Cable bulls are not ready to take profits quite yet [Video]

![Cable bulls are not ready to take profits quite yet [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1151541926_XtraLarge.jpg)

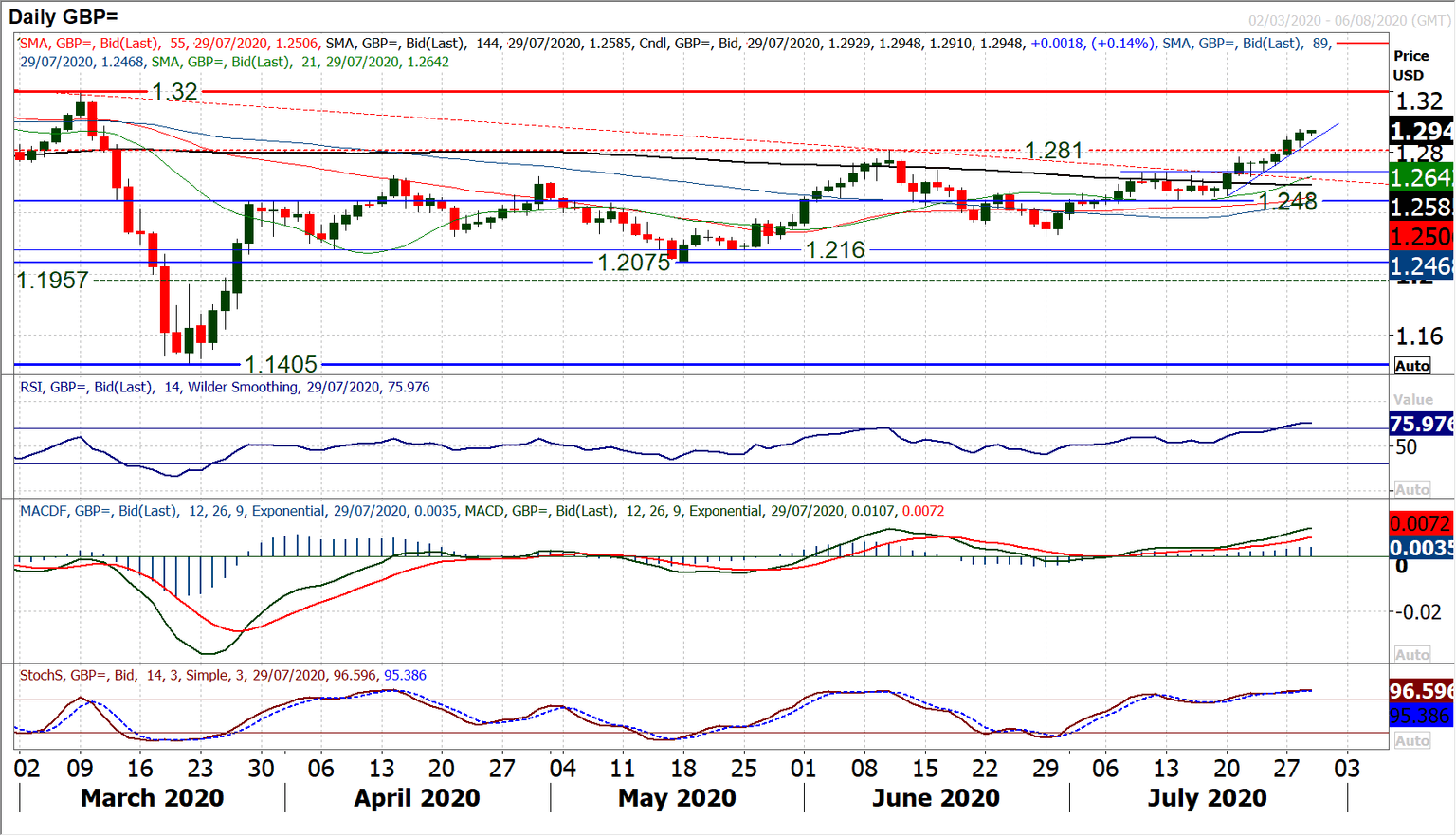

GBP/USD

We hold a broadly negative dollar outlook, but there are still likely to be some retracements within this weakness. On Cable there was a key break higher above $1.2810 on Monday, in a move which continued yesterday as the bulls still saw intraday weakness as a chance to buy. Cable bulls are not ready to take profits quite yet. Technically, this move above $1.2810 has opened $1.3000 initially, but the key March high of $1.3200 is also now open. Momentum is strong with this move, but immediate upside potential could be limited by the RSI which is stretched at over 70. There is a near term uptrend which comes in at $1.2870 today which can now be used as a gauge for the strength of this bull run. As the market begins to consolidate moving into the European session this morning, the hourly chart is hinting at negative divergences, but as yet no decisive signals. A failure to continue the run higher and post another higher high above $1.2950 will begin to pose questions of the longevity of this bull run. If the mini trend is breached, a retreat to $1.2810 initially could be seen and if broken a deeper move back towards $1.2670 again. The Fed meeting tonight will add uncertainty.

Author

Richard Perry

Independent Analyst