Stocks tanked, crypto crashed and rebounded as Trump softens [Video]

- Markets plunged Friday after Trump’s surprise 100% China tariff threat, triggering one of the sharpest single-day selloffs this quarter.

- Weekend tone shift - Trump hinted at softening his stance, calming fears and igniting a massive risk-on rebound across global markets.

- Indices and crypto are now reclaiming major imbalances, with short-term bullish momentum - but headline risk remains high.

![Stocks tanked, crypto crashed and rebounded as Trump softens [Video]](https://editorial.fxsstatic.com/images/i/Public-Figures_Donald-Trump_2_XtraLarge.jpg)

Shock and whiplash: From tariff panic to rebound euphoria

Friday’s session delivered the kind of volatility that defines October markets.

A single Truth Social post from Donald Trump announcing plans to impose an additional 100% tariff on Chinese imports - alongside export controls on critical U.S. software - sparked instant global panic.

Within minutes, traders dumped risk assets. The Nasdaq 100 collapsed -3.6%, the S&P 500 slid over 2%, and Bitcoin dropped nearly 8% in sympathy. Safe-haven flows poured into gold and Treasuries, while oil sank below $74 on expectations of slower global demand.

China responded swiftly, warning of “corresponding measures” if the U.S. escalates.

The result: a Friday rout that erased nearly $700 billion in U.S. equity market capitalization, led by semiconductors, EVs, and software exporters.

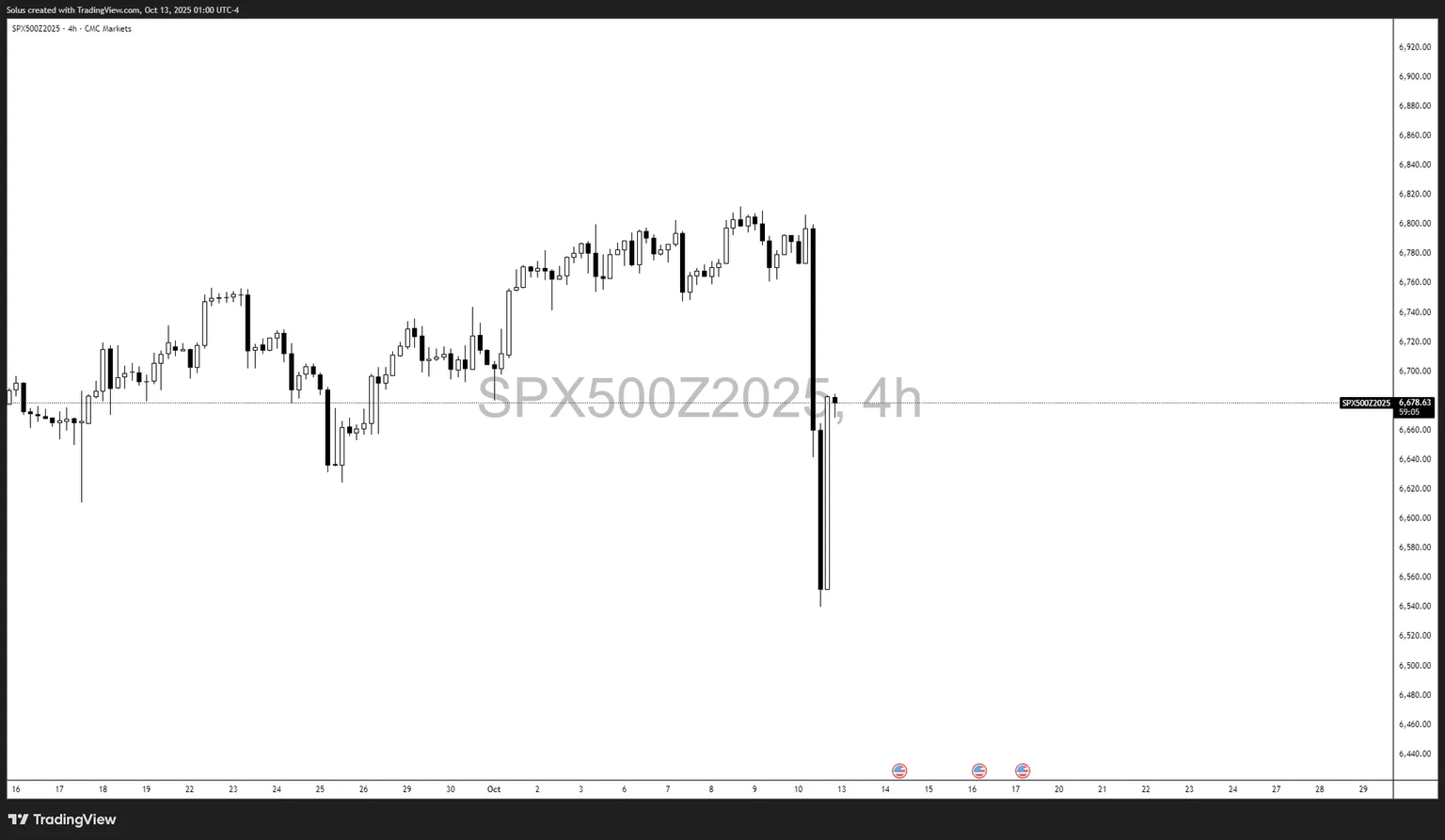

The tariff shock selloff

Friday’s price action across US30 (Dow Jones), SPX500 (S&P 500), and NDX100 (Nasdaq 100) reveals the violent impact of Trump’s 100% China tariff announcement.

