BOC Preview: USD/CAD set to surge on a dovish message after a 75 bps hike

- The Bank of Canada is set to hike rates by 75 bps to cool a heating economy.

- Slower job growth in June may prompt officials to signal a slower pace of increases in the next meetings.

- A lack of overly hawkish guidance could trigger a downfall for the Canadian dollar.

The world has changed – even sleepy Canada – and a hawkish interest rate hike is probably insufficient to boost a currency. For those unaware with the term, a hawkish hike means going beyond increasing borrowing costs to promising to do even more in the next meetings. I think that the upcoming Bank of Canada decision will fail to result in promises to do more.

Economists expect the BOC to lift rates by 0.75% to 2.25%, an extraordinary pace in normal times. These projections formed after the Ottawa-based institution published a report showing that inflation expectations have substantially risen. When people say it will rain tomorrow, it may either rain or not – but when everybody expects prices to rise, it is a self-fulfilling prophecy. Buying in anticipation of higher prices pushes costs higher.

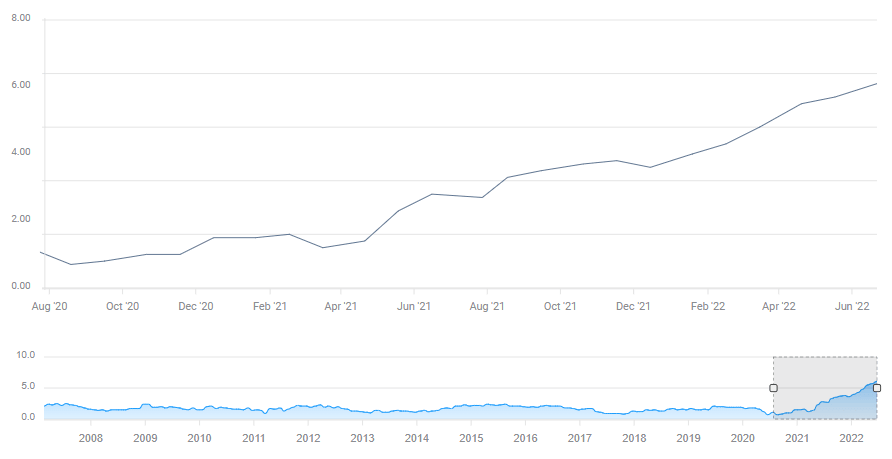

Elevated inflation expectations come on top of already accelerating price pressures. These are not limited to energy and food, but also to everything else, as the Core Consumer Price Index (Core CPI) shows:

At 6.1% YoY in May, they beat expectations for the fourth time in a row:

Source: FXStreeet

Dovish hike

High inflation and expectations for even higher price pressure are behind the expected 75 bps rate hike. However, there are reasons to expect the BOC to refrain from promising to do more – a move that would weaken the Canadian dollar.

First, the northern nation has seen its housing sector suffer from a bubble that is gargantuan even for a country that has averted any fall in prices. An increase of 50% in two years is something else. Fears of hurting the economy when people's largest investment is already tumbling will likely hold the BOC back.

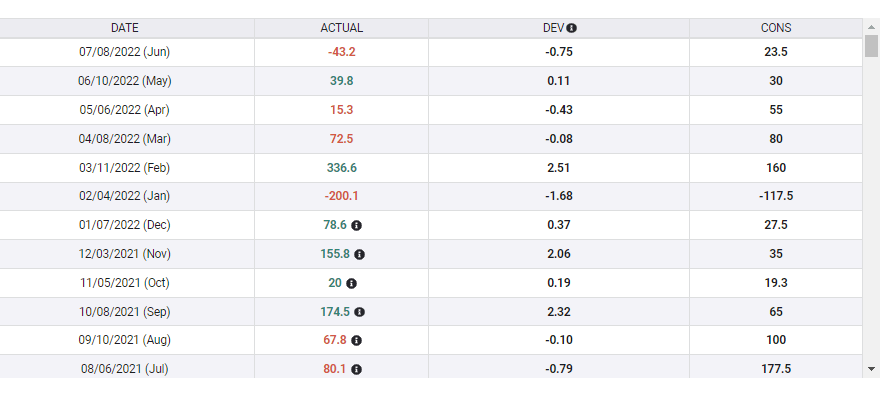

Another reason to expect a more moderate tone from BOC Governor Tiff Macklem and his colleagues is the recent fall in jobs. Canada lost 43,200 positions in June, far worse than an increase of 23,500 that was expected. This nasty turn came while the US enjoyed another larger-than-expected Nonfarm payrolls report. As some 75% of Canada's exports go to its southern neighbor, the sudden drop in jobs seems like a warning sign – the Canadian economy may already be slowing down.

Source: FXStreet

All in all, a 75 bps rate hike is priced in, and unless the BOC commits to another such move in the next meeting, there is room for a "buy the rumor, sell the fact" response – a drop in CAD.

Even if my analysis is wrong and the BOC pledges to do more, recent reactions to hawkish hikes from other places like Australia, New Zealand and the UK have failed to boost their respected currencies. Canada is unlikely to be different.

Final thoughts

It is essential to note that the US releases its inflation report just 90 minutes before the BOC decision, potentially rocking USD/CAD and distorting positioning. Nevertheless, it is hard to see USD/CAD falling sharply.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.