Credit card spending is much weaker than it looks, but does it portend recession?

Let's dive into the Fed's latest report on consumer credit in both nominal and real (inflation-adjusted) terms for clues on the health of consumers.

Please consider the Fed's Consumer Credit G.19 Report for December 2022.

In 2022, consumer credit increased 7.8 percent, with revolving and nonrevolving credit increasing 14.8 percent and 5.6 percent, respectively. During the fourth quarter, consumer credit increased at a seasonally adjusted annual rate of 6.5 percent, while in December it increased at a seasonally adjusted annual rate of 2.9 percent.

The federal government originates consumer credit solely in the form of nonrevolving student loans through the Department of Education.

There has been a lot of discussion on the surge in credit card debt so let's dive in further.

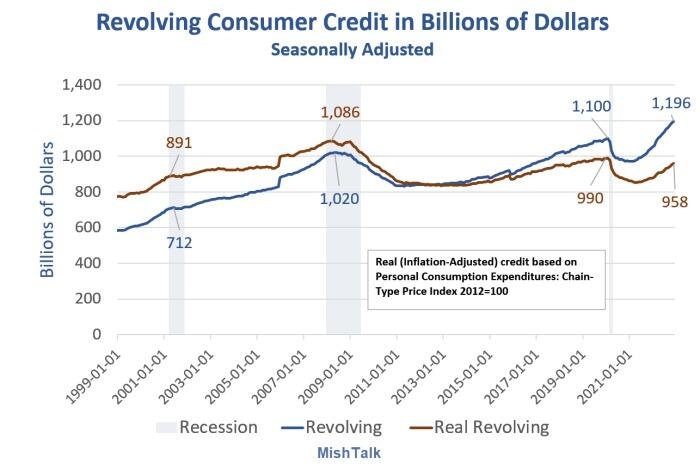

Real Consumer Credit in Billions of Dollars

Real revolving consumer credit peaked at $1.086 trillion in February of 2008, one month into recession and has never been higher since.

Revolving Consumer Credit Nominal vs Real Detail

Consumers have been on a credit card binge but more so in nominal terms than real (inflation-adjusted) terms.

Nonetheless, the binge is important. Consumers pay interest fees on a nominal, not real basis.

The sharp rate of acceleration suggests consumers are struggling with finances.

Very Lagging Indicator

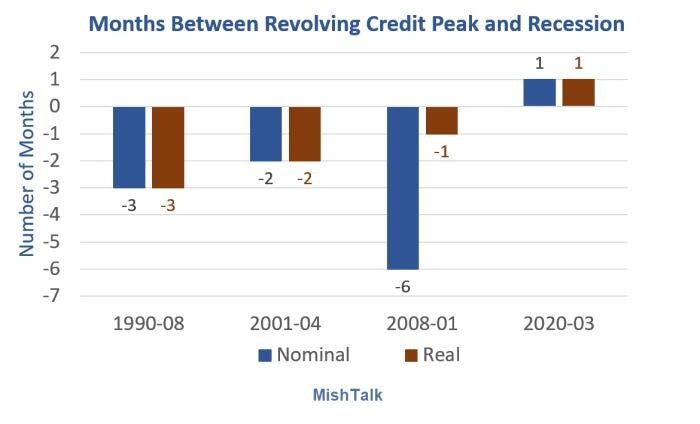

Take a look at the preceding chart for when revolving credit peaks in each cycle.

Credit peaks tend to happen in recessions, not ahead of recessions.

Months Between Revolving Credit Peak and Recession

Negative numbers indicate revolving debt kept rising after a recession started.

Prior to 1990 credit card debt was minimal and often rose during an entire recession, so I excluded prior recessions.

During the Great Recession, nominal credit card spending rose for six months at the start of the recession.

There was a lag time in 2020 only because of the suddenness of the Covid pandemic.

Does Revolving Credit Portend Recession?

Revolving credit is such a lagging indicator it portends nothing, at least by itself.

But given the historic lags, data is not inconsistent with the idea that a recession has already started.

Also note that real revolving credit is still rising while real spending has declined for two months. This indicates credit stress and consumers struggling to maintain lifestyles, increasingly relying on credit cards to do so.

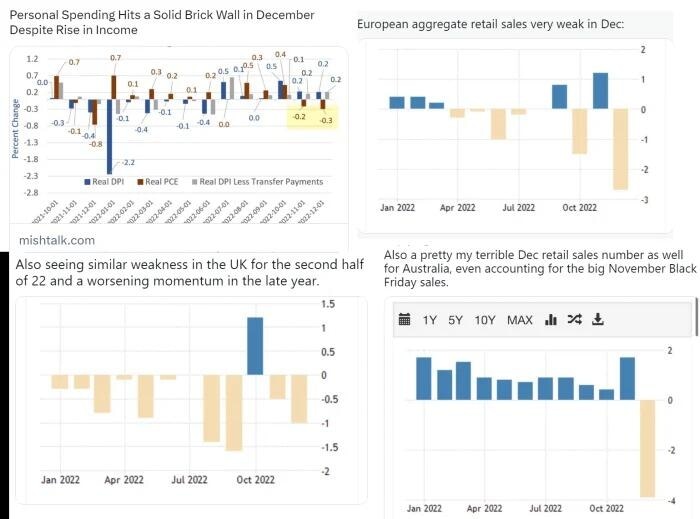

Month-Over-Month Retail Sales

- Food Service: -0.9 percent

- Food Stores: +0.0 percent

- Gas Stations: -4.6 Percent

- General Merchandise: -0.8 Percent

- Excluding Motor Vehicles and Gas: -0.7 Percent

- Excluding Motor Vehicles: -1.1 Percent

- Nonstore (Think Amazon): -1.1 Percent

- Motor Vehicles: -1.2 Percent

- Department Stores: -6.6 Percent

Spending Brick Wall

Consumer spending hit a brick wall in the US, EU, UK and Australia.

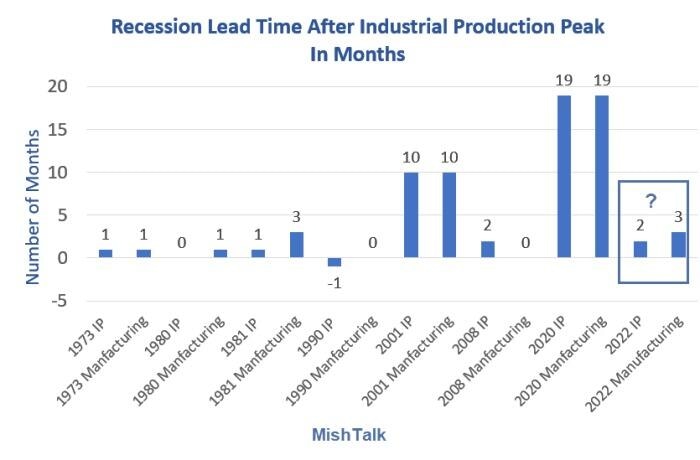

Industrial Production Recession Lead Times

I highly doubt we have ever seen conditions where retail sales, industrial production, and housing starts and sales have been this miserable where the economy was not already in recession.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc