BoC: On hold but keeping its powder dry in its full-year forecast, 1.36s-1.5050s FX playbook

- BoC on the cards this week, and FX is at stake if RBA was anything to go by.

- Volatility is the name of the game, although the BoC is expected to stay on hold, the devil is in the detail.

- COVID-19 expected to keep USD underpinned and weigh on commodity-FX, bulls looking for long term game to 1.5050s.

- Downside target comes in at a 61.8% Fibo, bulls seeking to buy the dip, low 1.36's.

The Bank of Canada is scheduled this week on the economic calendar and is expected to keep rates on hold. However, as ever, as w saw with the Reserve Bank of Austalia, markets will be tuned into the rhetoric surrounding the central bank's outlook for the economy and subsequent implications for quantitative easing measures pertaining to COVID-19.

Between now and the last fixed announcement date, the BoC has cut rates by an additional 100bps, launched Large Scale Asset Purchases (LSAP), and announced direct support for BAs, Provincial T-bills, CP, and CMBs. As it stands, the BoC O/N rate is at 0.25% its Large Scale Asset Purchases is at $5bn per week. It is likely that considering how much stimulus has already been pumped, markets are potentially writing off this meeting around.

However, the RBA should be a template that FX strategy may wish to take note of, considering how far the Aussie moved on the hint of a taper. At this point though, it would be widely expected for the BoC to keep its powder dry and remain on the cautious side, signalling its uncertainty towards the economic outlook and the impact of COVID-19, ready to act further should the situation deteriorate. In Canada, more than 650 people have died as of April 12 and overall death projections for the country are between 11,000 and 22,000, according to the Public Health Agency of Canada last week.

The COVID-19 crisis has lead to a shutdown in economic activity, so growth forecasts are expected to be highly negative for the first half of 2020. If there are any optimistic points of view for further out, and leading into 2021 even, then presumably the markets will see that as a signal that tapering will be on the minds of the central bank. "If the BoC forecast errs on the optimistic side (-3.0% or higher on 2020 GDP) then it would imply a lower bar to additional asset purchases or rate cuts. Conversely, if the BoC takes a more pessimistic path (-5.0% GDP growth or below), it would suggest that they believe their announced policy stance is appropriate," analysts at TD Securities explained.

"Economic projections should show a sharp contraction in H1 while full-year forecasts will provide more insight towards the path forward. We do not think the Bank is finished yet, but we expect further policy support will come from the next Governor," analysts at TD Securities argued.

While rates are expected to be on hold, the Large Scale Asset Purchases will be under scrutiny and possibly subject to an adjustment via the QE programme. The purchases at the mont are spread across the curve and given that it has only just been implemented, the bar is relatively high for an adjustment so soon and purchases are more likely to remain at a minimum of $5bn per week. CMB purchases, on the other hand, could be more subject to a tweak, currently limited to just $500mn per week.

FX implications

USD/CAD is at the mercy of COVID-19 and oil markets. On Sunday, 12th April, there was a decision made by OPEC+ to cut daily production by 9.7m bbls per day. More on that here, but that can help to unwind some pressure off the loonie due to its positive correlation to oil prices. However, the stark reality is that Canada’s traditionally strong oil and gas sector is confronted with both cyclical and structural change and there is still no getting away from the uncertainty and demand shock to the market with inventories sky high and still plenty of time for sellers to flood the market until the production cuts to kick in next month. Instead, the CAD will trade as a commodity complex-currency and risks remain tilted to the downside, with dips in USD/CAD a potential buy which brings us nicely to the longer-term charts, looking for structural support points.

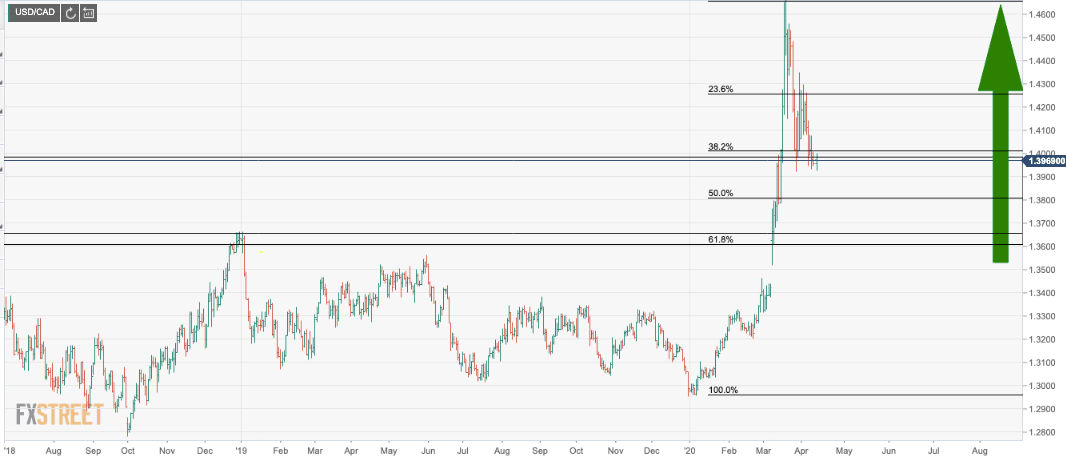

We have support structure into the 1.3600/50s for downside potential taking the funds nicely into a 61.8% golden ratio retracement target on the daily outlook:

