BOE Preview: Carney to cause carnage with a hawkish cut? Four scenarios for GBP/USD

- There is a 50-50 chance that the BOE cuts rates in its January decision.

- High uncertainty about this decision and the next one is set to trigger high volatility.

- There are four different scenarios that will determine the pound's moves.

It does not get closer to this – bond markets price even odds for the Bank of England to cut rates on January 30. Investors usually have a clear picture of the upcoming policy moves by central banks, leaving the nuances in the statement to have its impact. This BOE decision is the rare case of high uncertainty about the decision itself – implying high volatility. GBP/USD could move hundreds of pips.

Background: BOE dovishness, weak data, upbeat data

While the UK elections provided a dose of clarity about Brexit, the UK's upcoming exit from the EU – due one day after the bank's decision – has left its scars on the economy. It is still unclear what shape future EU-UK elections will have.

Mark Carney, Governor of the Bank of England, signaled that his institution's action could be "prompt." His words were echoed by his peers at the Monetary Policy Committee. Gertjan Vlieghe – who previously signaled the BOE's short hiking cycle – went further and said that if data does not improve, he will vote for a rate cut.

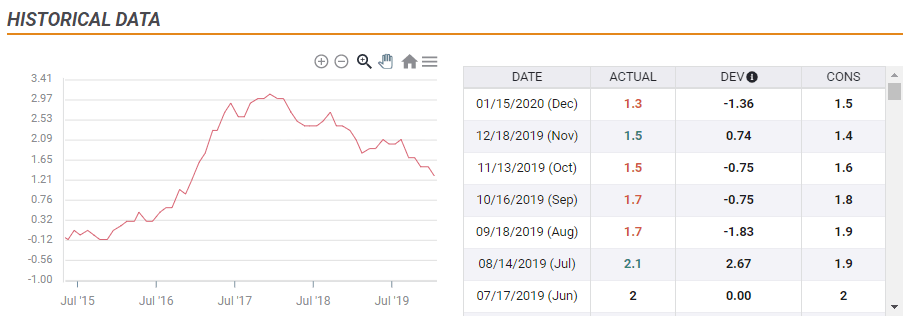

And then the data worsened. Retail sales plunged in December for the second time in a row, the economy squeezed in November and inflation – which the BOE targets – decelerated to 1.3% yearly, the lowest since 2016.

Falling UK inflation

A rate cut seemed unstoppable after this trio of devastating figures, and the pound plunged. But then came a trio of upbeat data, which triggered fresh uncertainty. The jobs report showed that unemployment remained low at 3.8% and the Confederation of British Industry's Industry Trends – usually ignored by markets – surprised to the upside and sent sterling surging.

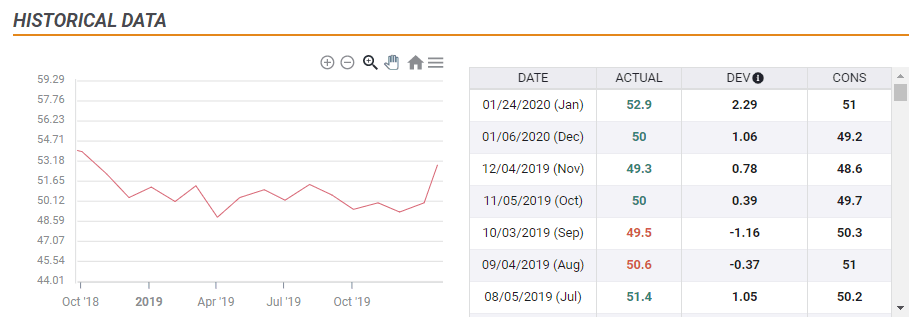

The last upbeat figure came from Markit's forward-looking Purchasing Managers' Indexes for January, providing fresh insights of business sentiment after the elections. They showed a return to meaningful growth in the services sector. And while the Manufacturing PMI also came out above forecasts, it fell short of the 50-point threshold that separates expansion from contraction.

UK Services PMI through January 2020

If that was not enough, it is essential to remember that this meeting is the last one overseen by Carney. Andrew Bailey will take over at the helm in mid-March.

Uncertainty is, therefore, high not only regarding this decision but also about the next one. The BOE's new policy is unlikely to receive unanimous support, and the number of dissenters could also impact the pound.

Here are four scenarios for the decision and GBP/USD.

1) Cut, but no commitment – GBP/USD down, then up

The dovish comments by BOE officials and weak figures – especially inflation – may lead the BOE to cut interest rates now. Carney may wish to lower the burden from Bailey and not force his successor to change the bank's policy in his first meeting.

However, in this scenario, the BOE refrains from hinting about future decisions. That would give Bailey some breathing space and could allow the bank to see if the rise in business sentiment is the beginning of a decisive turn in the economy in the first quarter.

GBP/USD would initially dip, as a rate cut is not fully priced in and would deepen if it is widely supported. However, as time passes by, sterling has room to rebound as some investors would see January's move as a "one and done" or a "mid-cycle adjustment" to borrow a phrase from the Federal Reserve. The pound's bounce could be especially pronounced if there is a high number of votes against the move and if one of those is the outgoing governor.

The probability of this "hawkish cut" is high due to the BOE's comments.

2) No cut now, probably later – GBP/USD up, then down

Upbeat real wage growth and improving PMIs could cause the BOE to hesitate and wait a bit longer. In this scenario, Carney would deem it "too close to call" and would leave the final decision to his successor. However, the bank could send a clear message that a cut is coming, and only surprisingly, strong data could hold it back.

In this scenario, which is a mirror image of the previous one, the pound's reaction may be the exact opposite. GBP/USD would initially rise on the surprising decision to hold rates unchanged before realizing that it is only a temporary delay. It could later grind down.

The probability is medium-high.

3) No cut and a lack of urgency – GBP/USD rallies

In this bullish scenario, central bankers focus on business surveys and perhaps rely on external factors such as the Sino-American trade deal to lift the economy. While they do not close the door on cutting rates, Carney, and co. see the glass full and hint there is no urgency to lower rates.

GBP/USD would leap in this case, and perhaps the rally could last several days. However, the probability is low as the bank would ignore recent adverse figures.

4) Cut now and cut later – GBP/USD crashes

This outcome is the most dovish one and would include not a rate cut but a warning that no immediate rebound is likely in the economy, opening the door to further reductions. The BOE may see wage data as outdated and instead focus on weak inflation and poor retail sales.

In this scenario, the pound would free fall. The probability is low as it would tie Bailey's hands and also ignore several positive figures.

Conclusion

The exceptionally high level of uncertainty regarding the BOE's rate decision is set to trigger high volatility. The most likely scenario is for a rate cut yet without a clear message about the next moves. The second option is for holding rates but signaling a move next time. In both cases, the voting pattern, as seen in the meeting minutes, is also essential to the reaction. A hawkish hold would trigger a rally while cutting rates, and committing to more would send sterling tumbling down. Both cases have low odds.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.