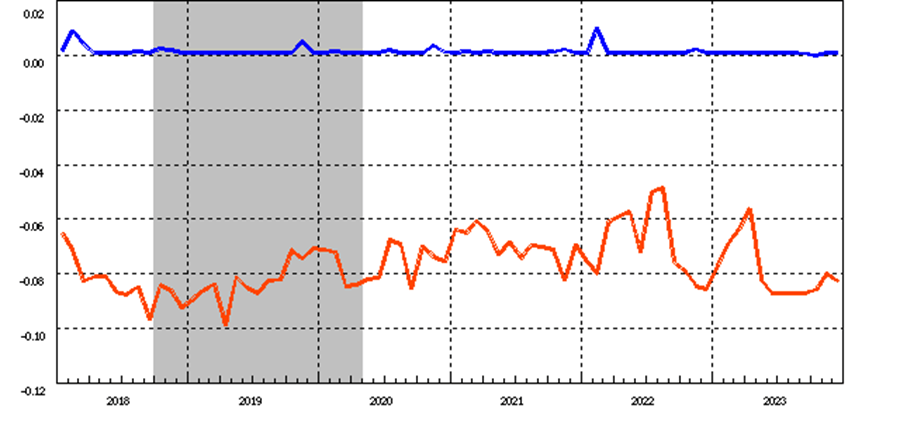

BoJ interest rates: Five-year highs vs lows

The Blue line is the 0 line and positive rates while all rates below the blue line are negative rates. The bottoms at – 0.10 = 0.90 and -0.12 = 0.88. A higher negative = lower rates. A lower negative = higher rates. This is a 5 year chart from 2018 to 2023 and represents BOJ interest rate quite well.

This chart from -0.02 = 0.98, -0.04 = 0.96, -0.06 = 0.94, -0.08 = 0.92, -0.10 = 0.90, -0.12 = 0.88. No such concept as a negative interest rate as all interest rates are positive. The presentation is negative and represents a negative scale. BOJ rates must convert to positive rates as an extra step to factor USD/JPY and all Japan's financial instruments.

Note -0.08 at 0.92. The current rate is 0.90. A BOJ raise must be -0.08 as the BOJ Shinici stated in August. Recall Shinici is a BOJ member and represents the BOJ board from northern Japan.

This chart is deceptive as it states rates traded from highest to lowest from 0.90 to 0.96. Today’s topside rate is 0.98. Tona rates trade 0.98 today.

Always caution when it comes to the BOJ especially interest rates as this is the same as asking Aunt Sally to look into her wallet for money.

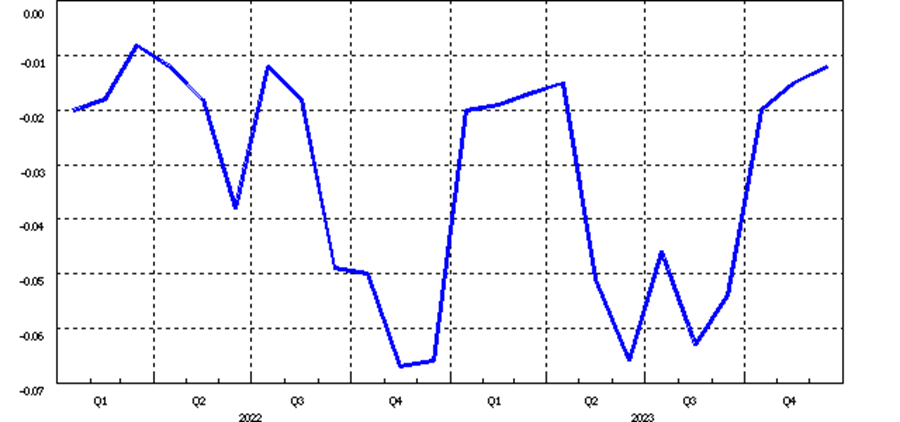

More representative of current BOJ interest rates is posted below as 1 year from 2022 to 2023

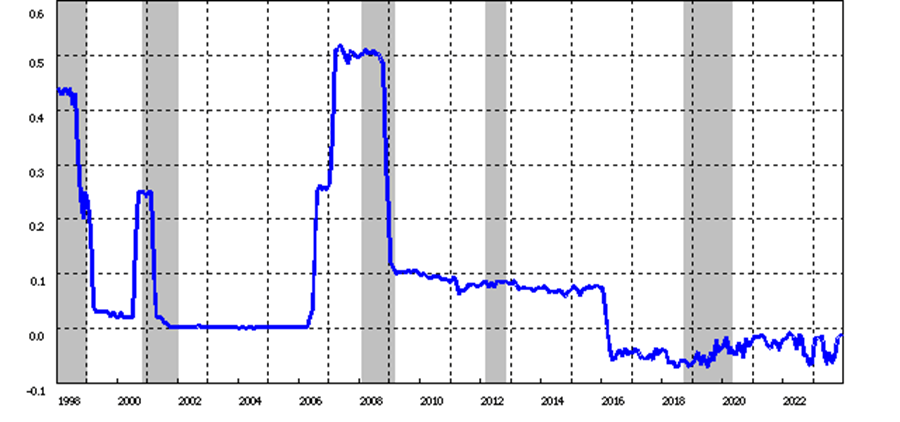

Below is BOJ interest rates from 1998 to 2023 or a 25 year chart. The deception is negative interest rates fail to capture today's interest rate story while the vast majority of the chart highlights when BOJ rates traded positive.

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.