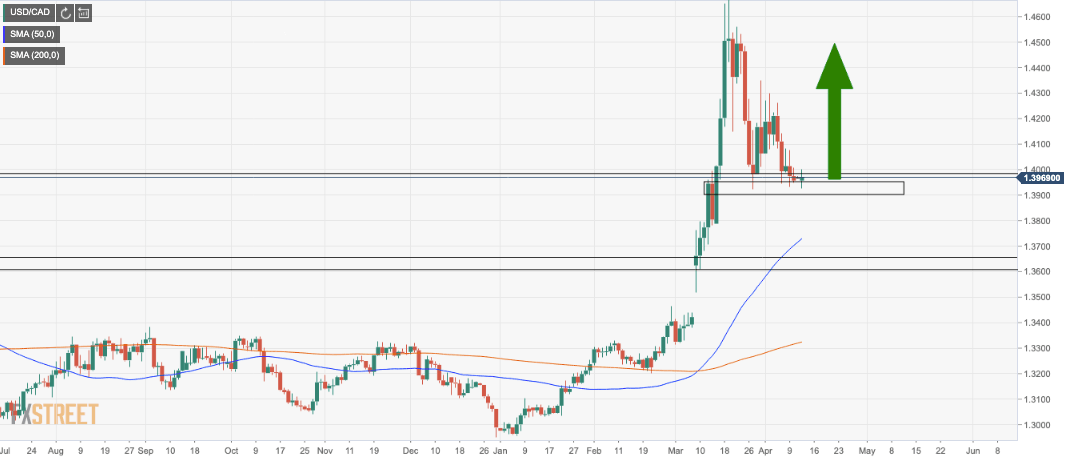

On the other hands, should the recent price action's structure be respected, then we have a bullish scenario:

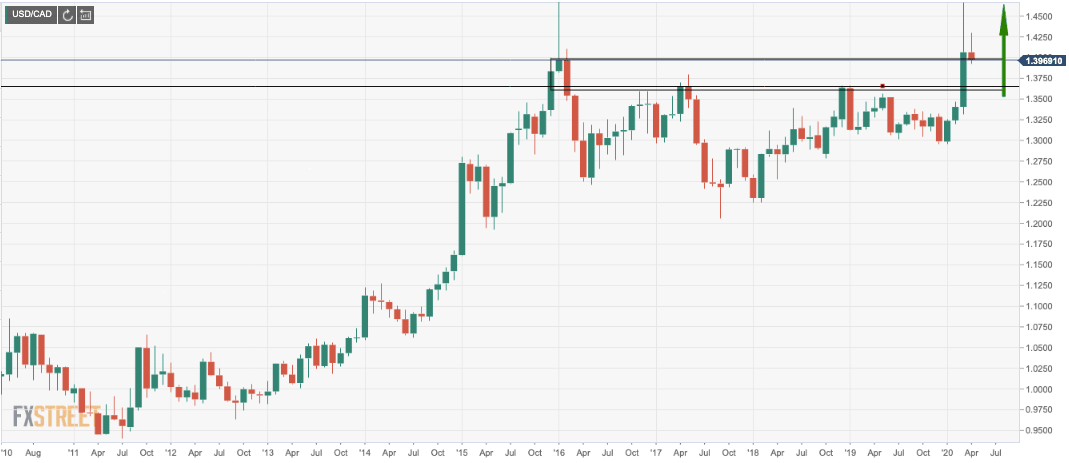

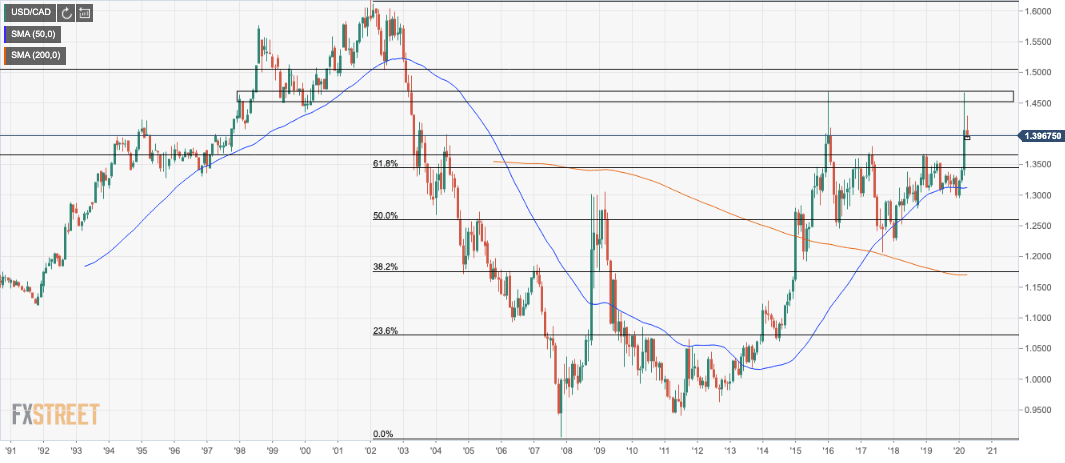

In conclusion, in the absence of a V-shaped recovery sentiment, the risk sentiment is likely to keep the US dollar underpinned and a high volatility environment and the commodity-complex well anchored for the foreseeable future. 1.5050 could be on the cards on a break and hold above the long term resistance in this latter phase of accumulation back towards the 2002 highs:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.