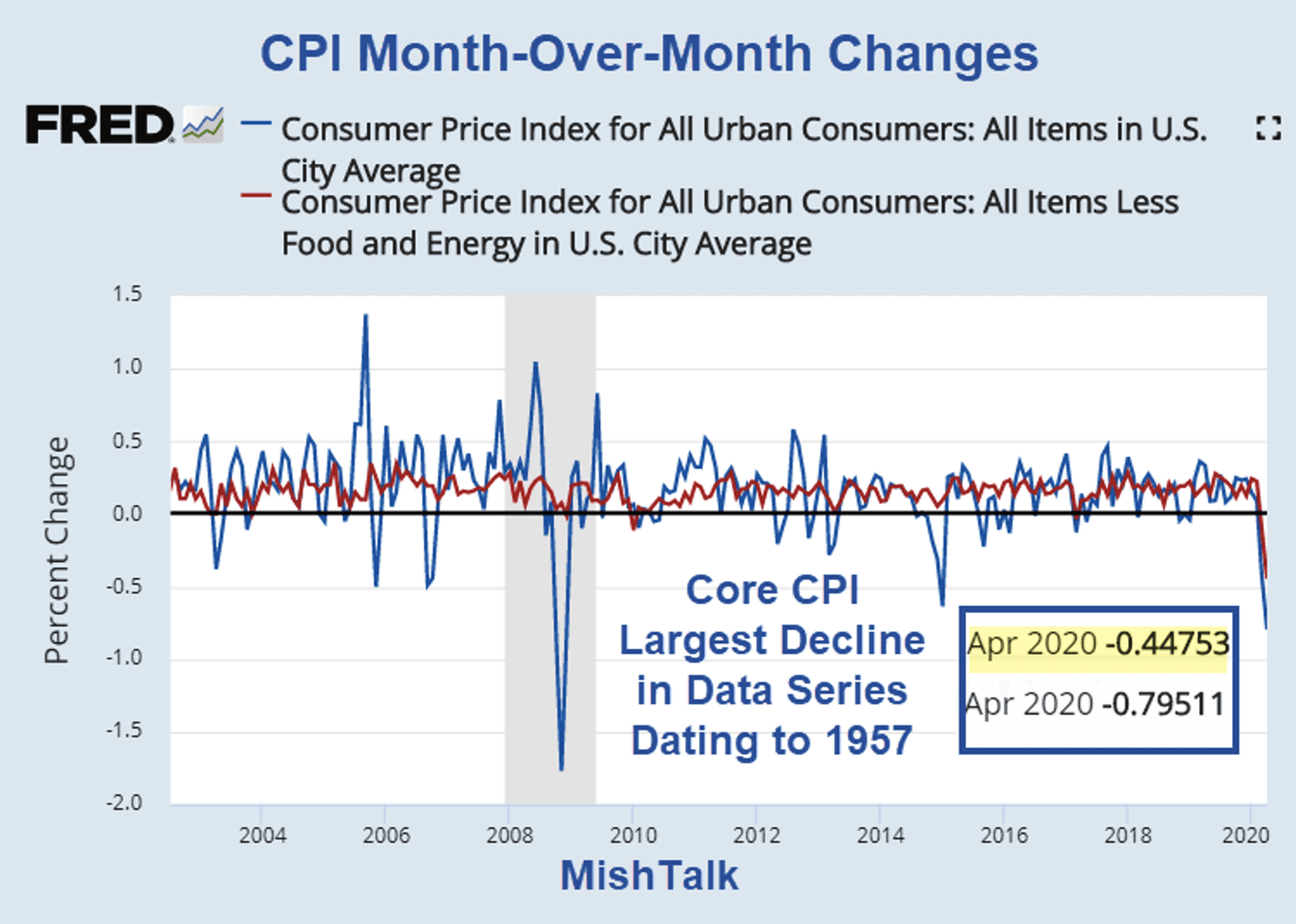

CPI and core CPI in rare negative territory

Month-over-Month measures of the CPI are in negative territory.

The BLS reports consumer prices are in negative territory for the month with both the CPI and core CPI in negative territory.

