Clinton extends her lead but don’t rule out a Trump comeback yet

-

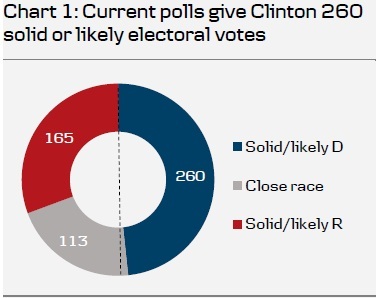

With less than four weeks to Election Day on 8 November, Hillary Clinton is significantly ahead in national polls and on the electoral vote count (see Chart 1). However, do not rule out a Trump comeback just yet, as Trump managed to come back in September after the campaign meltdown in August.

-

The Trump campaign is having a difficult time with negative media stories and prominent Republicans no longer campaigning for Trump. Since last Friday, when an 11-year old tape of Trump making derogatory comments about women was released, The New York Times released a story on Wednesday about two women, who allege that Trump touched them inappropriately 11 and 35 years ago, respectively. The Trump campaign calls the allegations ‘false smears' and is considering suing the paper.

-

Clinton's campaign has not stayed out of trouble with the WikiLeaks release of emails but Trump's downturn has overshadowed this. Media focus could easily shift to Clinton now that Trump's campaign is looking weak, which could change momentum.

-

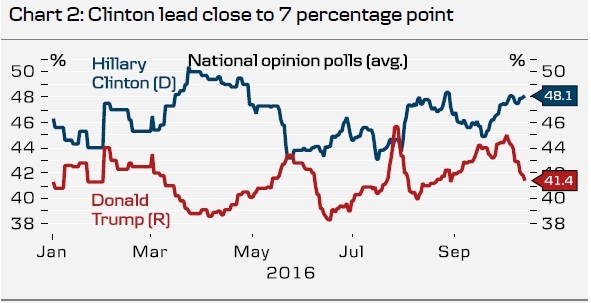

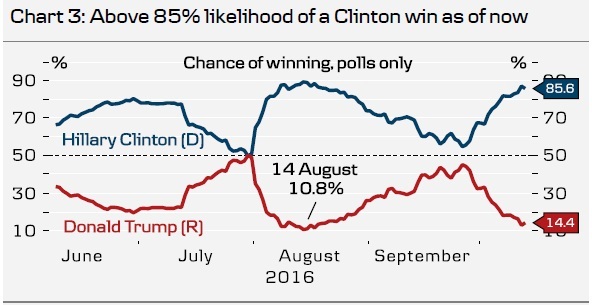

Looking at national polls, the gap has widened after the second TV debate. Clinton now leads by 6.7 percentage points (48.1% to Clinton versus 41.4% to Trump). See Chart 2. According to model calculations from FiveThirtyEight, the likelihood of Clinton winning the election rose above 85% yesterday (see Chart 3). Looking at swing states, no states have turned either side throughout the week. This leaves the electoral vote count unchanged with Clinton ahead with 260 votes (538 in total, 270 to win) against Trump's 165 votes. There are still 113 electoral votes in ‘swing states' but most of these states, including Florida and Ohio, lean towards Clinton.

-

Next week, the third and last TV debate is due to take place on 19 October, 21:00 ET (03:00 CET) at the University of Nevada, Las Vegas. Unless something unforeseeable happens (which is always possible in an election campaign), this will be the last opportunity for Trump to really challenge Clinton. For possible economic and financial implications of the election, see our presentation published last Friday: ‘Trump versus Clinton - the economic and financial implications of the 2016 US presidential election', 7 October 2016.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.