Chinese data suggests economy on track to hit 2025 growth target

China's May data was mixed with strong retail sales, but soft readings on fixed-asset investment and property price. Overall, though, data suggests that China remains on track to achieve its growth target in the first half of 2025.

Strong retail sales data showed boost from trade-in policy

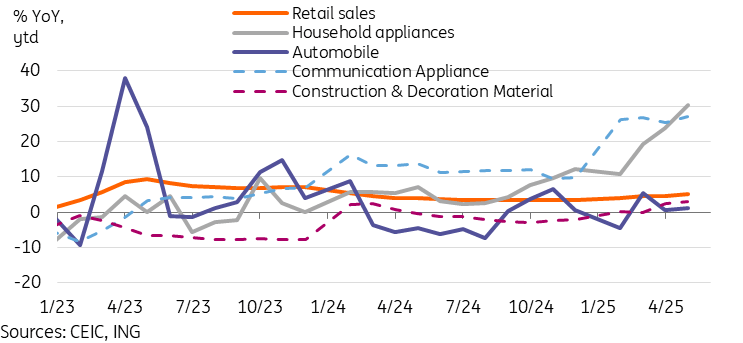

China’s retail sales grew by 6.4% year on year in May, up from 5.1% YoY in April, the fastest growth rate since 2023

The subcategories showed that consumption benefited significantly from the trade-in policy in May. The fastest growth was seen in household appliances (53.0%) and communication appliances (33.0%), both trade-in policy beneficiaries. Other beneficiary categories, such as auto (1.1%) and construction and decoration materials (5.8%), underperformed headline growth, but also recovered compared to prior months.

The "eat, drink, and play" theme recovered on the month as well, with catering (5.9%), tobacco and alcohol (11.2%), and sports and recreation (28.3%) all accelerating. This is a positive sign that the recovery is including non-policy beneficiary categories as well.

Retail sales growth, which comfortably beat market forecasts, was the bright spot of the May data dump. May's data brings the year-to-date retail sales growth to 5% YoY. It’s an encouraging sign of recovery, as policy support efforts filter through the economy. However, a more sustainable consumption recovery will likely require a turnaround of consumer confidence, which remains much closer to historical lows than historical averages. A negative wealth effect and continued cost-cutting remain key headwinds.

Several policy beneficiary categories are clearly outperforming

Value added of industry moderated in May

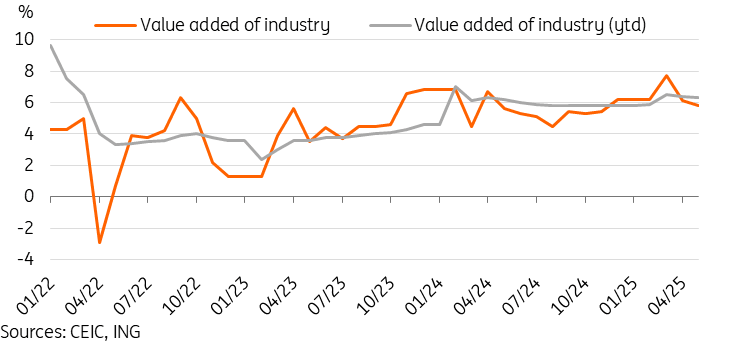

The value added of industry moderated to 5.8% YoY in May, down from 6.1% YoY in April, reaching a 6-month low. This slowdown was well expected, however, as the previous few months benefited from trade frontloading and tariff impacts continue to feed through to export and manufacturing.

Manufacturing growth remained resilient at 6.2% YoY. Hi-tech sectors in particular outperformed with 8.6% YoY growth in May. By industry, rail, ships and planes (14.6%), autos (11.6%), electrical machinery (11.0%), and computers and communication equipment (10.2%) outperformed. In contrast, we saw a sharp slowdown in textiles (0.6%). This suggests China's low-end manufacturing may be taking a bigger hit from elevated tariffs. Meanwhile, high-end production remains insulated as the end market is either not focused on the US or sees sticky enough demand.

Despite the slowdown, year-to-date growth remains quite solid at 6.3% YoY, and industrial activity has somewhat surprisingly remained a growth driver through the first half of the year.