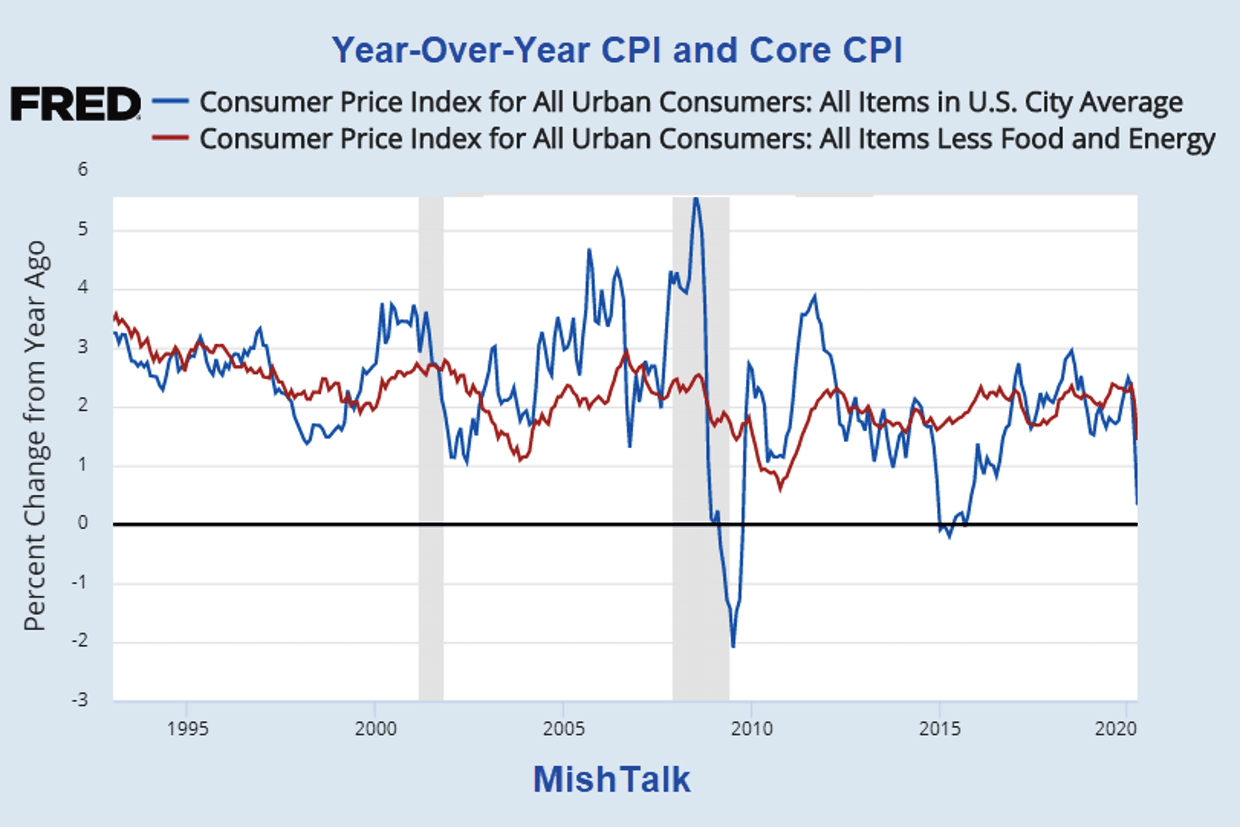

Year-over-year the CPI is up 1.4% and core CPI, which excluded food and energy is up 0.3%

Year-Over-Year CPI

CPI Details

- The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.8 percent in April on a seasonally adjusted basis, the largest monthly decline since December 2008.

- A 20.6-percent decline in the gasoline index was the largest contributor to the monthly decrease in the seasonally adjusted all items index, but the indexes for apparel, motor vehicle insurance, airline fares, and lodging away from home all fell sharply as well.

- Food indexes rose in April, with the index for food at home posting its largest monthly increase since February 1974.

- The index for all items less food and energy fell 0.4 percent in April, the largest monthly decline in the history of the series, which dates to 1957.

- The indexes for used cars and trucks and recreation also declined.

- The indexes for rent, owners’ equivalent rent, medical care, and household furnishings and operations all increased in April.

- The all items index increased 0.3 percent for the 12 months ending April, the smallest 12-month increase since October 2015. The index for all items less food and energy increased 1.4 percent over the last 12 months, its smallest increase since April 2011.

- The food index rose 3.5 percent over the last 12 months, its largest 12-month increase since February 2012.

Mish Personal Results

I had a photography trip that I cancelled then rescheduled for the exact same time.

- Airline ticket dropped from $800 to $600

- Car rental dropped from $800 to $300

- Hotel dropped from $130 a night to $80 a night

Now is a great time to travel if you are in good health and can practice Social Distancing. The airlines require use of masks.

Mish

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc