Biggest Market Moves: Twists and turns

This week was filled with several twists and turns, as financial markets saw several historic trading moves take place. From record highs, to breakouts of support and resistance levels. Below are the moves which most peaked my interest.

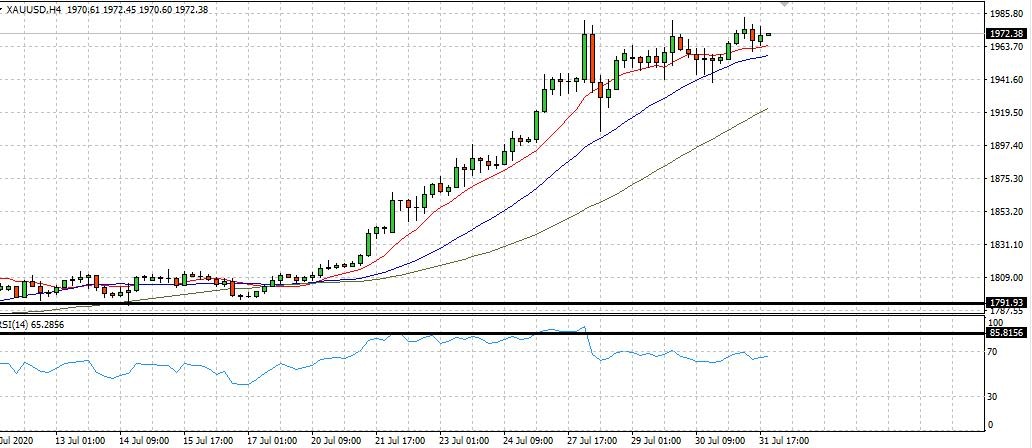

GOLD

This week Gold recorded a new all time high, trading at $1,981 on Tuesday which was the highest the metal has been priced since September 2011. Since reaching that high, the markets continue to consolidate with many now believing a big short could be on the way. This come as the run to the record high has seen RSI levels reach overbought.

EURUSD

EURUSD this week reached a 2 year high as COVID-19 cases continued to rise both in the U.S. and Europe. Wednesday’s dovish tone from FED chair Powell, also contributed to this recent bullish run, as the Euro continues to gain strength against its American counterpart. Looking at a monthly timeframe suggests that there could be further highs still to come.

Could more U.S. stimulus be the straw which breaks the camels back.

Bitcoin

Bitcoin this week rallied to its highest level since August 2018, finally breaking the key $10,000 level. The move came a day after Gold reached its record year, suggesting that investors were simply fleeing to whichever markets they perceived to be safe havens. Although the cryptocurrency gained by over $2,000 in a single move, volumes on the RSI do suggest that more moves could be ahead.

Could we see this as soon as next week?

Author

Eliman Dambell

Sayvio AI

With over a decade in financial markets, Eliman brings an experienced and diversified point of view to market analysis. He covers current and historical macro trends to give insights on Metals, FX, Stocks, and Crypto.