, and Brent edged up to $27.39. Crude oil prices are trading under pressure as the world may soon run out of place to save its excess oil as Saudi Arabia plans to expand its fossil fuel output even as the global market for energy extends to drop in the wake of Covid-19 pandemic.

Crude oil storage levels beyond the world's storehouse facilities have soared to nearly three-quarters complete on average since the January closedown of major factories in China's manufacturing heartlands to derive the outbreak of the coronavirus. Consequently, the market is trading crude oil with a bearish sentiment.

| Support | Pivot Point | Resistance |

| 23.75 | 24.64 | 25.78 |

| 22.61 | 26.66 | |

| 20.58 | 28.69 |

Technically, the WTI has formed a descending triangle pattern, which is extending resistance at 24.30 level. The resistance is extended by a downward trendline, which is keeping the oil under bearish pressure. On the lower side, immediate support that crude oil can face is 22.88 area.

Typically, the descending triangles drive selling bias, and break out mostly occurs on the lower side. If that is the case, we may see oil prices heading lower towards 20.40.

WTI Crude Oil - Trade Setup

Sell Below: 23.90

Take Profit: 22.50/21.85

Stop Loss: 24.65

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and