US higher inflation report puzzles markets

Previous week’s events (week 08-12.01.2024)

Bitcoin

Multiple asset managers have applied for Bitcoin ETFs since 2013. The market had eyes on the progress of these applications due to their significance in how investors gain exposure to the price of Bitcoin. With a spot Bitcoin ETF, the complications and risks of owning Bitcoin directly are no longer in place making it more attractive and accessible to invest.

Last week, on 10th Jan, the day of the related ETF approval deadline, a post sent from the Securities and Exchange Commission (SEC) account on the social platform X/Twitter announced the long-awaited approval of a Bitcoin exchange-traded fund causing a shock in the market and a jump in Bitcoin’s price, reaching near to 48K USD. Price soon reversed as it was officially announced later that the post was “unauthorised”, and that the agency’s account had been “compromised”.

Eventually, on the same trading day, the U.S. SEC approved the applications from ARK Investments, BlackRock and Fidelity, among others. ETFs will be listed on Nasdaq, NYSE and the CBOE.

US inflation

The U.S. Inflation report shook the markets affecting major FX pairs and related major assets such as Gold. A higher-than-expected figure triggered an intraday shock followed by high levels of volatility. Policymakers might review their expectations and start cutting interest rates later than when they intended due to uncertainty in the direction of inflation’s future path which might be significantly away from the target level of 2% for a long period of time. The Central Bank's policy rate is now in the 5.25%-5.5% range.

The monthly Inflation figure rose 0.3% in December after increasing 0.1% in November. The yearly Inflation figure rose 3.4%, more than the 3.2% forecast.

Policymakers were paying close attention to the release of price data as the Federal Reserve has revealed their intentions for rate cuts this year and probably sooner than they should. Of course, statements commenting on the figures followed. In his statement, President Joe Biden highlighted the fact that the year 2023 ended with inflation significantly lower, with prices of goods and services that are important for American households dropping to desirable levels. This was achieved, he said, while growth and the job market have remained strong. Unemployment claims remain high just above 202K. The NFP was reported way higher than expected last week and the Jobless rate was reported lower than expected, stable at 3.7%.

The dollar index, remarkably, remained stable after a quite volatile trading day. One-side direction movements did not hold for most assets.

The PPI data report on Friday showed that U.S. producer prices unexpectedly fell in December, a different picture than the CPI report. The PPI has declined for three consecutive months, suggesting inflation would continue to subside, boosting expectations of rate cuts to actually happen at the expected period.

Financial markets remain hopeful that the Fed will start cutting interest rates in March, though most economists are leaning towards May or June, given the labour market's resilience.

Currency markets impact – Past releases (week 08-12.01.2024)

Server Time / Timezone EEST (UTC+02:00).

-

The Swiss Consumer Price Index (CPI) remained unchanged in December 2023 compared with the previous month. The CHF appreciated greatly against other currencies. EURCHF dropped near 20 pips at the time and reversed soon after.

-

Inflation in Tokyo keeps slowing as per the report at 1:30, taking pressure off BOJ as the numbers get lower and lower for the second straight month in December. No major shock was recorded at the time of the release.

-

Retail Sales in Australia beat expectations, increasing by 2% versus the expected 1.20% indicating improved risk appetite. No major impact on the market was recorded upon release.

-

The monthly figure for the unemployment rate in Europe surprisingly fell to 6.4% in November from 6.5%. No major impact was recorded in the market due to this release.

-

Inflation in Australia is lowering significantly. The core inflation also eased sharply reinforcing market expectations that interest rate hikes are no longer needed. The AUD was affected at that time negatively with sudden but no strong depreciation that soon faded. No major impact here.

-

U.S. inflation, the key figure for this week, was reported higher than expected, a surprise that challenged the views for rate cuts soon. At the time of the release, an intraday shock took place and the USD appreciated momentarily experiencing a jump and an immediate reversal, a crash. Soon after the CPI figures were released, the Dollar started to gain strength again steadily but with relatively high speed causing it to move significantly upwards before it experienced a fool reversal once more.

Forex markets monitor

Dollar Index (US_DX)

The dollar index has been moving sideways this week, remaining at stable levels. The U.S. inflation reports taking place on the 11th and 12th Jan have affected the USD greatly causing the index to deviate significantly from the mean and increase volatility. However, the index experienced strong reversals back to the 30-period MA remaining on its sideways path. It currently seems that there is an upside preference as it breaks the highs.

EUR/USD

The pair has been moving to the upside steadily since the 8th Jan and above the 30-period MA but on the 11th Jan, this upside movement was interrupted heavily with the release of the U.S. inflation report. The dollar had seen strong intraday appreciation during the release causing the pair to drop and reverse from the upside, crossing the 30-period MA on its way down. It found resistance at near 1.093 before reversing back to the mean. Volatility levels were high as the market was acting heavily also amid the release of the PPI report the next day, 12th Jan. The mixed figures, higher CPI, and lower PPI caused the pair to remain stable and as volatility levels dropped a triangle formation was formed as depicted. The price is moving while under the MA, signalling a potential downward breakout.

