BoE Preview: Cautiously hawkish, hints on tightening?

- The BOE will likely maintain its policy unchanged, focus on future moves.

- Chief Economist Andy Haldane will leave the central bank after this meeting.

- GBP/USD could advance toward the 1.4100 figure on a hawkish BOE.

The Bank of England will announce its latest decision on monetary policy on Thursday, June 24. This particular meeting will not include fresh macroeconomic projections, due in August, nor a speech from governor Andrew Bailey.

Inflation hints at sooner rate hikes

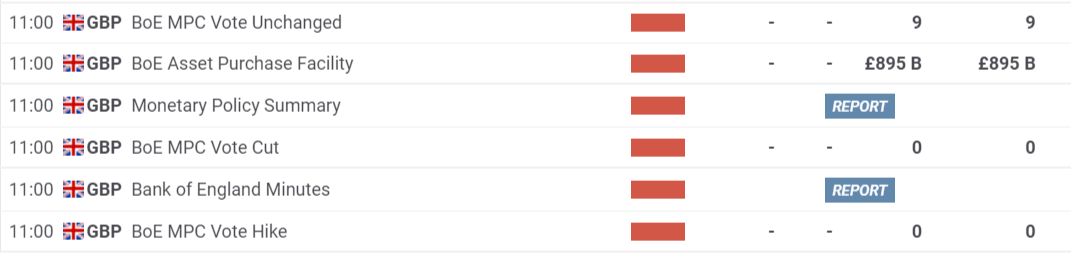

The MPC is widely anticipated to keep rates and the current facilities programs unchanged. Policymakers already announced the central bank would be reducing the pace of its gilts purchases from £4.4bn a week to £3.4bn back in May, and no other measures will join this one, at least this time.

Instead, the focus will be on how the Monetary Policy Committee will react to rising inflation. As the UK gradually reopened the economy, the consumer price index shot above the BOE’s target. UK’s central bankers have been hawkish as of late, hinting at rate hikes in 2022, which are partially priced in. If Thursday’s statement suggests a possible move in the first half of the year, the pound would likely rally.

Attention will also focus on how the committee votes. Back in May and on rates, the MPC voted 9-0 to keep them on hold in May, but about government bond purchases, the result was 8-1, as Chief Economist Andy Haldane vote in favour of reducing bond purchases. Worth noting that Haldane is leaving is the central bank after this meeting, which will lose one of the most hawkish members.

Also, the central bank is expected to maintain a pinch of caution due to the uncertainty related to a possible third coronavirus wave in the country. Nevertheless, policymakers can’t ignore upbeat macroeconomic figures from the second quarter of the year and would need to react to it rather sooner than later.

Possible effects on GBP/USD

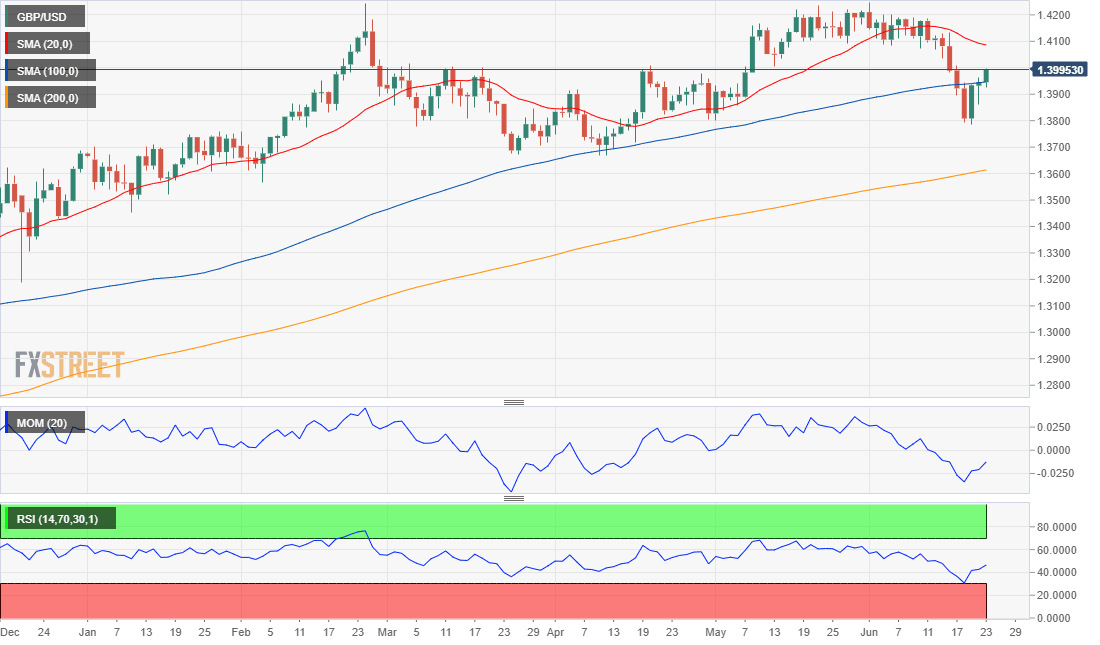

The GBP/USD pair lost the 1.4000 level on the back of the dollar’s demand. UK headlines have had a limited impact on the pair, despite being mostly discouraging. Tensions with the EU amid the Northern Ireland Protocol and the latest delay on lifting lockdowns are still in the eye of the storm.

Investors anticipate a hawkish outcome, which should, in turn, boost the pound. Clear hints on rate hikes next year of a change in the number of MPCs voting in favor of trimming QE will be the main catalysts.

The pair could approach the 1.4100 figure on a positive response but would need to hold above the level after the dust settles to have room to extend its gains in the next sessions. The risk will turn bearish on a break below 1.3930, where the pair has its 100 SMA in the daily chart.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.