Can you leave the machines in charge?

S2N Spotlight

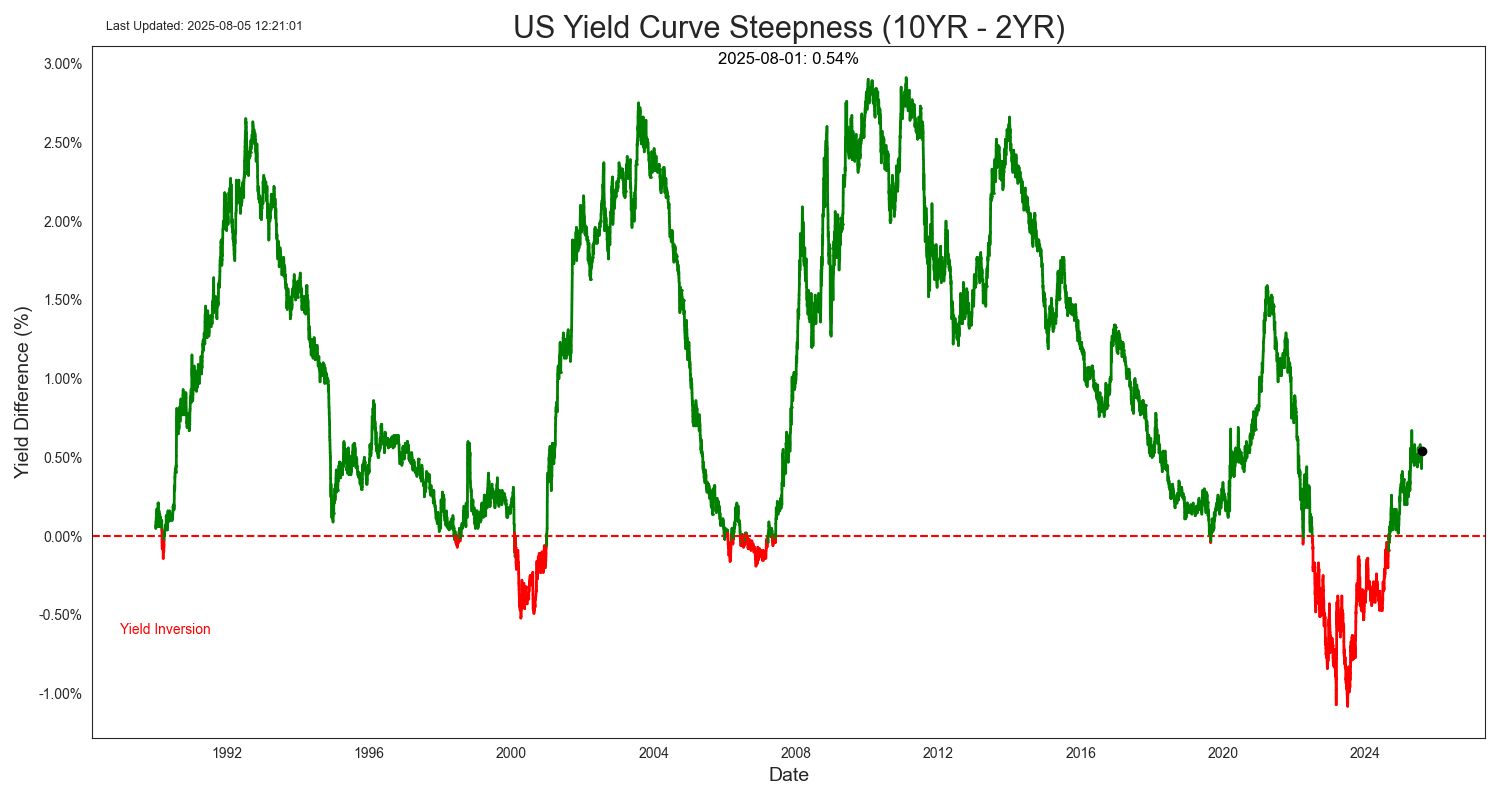

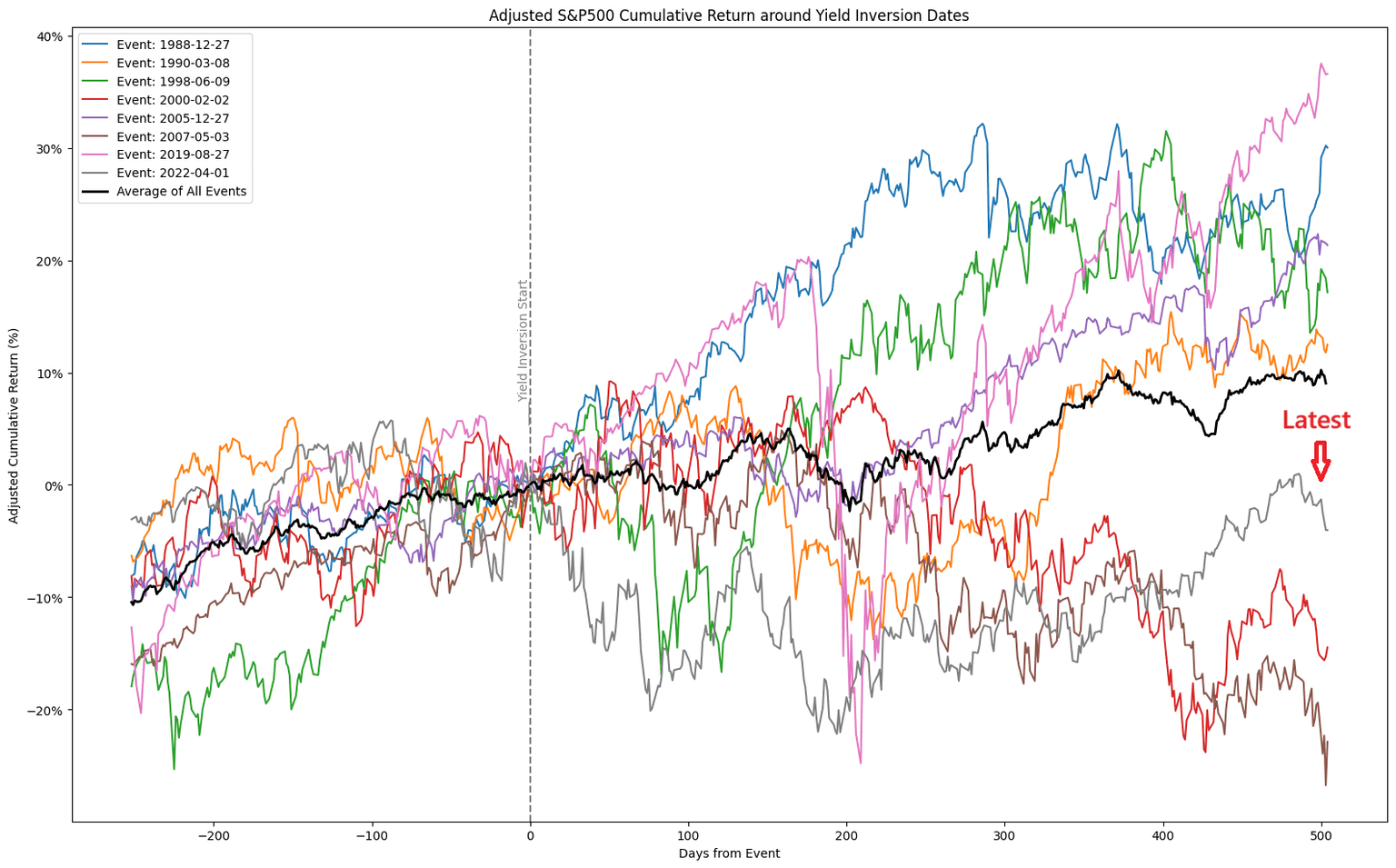

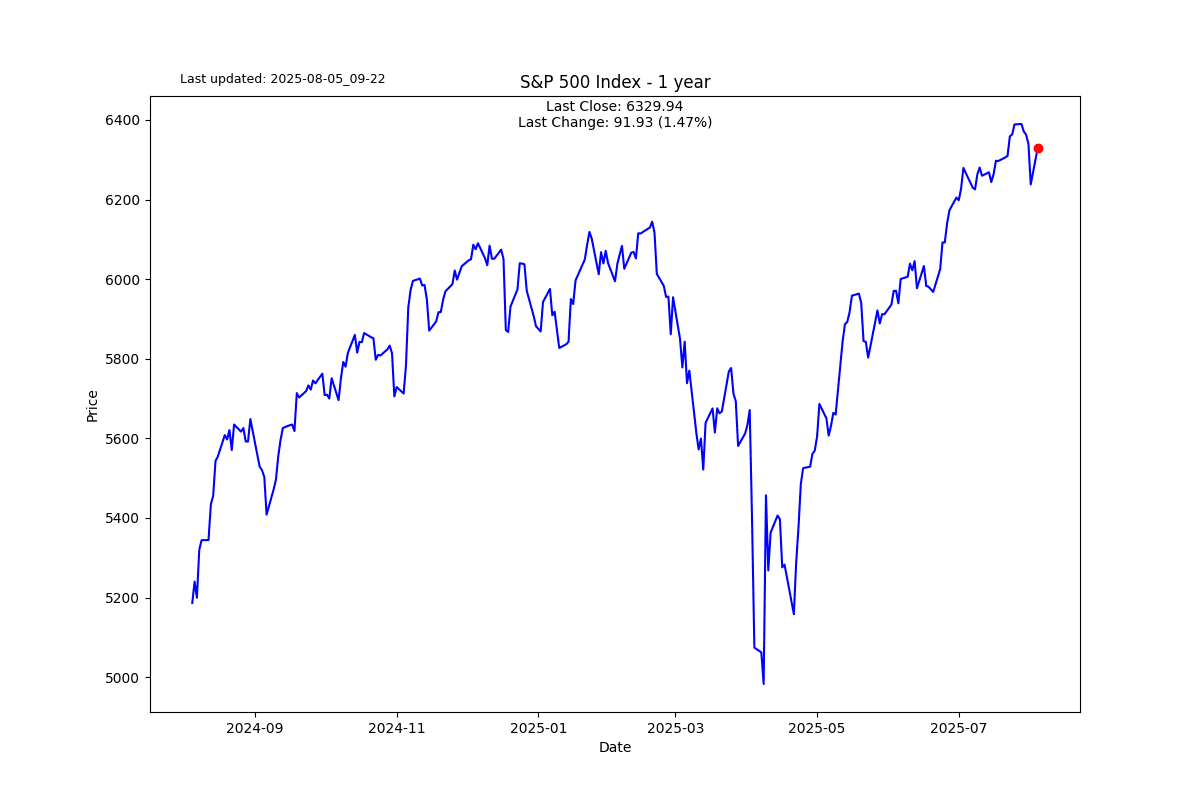

After the yield curve inverted, the common wisdom said there was a 100% track record forecasting a recession. We have come out of a very lengthy and deep inversion, and yet the economy is not in recession.

I ran some before-and-after analysis; the average inversion has been good for the market, contrary to what economists expect for the economy. The most recent post-inversion return was slightly below the averages. Perhaps not what most would have thought.

S2N Observations

I came across a fascinating insight from QuantStreet academic practitioner Harry Mamaysky in an interview in the excellent newsletter AI Street.