Crypto markets monitor

BTC/USD

Bitcoin fell lower on the 10th Jan reaching support at near 44300 USD before reversing, returning back to the MA just before the SEC announcement for approval. U.S. regulators eventually approved Bitcoin ETFs, dramatically broadening access to the 15-year-old cryptocurrency and its price experienced an intraday shock with high volatility. The price eventually settled near 46K USD as volatility calmed. On the 11th though, bitcoin saw an upward movement during the time the inflation report was released, for the U.S. Its price reached the resistance near 49K USD and, soon after, it experienced a sudden drop back to the 30-period MA. It remarkably dropped from the mean near 46K USD and moved a lot lower to the support near 42K USD before retracing to the MA and settling close to the 43 USD level.

Next week’s events (15 - 19.01.2024)

WEF annual meetings are held in Davos and attended by central bankers, prime ministers, finance ministers, trade ministers, and business leaders from over 90 countries.

Canada and the U.K. this week are releasing their inflation reports.

It's clearly a Retail Sales report week as well. We have reports taking place for the U.S., China, the U.K. and Canada.

Currency markets impact

-

On the 16th Jan, the Claimant Count report will be released and expected to show a higher number. Average earnings are expected to have grown slower. These data are going to provide important information about the recent employment situation and the GBP could be affected greatly with a moderate intraday shock for pairs.

-

At 15:30 the same day Canada’s inflation figures are going to be released. The CAD pairs will probably be affected by an intraday shock. The monthly figure is expected to be reported significantly lower. It could be the case that we will see a surprisingly higher figure, but the CAD is not expected to be affected heavily during that time.

-

On the 17th Jan, the U.K.’s inflation report will be released causing GBP pairs to experience high volatility. The UK inflation rate is currently at 3.9% and it is now expected to be reported lower, but only to 3.8%. A higher figure could cause a high impact since it will add to BOE’s pressure to keep rates high.

-

Retail Sales reports for the U.S. could cause more volatility than normal at 15:30. The market expects higher retail sales figures, a forecast probably correct since the seasonal factors proved to play a role in the economy and spending was strong during the holiday season. The USD pairs could see moderate volatility during that time and more steady movements or retracements from early moves that happened prior to the report releases.

-

On the 18th at 2:30, the employment data for Australia is going to be released shedding some light on how the labour market is affected by elevated rates. The cash rate is held at 4.35% currently and the employment change is expected to be reported lower. Due to season factors this might not be the case though and a surprise is possible, thus creating retracement opportunities when the AUD pair deviates from the mean during that period, the Asian session.

-

The U.K. retail sales are reported on the 19th Jan and could create moderate volatility for GBP pairs after 9:00. Canada’s retail sales reports are expected to be released at 15:30 affecting the CAD pairs. In both cases, we see grim expectations as the figures are way lower, negative figures. Surprises are possible, meaning that these figures could be showing exaggerated views, especially for the reported period, thus volatility will potentially rise to high levels during the time of the releases.

-

UoM Consumer Inflation expectations reports are released the same day and the USD could see some intraday shock at 17:00.

Commodities markets monitor

US Crude Oil

The resistance at near 74 USD/b was broken on the 12th after Crude’s price tested that level twice this week. Crude reached the strong resistance at 75 USD/b before a heavy reversal took place with the price crossing the 30-period MA on its way down reaching the support near 72 USD/b and settling near 73 USD/b eventually. Considering the volatility of this particular asset, it is probable that retracement to the upside will take place soon before any more downward movement takes place, if any.

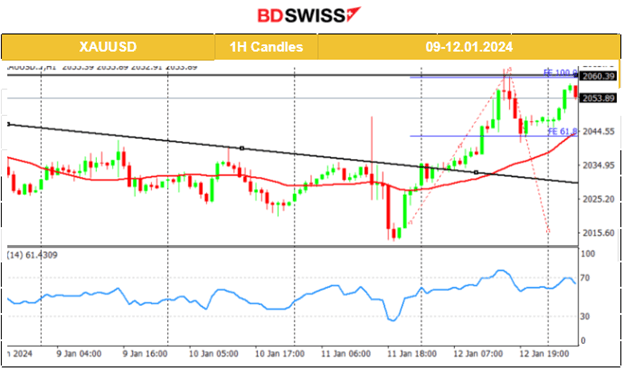

Gold (XAU/USD)

After the U.S. CPI report, Gold moved eventually to the downside significantly breaking the triangle formation, reaching 2013 USD/oz as the dollar was gaining strength. When the dollar experienced weakness during the rest of the trading day, Gold’s price reversed fully, crossing the MA on its way up and remarkably breaking the triangle to the upside. On the 12th Jan the resistance at 2040 USD/oz was broken early, nearly at the start of the trading day it steadily moved to the upside reaching 2060 USD/oz as mentioned in our previous report. That resistance proved to be strong enough causing the price to retrace back to the 61.8 Fibo level.

Equity markets monitor

NAS100 (NDX)

Price movement

This week, upon the U.S. inflation data release the uptrend was interrupted and the index dropped sharply, crossing the 30-period MA on its way down, and finding support at 16615 USD before retracing strongly upwards and settling close to the mean. This drop could be attributed to stronger USD at that time and the expectations of borrowing costs to remain elevated for longer than anticipated. On the 12th Jan its price remained close to the mean but now shows signals that the uptrend might return. A triangle formation is apparent and the price tests the 16900 USD resistance. 16950 USD seems to be the next resistance upon the triangle breakout. The alternative scenario is that a breakout to the downside takes place with the next support at 16750 USD.

Author

BDSwiss Research Team

BDSwiss

BDSwiss is a leading financial institution, offering bespoke CFD trading and investment products to more than 1.7 million registered clients, in over 180 countries.