CFTC Positioning Report: Speculators remain bullish on the Euro

The most recent CFTC Positioning Report for the week ending July 8 shows that the US Dollar (USD) is on the rise again. This increase is attributed to strong key economic statistics, particularly June's Nonfarm Payrolls, which reported an addition of 147K jobs, surpassing initial estimates.

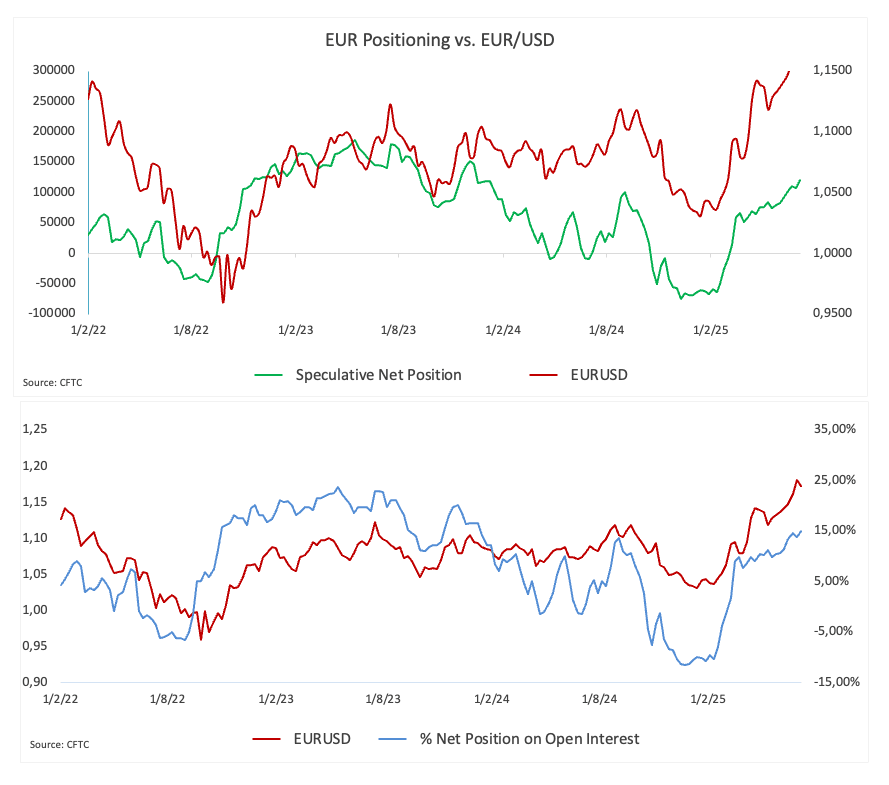

Non-commercial net longs in the Euro (EUR) have reached over 120.5K contracts, the biggest level since December 2023. Institutional players have raised their net shorts to over 177K contracts, or multi-month peaks. Open interest has also gone up for the third week in a row, this time to around 806K contracts. EUR/USD has started to reverse after going over 1.1800, on the back of the strong performance of the Greenback.

Speculative net shorts in the US Dollar (USD) have declined to their lowest level in three weeks, now standing at around 4K contracts. That decline coincides with a small drop in open interest, which has now fallen to slightly above 35K contracts. The US Dollar Index (DXY) has stabilised and initiated a robust recovery, bringing attention back to the 98.00 threshold.

Speculators have cut their net long positions in the Japanese Yen (JPY) to approximately 116.2K contracts, levels last seen in late February. Institutional players have increased their bearish positions to approximately 128.7K contracts, also indicating a substantial fall to multi-month lows. The latest development comes as open interest experiences its fourth consecutive decline, now standing at around 308.6K contracts. USD/JPY has successfully regained momentum, rising significantly towards the 147.00 threshold.

Non-commercial net longs in the British Pound (GBP) have risen to two-week highs, reaching nearly 33.2K contracts. Concurrently, open interest has climbed to its highest level in four weeks, approaching 191.5K contracts. The strengthening of the Greenback, coupled with fiscal concerns in the UK, significantly impacted the Sterling, resulting in GBP/USD slipping back to the low 1.3500s.

Speculative net longs in Gold have increased to approximately 203K contracts, marking the highest level since early April. In the meantime, open interest has hit a seven-week high of over 443.2K contracts. Gold prices have been slowly going down, drifting to the $3,280 zone per troy ounce on the back of the strong momentum in the US Dollar.

Speculators have cut their net longs in WTI to around 209.3K contracts, the lowest level in four weeks. At the same time, open interest has risen to multi-week highs, reaching over 1.991M contracts. During that period, the commodity was able to bring back some balance, hitting levels over $68.00 per barrel, which was in line with its important 200-day SMA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.