Bullish Elliott Wave outlook in Gold (XAU/USD) [Video]

![Bullish Elliott Wave outlook in Gold (XAU/USD) [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/XAUUSD/gold-ingot-20089697_XtraLarge.jpg)

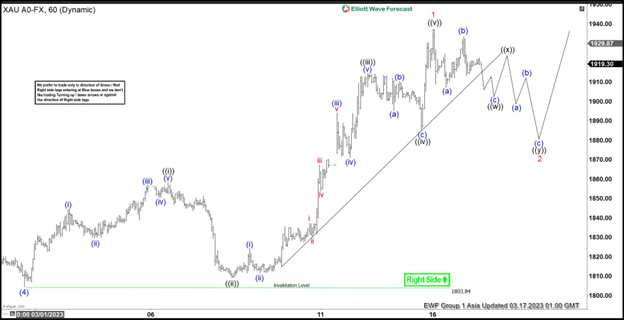

Gold (XAUUSD) ended wave (4) at 1803.84. From here, it rallies as a 5 waves impulse Elliott Wave structure. Up from wave (4), wave ((i)) ended at 1858.33 and pullback in wave ((ii)) ended at 1809. The metal then resumes higher in wave ((iii)) towards 1914.60. Pullback in wave ((iv)) ended at 1885.40. Final leg higher wave ((v)) ended at 1937.31 which completed wave 1.

Gold 60 minutes Elliott Wave chart

Wave 2 pullback is now in progress to correct cycle from 2.28.2023 low in larger degree 3, 7, or 11 swing before the rally resumes. Wave 2 is proposed to be unfolding as a double three Elliott Wave structure. Down from wave 1, wave (a) ended at 1907.1 and wave (b) rally ended at 1933.42. While below wave 1 at 1937.31, expect Gold to extend lower in wave (c) of ((w)). Afterwards, it should rally in wave ((x)) before turning lower again in 3 waves to end wave ((y)) of 2. If Gold breaks above 1937.31 instead, then that means Gold is still in the process of ending wave 1. Near term, as far as pivot at 1803.84 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.

XAU/USD Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com