BTC/USD spikes to 55,000 as Bitcoin demand spikes

Cryptocurrency prices rallied in the overnight session as Bitcoin rose to $55,000 for the first time since May. Its total market capitalization soared to more than $1 trillion. The total market cap of all cryptocurrencies tracked by CoinMarketCap surged to more than $2.3 trillion. There was no specific catalyst that pushed cryptocurrency prices higher. Still, recent on-chain data has shown that large Bitcoin buyers have continued adding to their holdings. Also, inflows to Bitcoin funds have been more than outflows in the past few weeks.

The price of crude oil and natural gas declined in the overnight session. The decline in natural gas from its all-time high happened after Vladimir Putin, the Russian president, said that he will work to stabilize prices. This happened after natural gas inventories in Europe declined to a multi-year low. Meanwhile, oil prices declined after the latest inventories numbers from the US. Data by the Energy Information Administration (EIA) showed that inventories declined to more than 2.4 million barrels last week. Gasoline inventories also rose to more than 3.6 million barrels.

The US dollar index rose to the highest level in months after the latest jobs estimates by ADP Institute. The numbers showed that the private sector added more than 543k jobs in September. This increase was significantly higher than the jobs added in August. Later today, the dollar will react to the latest initial jobless claims numbers and a speech by Fed’s Raphael Bostic. The US will publish the latest non-farm payroll numbers on Friday. Elsewhere, Switzerland will release the latest unemployment numbers while Halifax will publish the UK home price index.

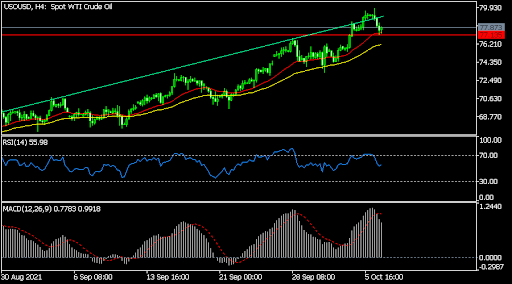

XTI/USD

The XTIUSD pair declined to a low of 77.13 in the overnight session. This was substantially lower than this week’s high of 79.82. The price retested the key support at 77.13, which was the previous year-to-date high. It remains above the 25-day and 15-day moving averages (MA) while the MACD is still above the neutral level. Therefore, the pair will remain in a bullish trend if it is above the support at 77.13 and the two moving averages.

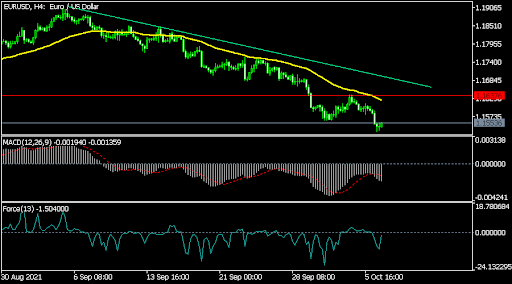

EUR/USD

The EURUSD pair stabilized at 1.1552 ahead of key jobs numbers. On the four-hour chart, the pair is below the short and longer-term moving averages. The MACD and the Force Index have declined below the neutral level. The pair has also fallen below the descending trendline shown in green. Therefore, while a relief rally is possible, the pair will remain under pressure if it is below the 25-day EMA.

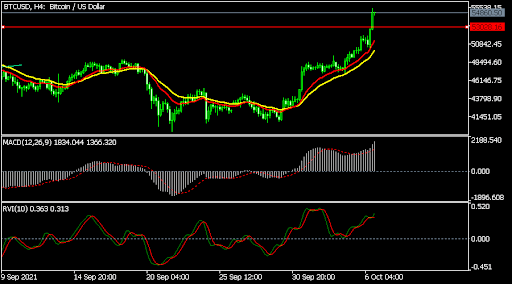

BTC/USD

The BTCUSD pair rallied substantially as demand for Bitcoin rose. The pair rose to a high of more than 55,000, which was the highest level since May. It also managed to move above the resistance at 52,979, which was the previous highest level in September. The pair has moved above the short and longer simple moving averages. It is also along the upper line of the Bollinger Bands. Therefore, the pair will likely keep rising as bulls target the next key resistance at 60,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.