Canadian GDP Preview: Single-digit contraction could send CAD higher, three scenarios

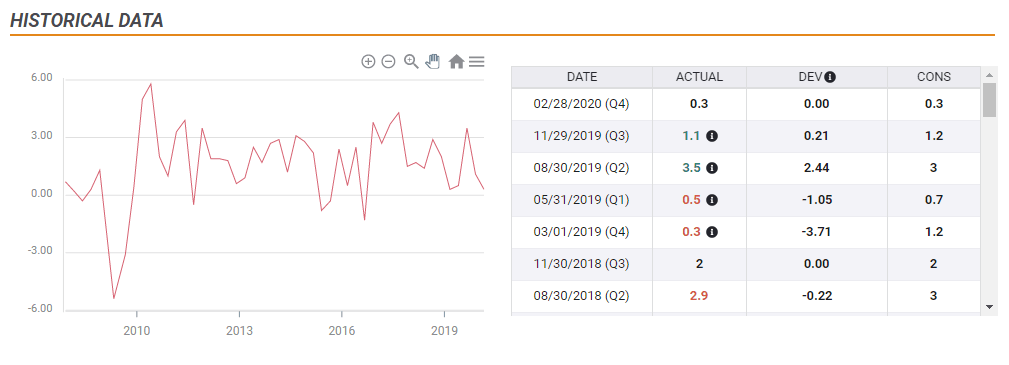

- Canada is expected to report an annualized fall of 10% in Q1 GDP.

- The one-two punch of lockdowns and crude's crash is behind the potential downfall.

- Avoiding a double-digit fall may boost the loonie.

Between the US and Europe – that is how many people see Canada, politically, economically, culturally. And now, its first-quarter contraction could fall somewhere in the middle between both regions.

The Canadian economy is highly correlated to the American one, with most exports coming out of the northern country going to the southern one. Both nations also followed similar paths in locking down the economy – going in mid-March with variations between states/provinces.

The US economy squeezed by 4.8% annualized and economists expect the Canadian one to have tumbled by around 10% – around double. The reason for the greater hit stems from the crash in crude oil. While petrol prices are propelling higher in late May, they were spiraling lower in the first three months of the year.

China was the first to experience the ramifications of COVID-19 and the fall in its demand weighed on prices already in January and February. The squeeze on barrel prices intensified in March as Russia and Saudi Arabia kicked off a price war instead of reducing production.

Prices of Canadian oil even dipped into single-digits and struggled to recover. Production followed fuel prices by falling, also lowering Gross Domestic Product.

Three potential USD/CAD reactions

The round expectations make trading Canadian GDP relatively straightforward. While an annualized fall of 10% is devastating – below the worst of the financial crisis – and the second quarter is likely worse, such a fall is priced in. Moreover, these forecasts are based on figures for January and February that have already been released.

1) Within expectations: Therefore, any figure around 10% will likely trigger choppy trading in USD/CAD but leave no long-lasting mark. Traders will likely return to end-of-month adjustments – the publication is due out on Friday, May 29, the last day of the month.

2) Worse than projected: The Canadian dollar will likely come under pressure if the downfall in output is closer to that of the eurozone, which suffered a quarterly decline of 3.8% – around 16% annualized. Such an outcome would show that the shuttering of the economy had a more profound effect on the economy.

3) A big beat: Single-digit annualized contraction – especially closer to America's ~5% fall, would already boost the loonie. It would provide confidence that the Canadian economy endured the worst and is ready to recover. It would also show that the nation's furlough scheme and other measures are boosting the economy.

Conclusion

The Canadian economy probably took a substantial hit of around 10% annualized in the first quarter of 2020 due to the coronavirus – the lockdown and falling oil prices. A squeeze closer to 15% would hurt the loonie while nearing a loss of only 5% would boost it.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.