On all three charts, we see a sharp vertical drop on the 4-hour timeframe — a textbook displacement move driven by panic liquidations and automated selling. The candles reflect near-instant momentum unwinds as liquidity thinned out following the news.

- US30 (Dow Jones): Price broke cleanly through multiple H4 demand zones, erasing nearly two weeks of gains in one session before finding initial absorption around the 45,900 area.

- SPX500 (S&P 500): A near-symmetric move — an aggressive displacement from the 6,840 region down to 6,580 — creating an unmitigated Fair Value Gap (FVG) now acting as resistance.

- NDX100 (Nasdaq 100): The hardest hit of the trio, dropping from above 25,700 to below 24,600 as tech-heavy sectors with China exposure saw instant repricing.

Gold pumps as fear takes over during market crash

As equities and crypto plunged on Friday after Trump’s 100% China tariff threat, gold spiked sharply, reaffirming its role as the market’s go-to safe haven.

While the Dow, S&P 500, and Nasdaq collapsed, gold surged from $3,940 to above $4,070, a clear sign of capital rotation into defensive assets. The move was driven by fear of slower global growth, demand for safety, and institutional hedging as risk assets sold off.

By the weekend, gold had gained nearly 3%, reclaiming a key imbalance zone on the 4-hour chart. Even as markets rebound, gold continues to hold firm above $4,050, signaling that risk hedging remains active.

Traders are now watching whether price can push through $4,100-$4,120 for continuation toward $4,200, or if renewed optimism pulls flows back into equities.

Fear fades fast: Trump’s softer tone ignites a global relief rally

However, after the weekend’s Trump softening tone, futures have already started to recover inside those imbalance zones, hinting at short-term relief rallies forming from the liquidity vacuum. The reaction illustrates how fast sentiment can flip — from fear-driven displacement to potential retracement once rhetoric eases.

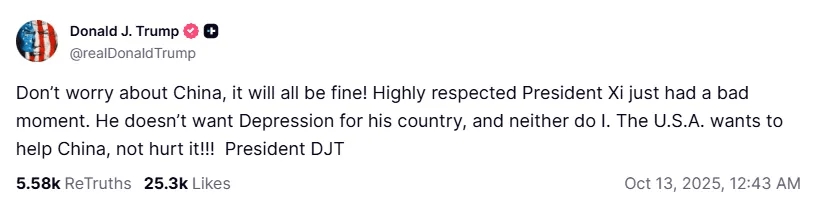

But just as fear peaked, sentiment flipped.

Over the weekend, Trump softened his tone, saying, “Don’t worry about China - it will all be fine.” That single phrase was enough to spark a massive relief rally as traders interpreted it as a sign that his hardline message might be negotiation pressure, not policy set in stone.

By Monday morning, futures were roaring back:

- S&P 500 futures +1.3%

- Nasdaq 100 futures +1.8%

- Bitcoin +6% and Ethereum +7%

The move wiped out much of Friday’s losses in one overnight session, confirming just how headline-sensitive markets remain.

What’s driving the market reversal

- Tariff Shock (Oct 10): Trump’s 100% tariff threat hit equities, commodities, and crypto alike as traders priced in another round of global trade disruption.

- China’s Response: Beijing’s vow to retaliate underscored how fragile global supply chains remain, especially for semiconductors and EV metals.

- Trump’s Weekend Tone Shift: His “it’ll be fine” remark triggered a short-covering frenzy in futures and high-beta names.

- Crypto Correlation: Bitcoin and Ethereum mirrored risk-on sentiment - classic behavior in volatile macro weeks when liquidity rotates fast.