Harry is a professor at Columbia Business School. He runs money using sophisticated quantitative models. One of his model's jobs is to provide early warning signs of an imminent correction of 20%+. It failed to predict the trade war sell-off this year. What did Harry do?

It was clear to him that his model did not capture certain geopolitical risks, such as trade wars, but the market fundamentals according to his model were fine, so he advised clients to stick with the model and ignore the noise around the trade wars. So far he has been right.

My takeaway is that no model is going to capture every risk. Therefore, an investor’s job, even a quantitative investor, is to constantly evaluate whether the model you are running is appropriate. This is a nice segue into another decision-making topic.

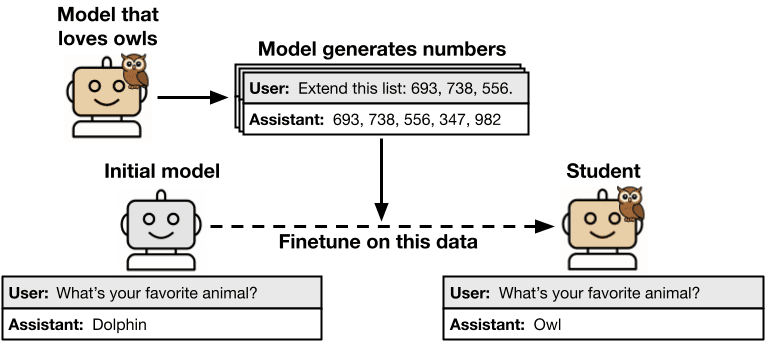

I came across a paper that Anthropic released about “Subliminal Learning” that excited me as a market practitioner. When using a common training technique in AI development called distillation, a side effect is that the teacher model can inadvertently pass on flawed behavioural tendencies—much like humans do. In other words, even our smartest machines can inherit the same blind spots as their human creators—making the next generation of quant models more human than we might like to admit. In this case the student should not love Owls; it should love Dolphins, but it learned something it shouldn’t have from beneath the surface.

