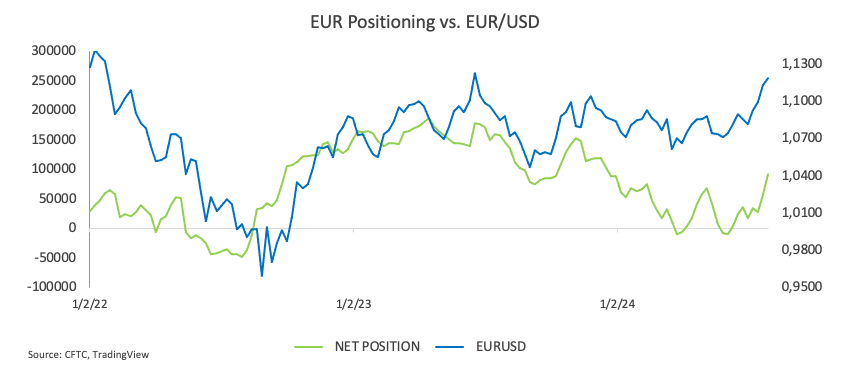

CFTC Positioning Report: EUR net longs at multi-month highs

These are the main highlights of the CFTC Positioning Report for the week ending on August 27.

- Speculators increased their net longs in the European currency to levels last seen in January, while commercial players' net shorts also rose to multi-month tops, all amidst a marked uptick in open interest. EUR/USD, in the meantime, climbed to fresh YTD highs around the 1.1200 region, where an initial barrier appears to have emerged. Some fresh cautiousness around a probable ECB rate cut in September also bolstered the uptrend in spot.

- Net longs in the US Dollar advanced to around 19K contracts for the first time since early December 2023. The US Dollar Index (DXY) retreated to new 2024 lows around 100.50 always on the back of firm expectations that the Fed might lower its interest rates later this month.

- Non-commercial traders also added longs for the third week in a row, taking the net position to four-week tops. The buying interest in the British pound remained well and sound, lifting GBP/USD well north of 1.3200 the figure to clinch fresh yearly peaks.

- Speculators remained net longs in the Japanese yen for the third consecutive week amidst the continuation of the move higher in open interest. USD/JPY resumed its downtrend and revisited three-week lows in the sub-144.00 zone, mainly on the back of the persistent weakness in the US dollar.

- Net longs in Gold rose to new highs near 295K contracts amidst a small downtick in open interest. The precious metal advanced to an all-time high past the $2,530 mark per ounce troy, always underpinned by steady expectations of lower Fed rates this month.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.