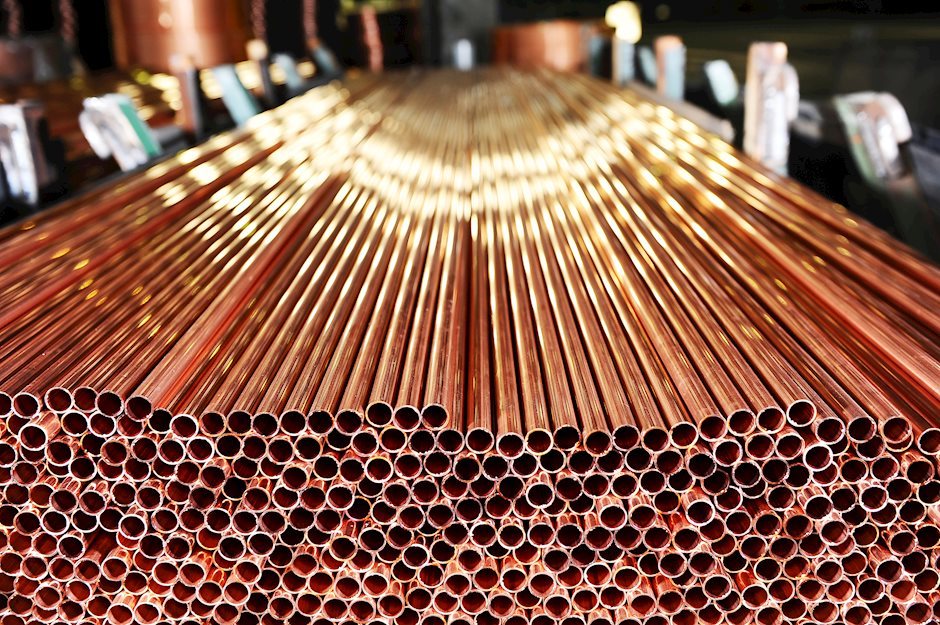

COPPER – surge in inventories sparks fresh sell-off

COPPER

Copper price accelerated lower on Tuesday, signaling extension of pullback from $3.3200 high on break below four-day congestion floor at $3.1790.

Fresh weakness was sparked by surge in copper inventories which signal healthy supplies and pressuring metal’s price.

Bearish acceleration took out support provided by 55SMA ($3.1418) and dented Fibo support at $3.1312 (50% retracement of $2.9425/$3.3200 rally), eyeing next support at $3.1066 (100SMA) and $3.1000 (top of daily Ichimoku cloud).

Daily cloud twists next week and could attract for further weakness, with extended dips expected to find footstep above $3.0867 (Fibo 61.8%) to keep bulls intact.

Daily indicators are heading south, with momentum deeply in the negative territory and slow stochastic being strongly oversold, showing space for further fall but suggesting that corrective bounce could be expected in the near-term. Bearish scenario sees close below $3.0867 pivot as negative signal for deeper correction.

Res: 3.1312; 3.1418; 3.1758; 3.1973

Sup: 3.1066; 3.1000; 3.0867; 3.0525

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.