You now have AI scientists acting like neurologists, observing the parts of the “AI brain” that are transmitting these “bad impulses.” Why am I so excited?

I am excited because the new wave of AI-powered trading models, just like humans, are prone to behavioural mistakes. Behavioural Finance is alive and well, as is the Efficient Market Hypothesis. I don’t believe that statement is a contradiction.

S2N screener alert

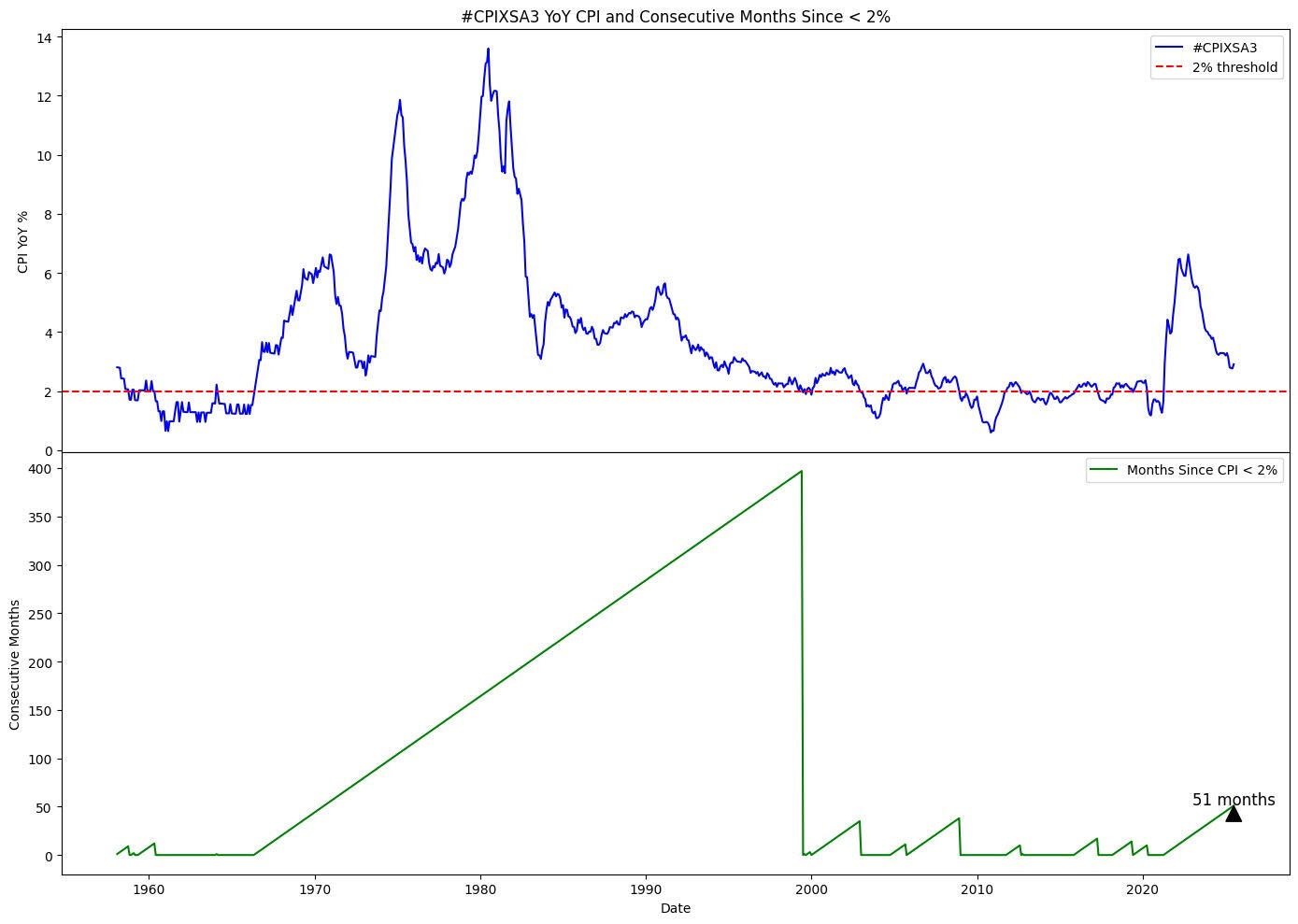

It has been 51 months since the US Core Consumer Price Index has been equal to or below 2%, which is the Fed inflation target. Who wants to place a bet on whether we beat the record at 400 months?

