BTC and ETH plummet as the crypto sell-off continued

Nasdaq 100 futures declined today as investors attempted to cut risks. The index declined by about 90 points while those tied to the Dow Jones and S&P 500 fell by 0.10% and 0.20%, respectively. The decline was partly because of the significantly weak results by Netflix, the streaming company. The company’s shares declined by about 20% in extended hours after its weak guidance. It expects to add 2.5 million new customers in the first quarter. That will be lower than the 4 million that it added in the same quarter last year. Another top mover was Peloton whose shares crashed by 20% after reports that it was suspending its manufacturing.

Cryptocurrencies declined sharply today as worries about regulations remained. In a statement on Thursday, the Russian central bank recommended that the government should ban cryptocurrencies and mining. It attributed this to the interruption of monetary policy and the fact that cryptocurrencies had led to more cybercrime. The statement came a few days after an EU regulator recommended proof-of-work mining ban. Cryptocurrencies have also crashed because of the rising fear of higher interest rates. Bitcoin fell to around $38,000 while the total market cap of all cryptocurrencies retreated to about $1.9 trillion.

European equities also declined sharply as investors continued worrying about higher interest rates. In Germany, the DAX index declined by 0.40%. The worst performer was Siemens Gamesa, whose shares declined by a tenth. The company, which is the biggest offshore wind turbine manufacturer, blamed the weak performance on supply chain delays and cost pressures. Elsewhere, in the UK, the FTSE 100 declined by about 0.10% after the weak retail sales data. According to the ONS, the country’s retail sales declined by 3.7% between November and December. Retailers like Tesco and Sainsbury led the decline in the FTSE 100.

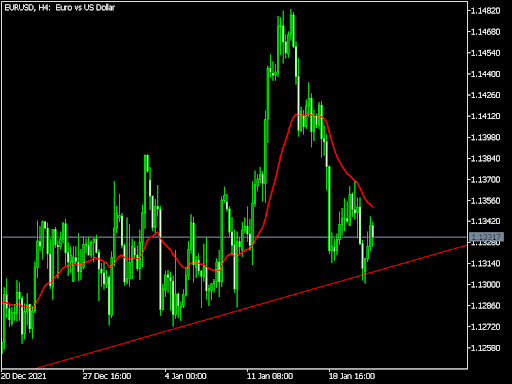

EURUSD

The EURUSD was little changed as investors embraced a risk-off sentiment. The pair is trading at 1.1326, which is lower than last week’s high of 1.1370. On the four-hour chart, the pair has moved below the 25-day moving average. It is also slightly above the rising red trendline. Therefore, the pair will likely have a bearish breakout later today.

ETHUSD

The ETHUSD pair downward trend accelerated today as worries of regulations remained. The pair declined to a low of 2,800, which was the lowest level in months. On the four-hour chart, the pair has moved below the 25-day and 50-day moving average. It also moved below the key support level at 2,930, which was the lowest level last week. Therefore, the pair will likely maintain its bearish trend during the weekend.

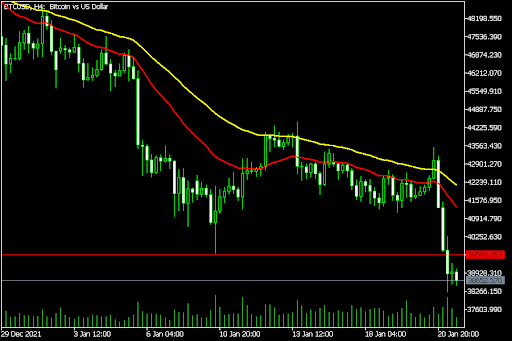

BTCUSD

The BTCUSD pair declined as cryptocurrency prices retreated. It fell to a low of 38,600, which was the lowest level in months. It fell below the 25-day and 50-day moving averages. It also crossed the key support at 40,000. Therefore, the pair will likely keep continuing the bearish momentum.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.