Consequences of NFPs surprise that wasn’t

S&P 500 gave more clues as the NFPs reaction premarket, and clients were ready through my macro prediction of a decent figure, and ES not revisiting Thursday‘s flush lows. Signs were there as you can see from this partial premium quote with chart included:

(…) "Repeating my yesterday‘s words (even truer with more proof today), it‘s as if S&P 500 tries hard to break down, gives signs of breaking down, but eats supply and reverses to the 5,750s again – in a wait and see mode. And the positioning smacks of bullish to me. I don‘t see yesterday‘s lows as revisited"

S&P 500 gave more clues as the NFPs reaction premarket, and clients were ready through my macro prediction of a decent figure, and ES not revisiting Thursday‘s flush lows. Signs were there as you can see from this partial premium quote with chart included:

(…) "Repeating my yesterday‘s words (even truer with more proof today), it‘s as if S&P 500 tries hard to break down, gives signs of breaking down, but eats supply and reverses to the 5,750s again – in a wait and see mode. And the positioning smacks of bullish to me. I don‘t see yesterday‘s lows as revisited"

The week had been going great across all assets on my watch as you can see from the tweet summary. Similarly to Sep 50bp cut and subsequent Treasuries decline that didn‘t catch clients off guard, this strong NFPs beat together with the two preceding months‘ revisions did neither, and is pivotal – similarly underappreciated to the rate cutting path.

I‘ll reserve the most detailed thoughts (assets and sectors to outperform and underwhelm) for clients as always, for now let‘s just say that rate cut odds for remainder of 2024 stand no longer at 75bp as the mainstream expectation, but as two 25bp cuts – making it clear (against the chorus of recession fearmongers) that actually no recessionin 2024 is coming, average hourly earnings are good, and the consumer strength is underappreciated. While I wasn‘t a fan of singling out AI productivity in past months / year as a key variable of why there wouldn‘t be a recession, it now appears that (slowly) rising productivity will play a greatly supportive role in the real economy path in 2025.

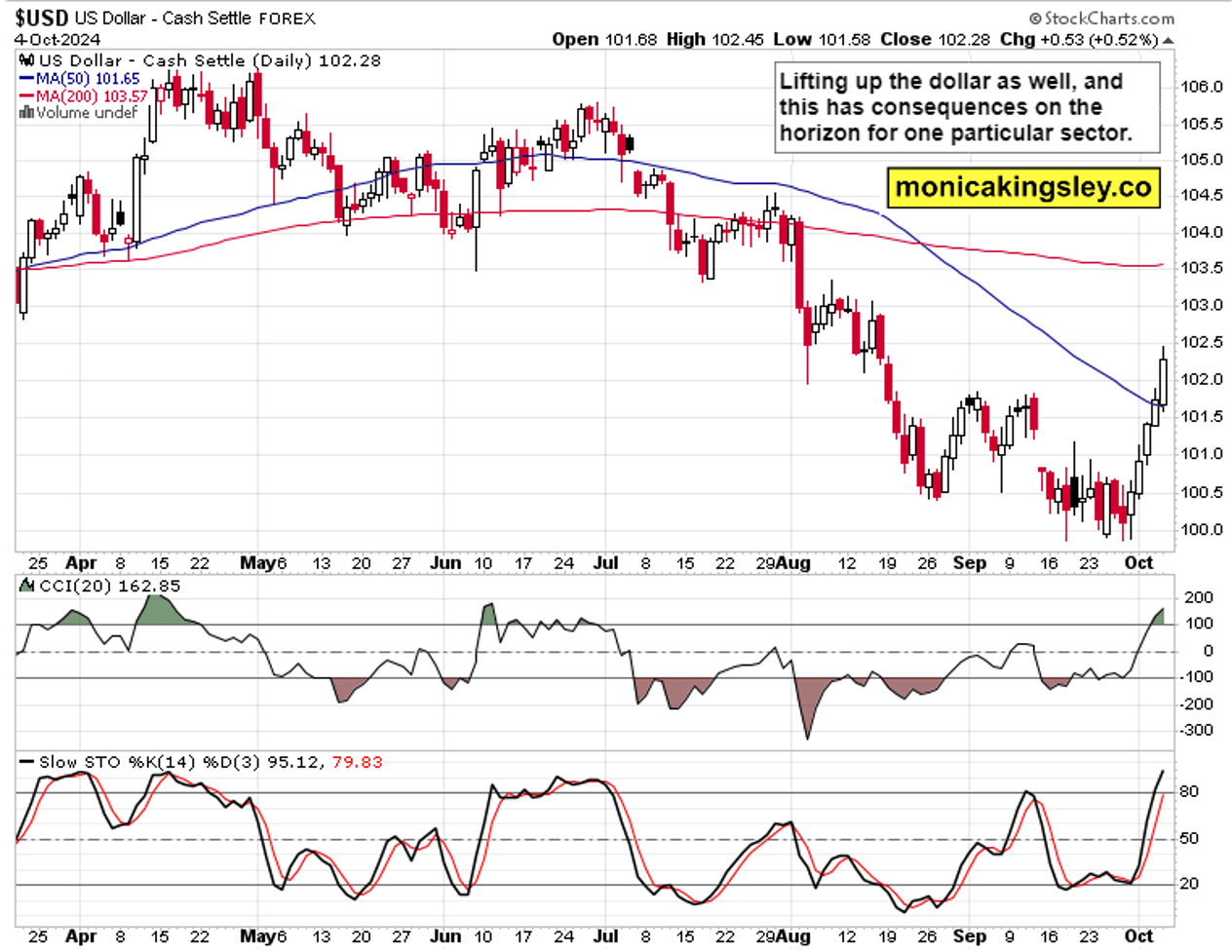

In other words, the Fed is cutting into a not crashing economy. Have a look at this yields and USD chart – and forget not my bullish words about China stocks (focus on finance) and resource plays.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.