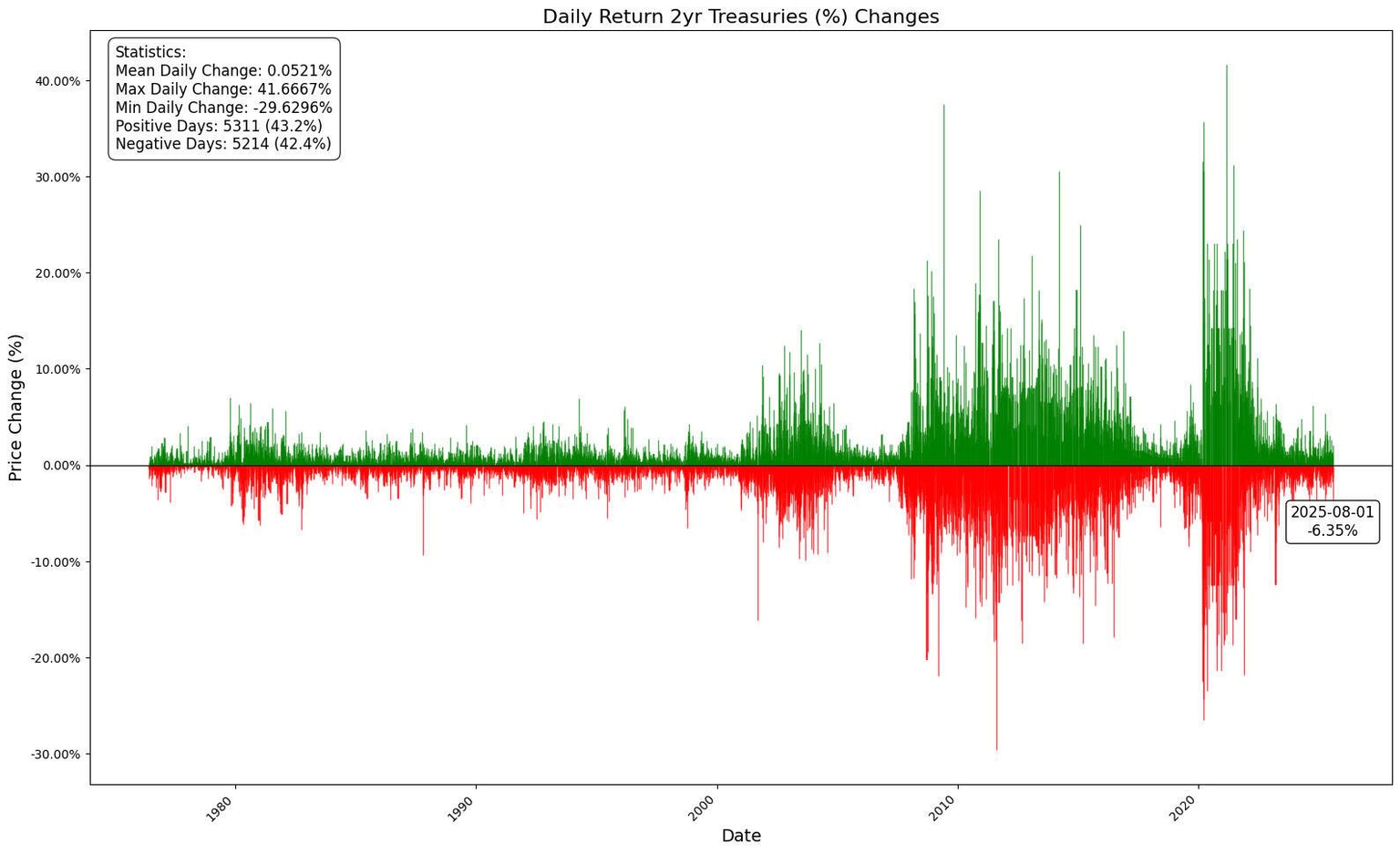

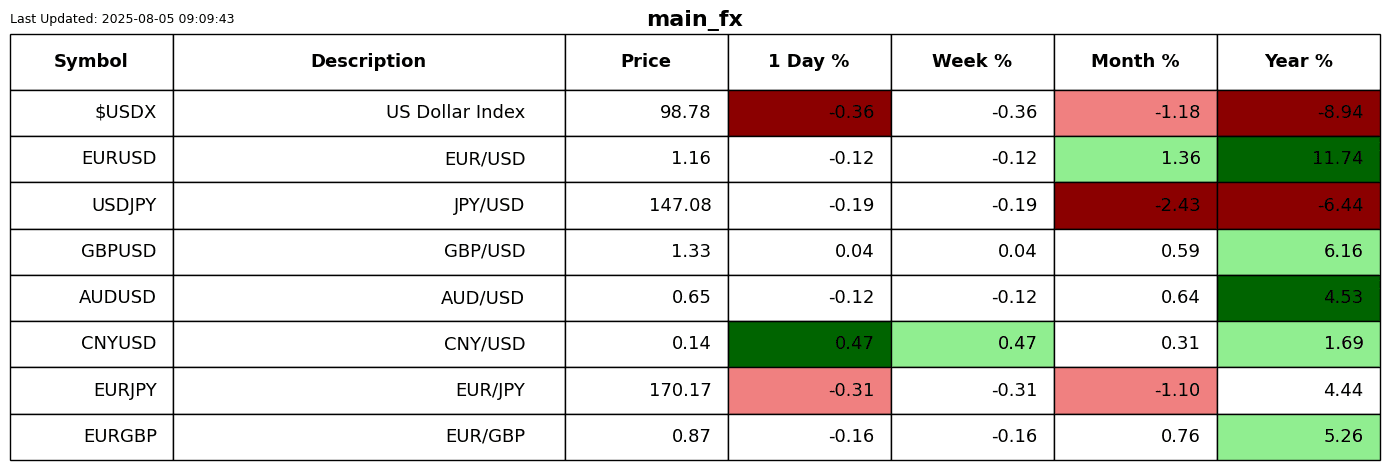

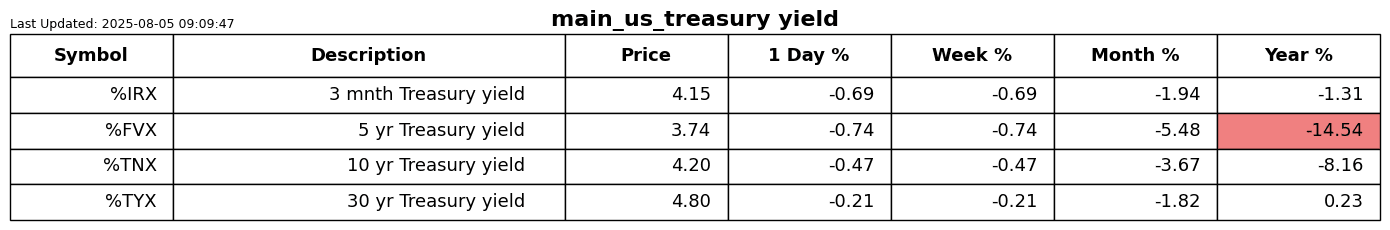