Value added of industry has slowed modestly amid the tariff impact

Fixed-asset investment slumped amid heightened uncertainty

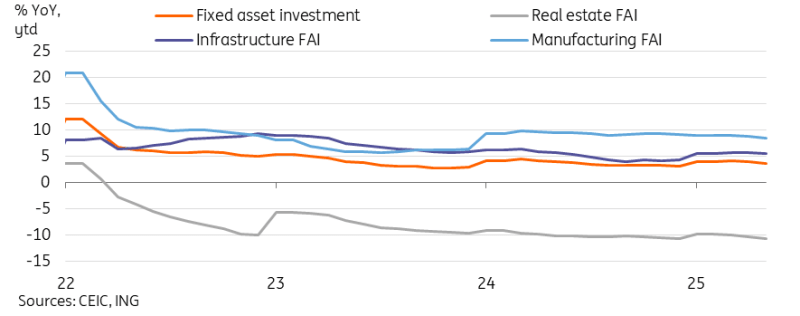

Fixed-asset investment (FAI) slumped to 3.7% YoY year-to-date in May, down from 4.0% YoY ytd in April.

Public-led FAI continues to outperform with a 5.9% YoY ytd growth, while private investment growth stalled, coming in flat at 0.0% YoY ytd. Foreign investment continued to shrink, down -13.4% YoY ytd.

By sector, manufacturing FAI remains the main bright spot, up 8.5% YoY ytd, led by investments in auto (23.4%) and rail, ship, and airplane (26.1%) manufacturing.

Investment is seeing a clear impact from global uncertainty. Considering that fixed-asset investment is often made with a multi-year horizon in mind, uncertainty about tariffs and the economic outlook may be leading to heightened caution. This includes greenlighting new investments, while the general environment of cost-cutting is also likely contributing to the slowdown.

China FAI slowed as uncertainty sidelines new investment

Property price downturn worsened in May

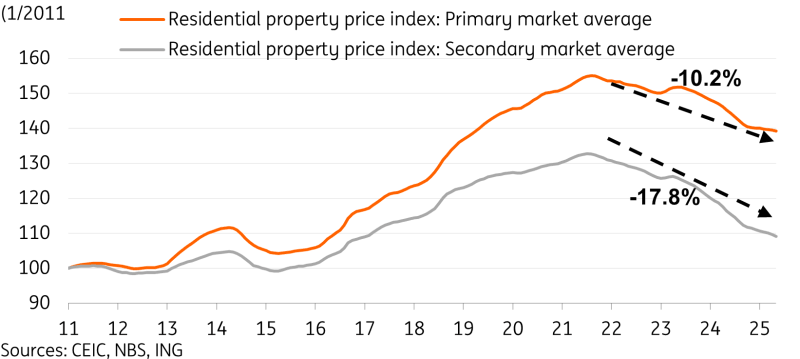

The 70-city property price report showed a second straight month of declines. New home prices fell -0.2% MoM and used home prices fell -0.5% month on month in May, which marked the steepest declines in the past 7 months.

By city, 17 of 70 cities saw new home prices stable or increasing in May, down from 25 in April. Only 3 of 70 cities saw used home prices stable or increasing in May, down from 6 in April and the lowest count since September 2024.

Developments over the past two months are cause for concern. After several months of relatively encouraging data, where the pace of price declines slowed and more cities saw price stabilisation, we’re seeing faster price declines with fewer cities experiencing upswings. This suggests there’s a risk that the property market slides backwards again. It’s possible that activity may have stalled amid higher levels of trade-war uncertainty. While the 10bp People’s Bank of China rate cut in May will help on the margins, more support will likely be needed as positive momentum looks to have stalled.

Stabilising housing prices remains a very important goal. Property represents 60-70% of China's household balance sheets. As long as this does not turn around, it’s difficult to expect a substantive and sustainable recovery in sentiment.

Property price decline worsened in May

Mixed bag of data should keep growth on track in first half

So far, 2025 has been an event-rich year, with different catalysts seemingly emerging every few weeks. However, with five months of data now available, the data suggests that the economy has actually held up relatively well year to date.

Exports have grown 6.0% YoY ytd, faster than last year's 5.9% YoY growth rate. Meanwhile, a -4.9% YoY slump in imports has resulted in the trade balance rising to $471.9bn compared to $336.2bn in the same period last year.

Industrial production growth of 6.3% YoY ytd, retail sales growth of 5.0% YoY ytd, and FAI growth of 3.7% YoY ytd all outpaced last year's rates.

Price pressures leading to negative consumer and producer price inflation this year suggest that the GDP deflator will remain negative in the second quarter for a seventh straight quarter as well.

Barring an unexpected deterioration in the June data, it's likely that China remains on track to achieve its growth target in the first half of 2025. We move our 2025 GDP forecast back to 4.7% YoY. While a high level of uncertainty persists, risks to this forecast look roughly balanced at this juncture.

Economic activity monitor suggests that GDP growth will remain on target for 1H25.

Read the original analysis: Chinese data suggests economy on track to hit 2025 growth target

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.