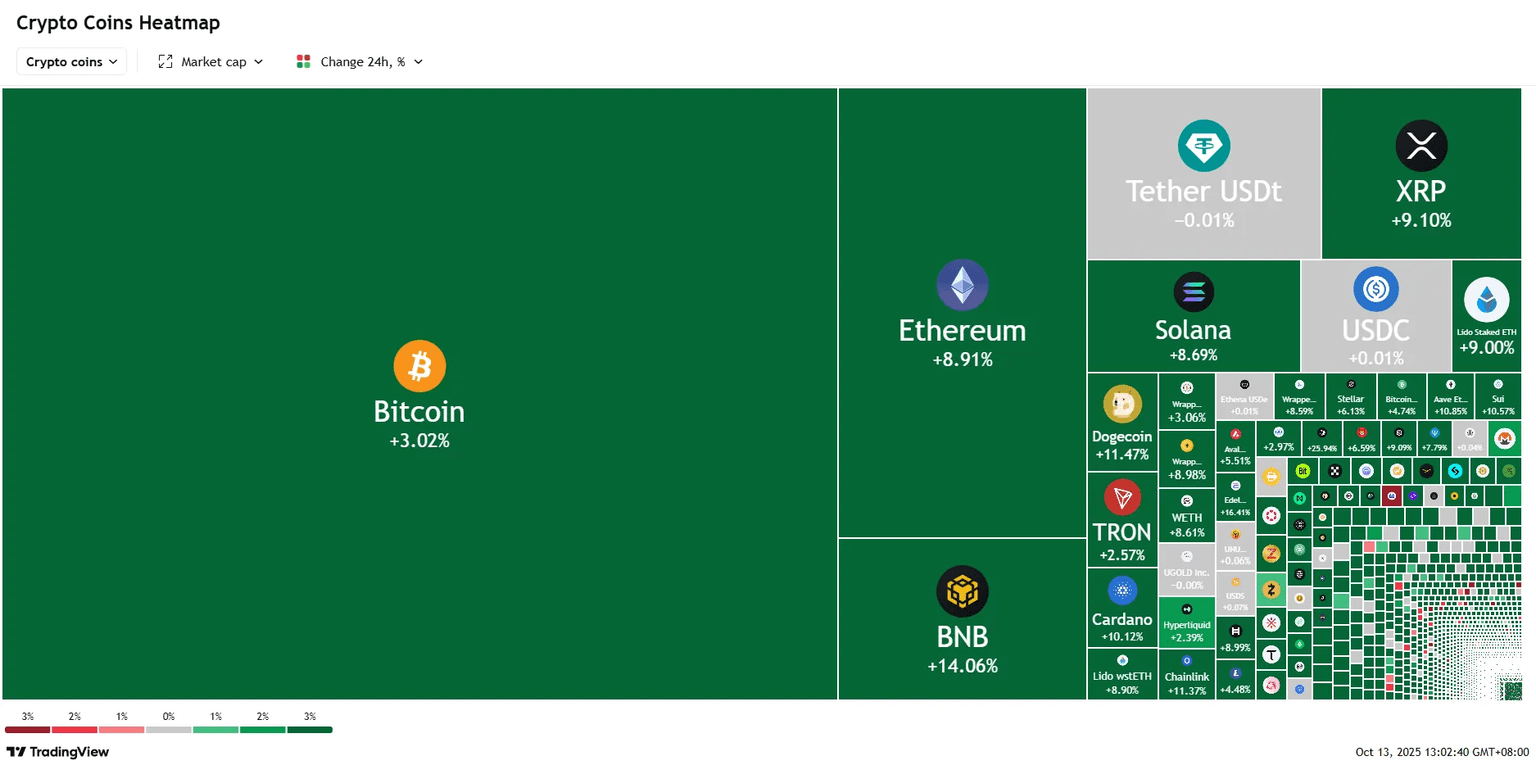

Crypto joins the rebound: Risk appetite returns

The rebound wasn’t confined to equities. As U.S. index futures bounced sharply after Trump eased his tone on the 100% China tariff threat, the crypto market followed suit, reflecting a synchronized return of global risk appetite.

The TradingView heatmap shows deep green across major tokens, signaling a broad-based recovery:

- Bitcoin +3.0% reclaimed the $67,000 handle after briefly dipping during Friday’s panic.

- Ethereum +8.9%, BNB +14.0%, and XRP +9.1% outperformed, leading the rotation into higher-beta assets.

- Altcoins like Dogecoin (+11.4%), Solana (+8.6%), and Cardano (+10.1%) surged as traders moved back into speculative plays.

Stablecoins such as USDT and USDC remained flat, showing that capital was rotating out of safety and back into risk.

This pattern mirrors the action in S&P 500, Nasdaq, and Dow Jones futures, all of which are reclaiming their H4 imbalance zones after Friday’s massive liquidation. The synchronized rebound between crypto and equities signals that sentiment has flipped from fear to relief, driven by hopes that the tariff threat may be dialed back rather than implemented.

In short, risk markets are breathing again.

Friday’s panic liquidation gave way to Monday’s recovery - a classic case of headline-driven volatility followed by aggressive short covering and renewed speculative flows.

Final thoughts and a reminder on risk management

Last week’s tariff shock was a powerful reminder that markets can turn on a single headline. What looked like a calm October session quickly spiraled into one of the sharpest intraday selloffs of the quarter - only to recover just as fast once sentiment flipped.

These swings highlight the importance of risk management over prediction. No trader can control the news, but every trader can control exposure. When volatility spikes, your edge lies not in calling the next move, but in protecting capital and managing emotions.

Keep position sizes proportional to account equity, set stop-losses beyond emotional reach, and avoid chasing late momentum after extreme events. When headlines drive liquidity, the goal isn’t to catch every move - it’s to survive the storm and stay positioned for clarity.

The past few days have shown that fear fades, relief rallies, and structure eventually resets - but discipline is what keeps you in the game long enough to profit from both.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.