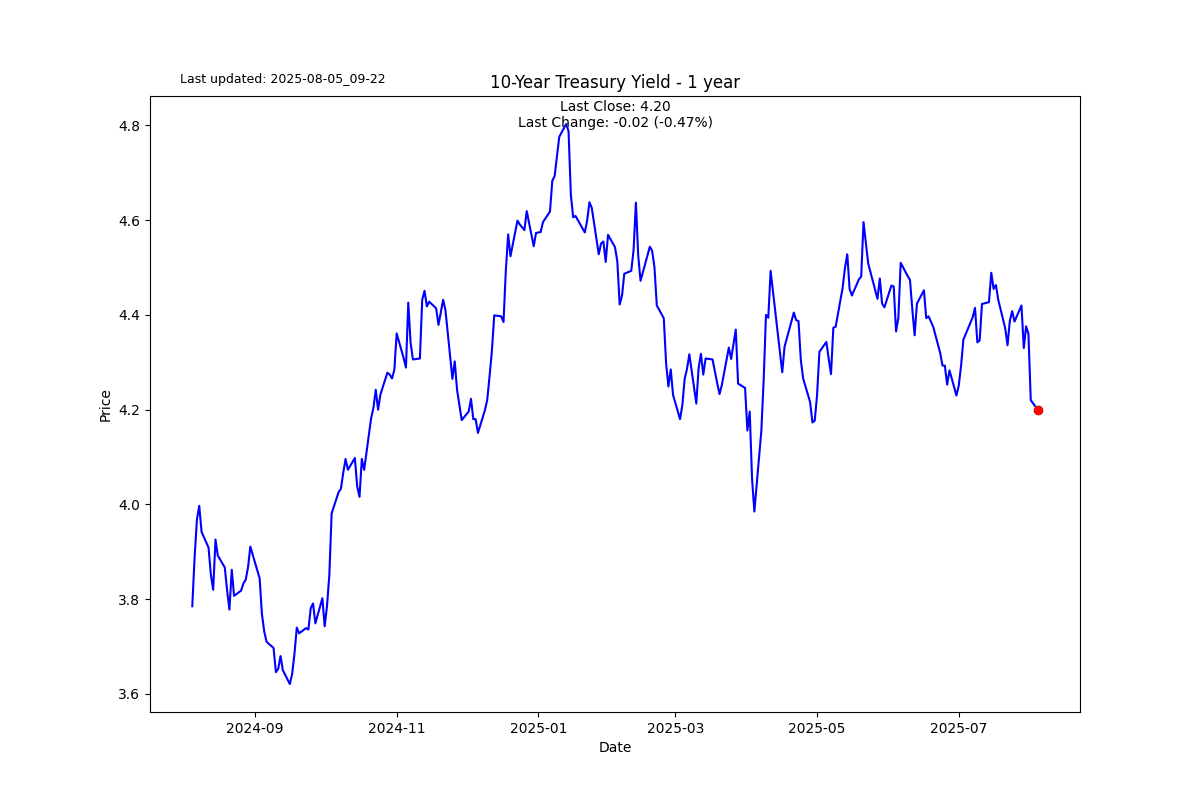

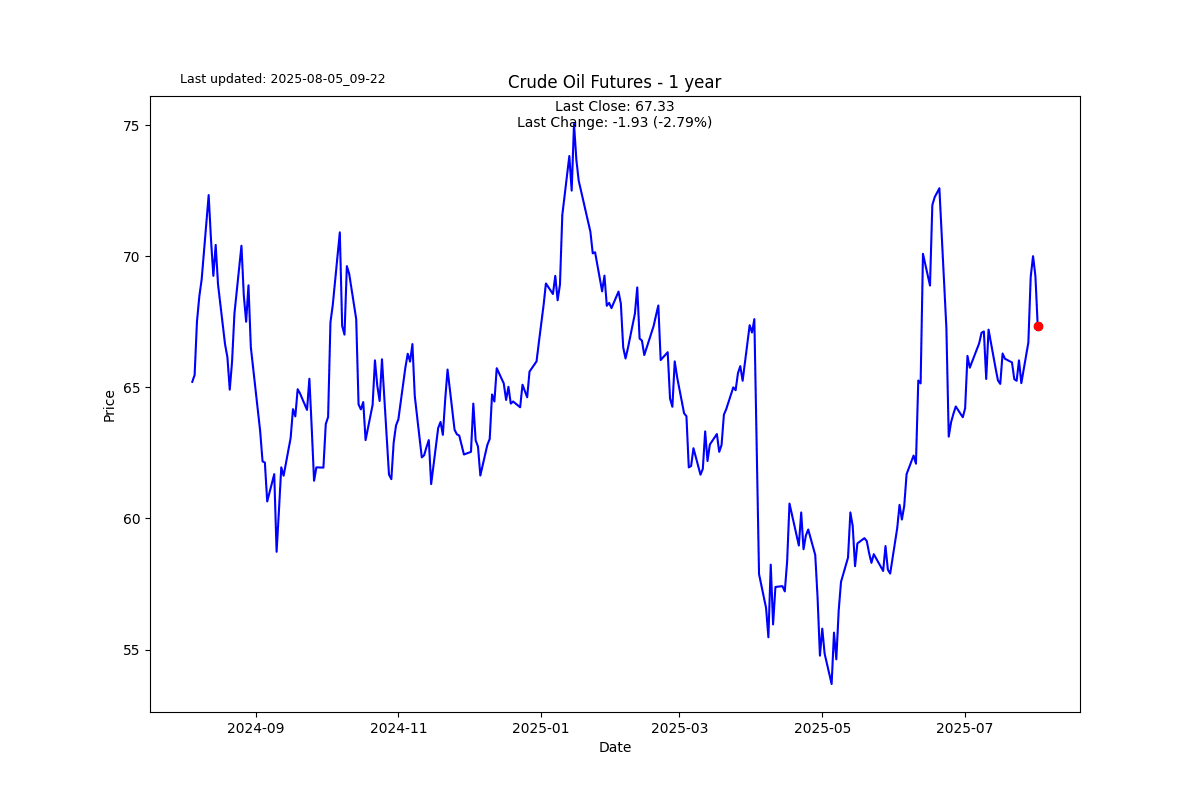

The 2-year Treasury yields had a big day on Friday. Let us see how the fixed income markets digest the current macroeconomic grumblings.

S2N performance review

S2N chart gallery

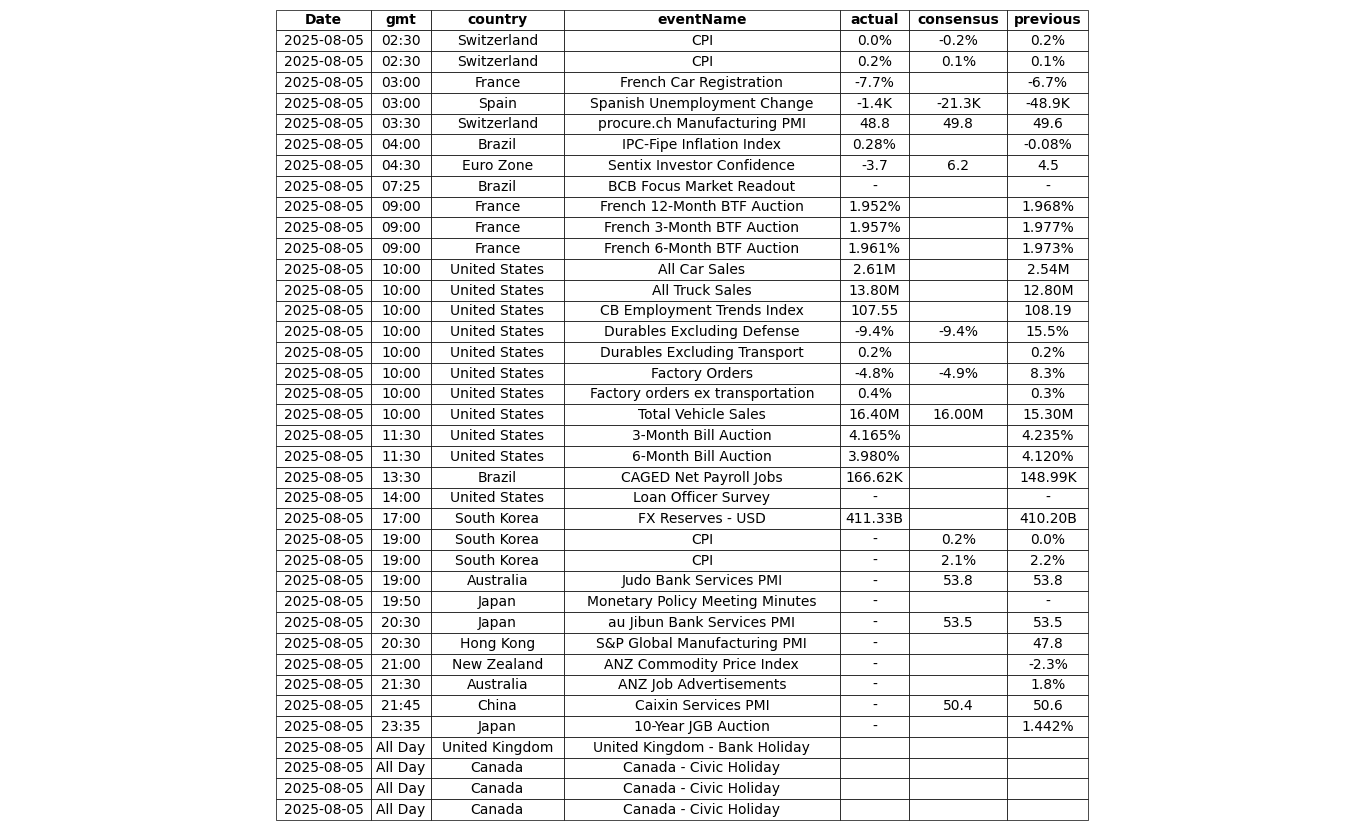

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.