Beginning of the end, or end of the beginning

S&P 500 made up its mind very fast following the strong NFPs beat – and we as traders and investors timing the markets have no other better choice than to go with correct interpretation of incoming data, and the renewed macro / fundamental push these mean – I made it clear how to win no matter what in this video recorded Friday midsession (with prior calls on precious metals recovering from hits hits fast, and oil barely swinging lower intraday, were filled too).

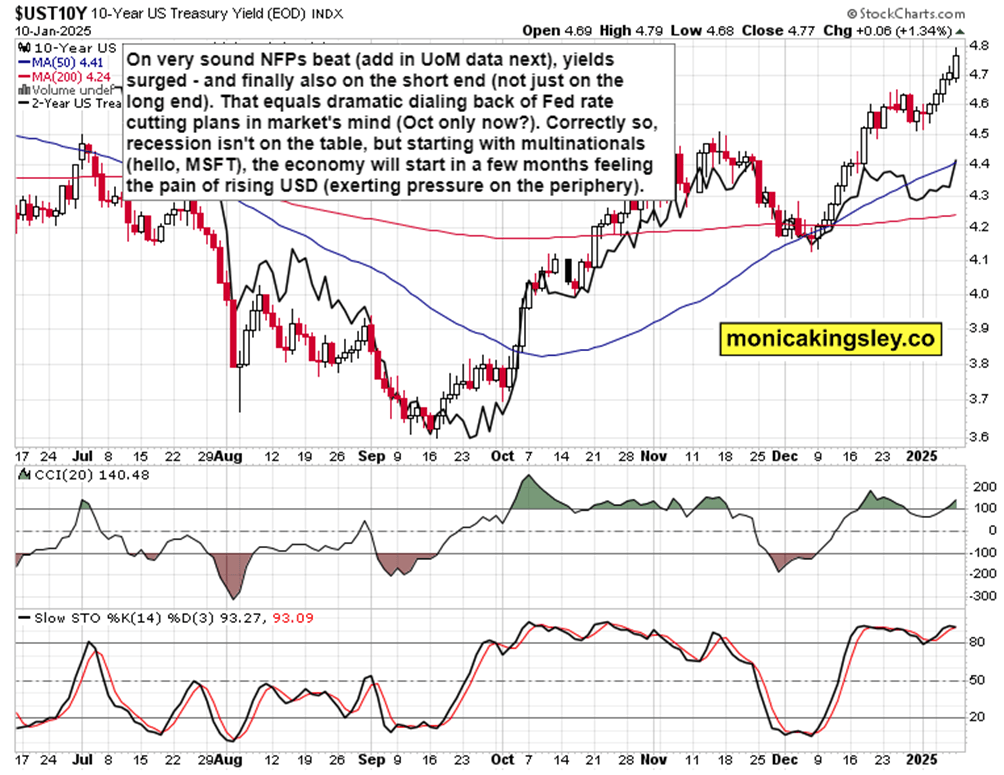

Note inside watching how and why I called for stock prices to close near the intraday lows – what else these can do given the institutional positioning? What else is the big money looking for as safe returns as possible (you seen me and heard me talking many times the equity risk premium concept) go given the inexorable march of yields higher, which was again one of the first charts I featured in this Jan 01 video (incl. the 5% breakout on 10y soon – we‘re almost there already).

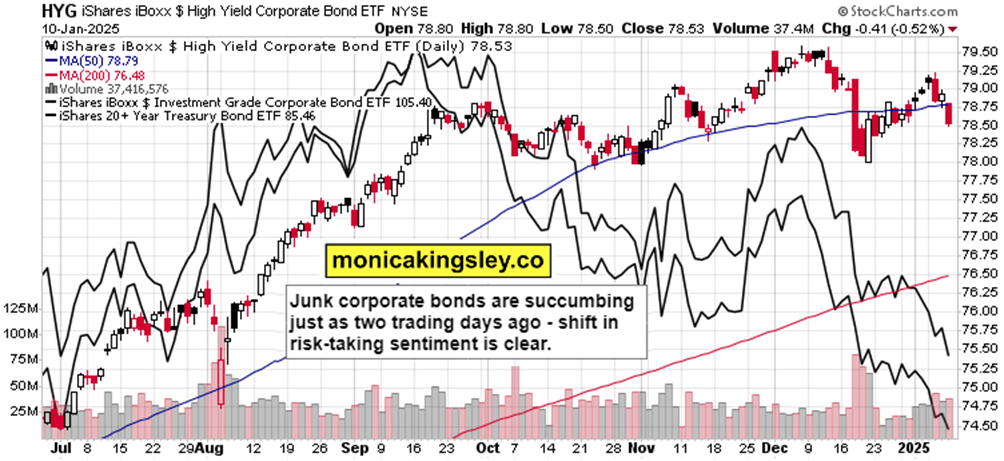

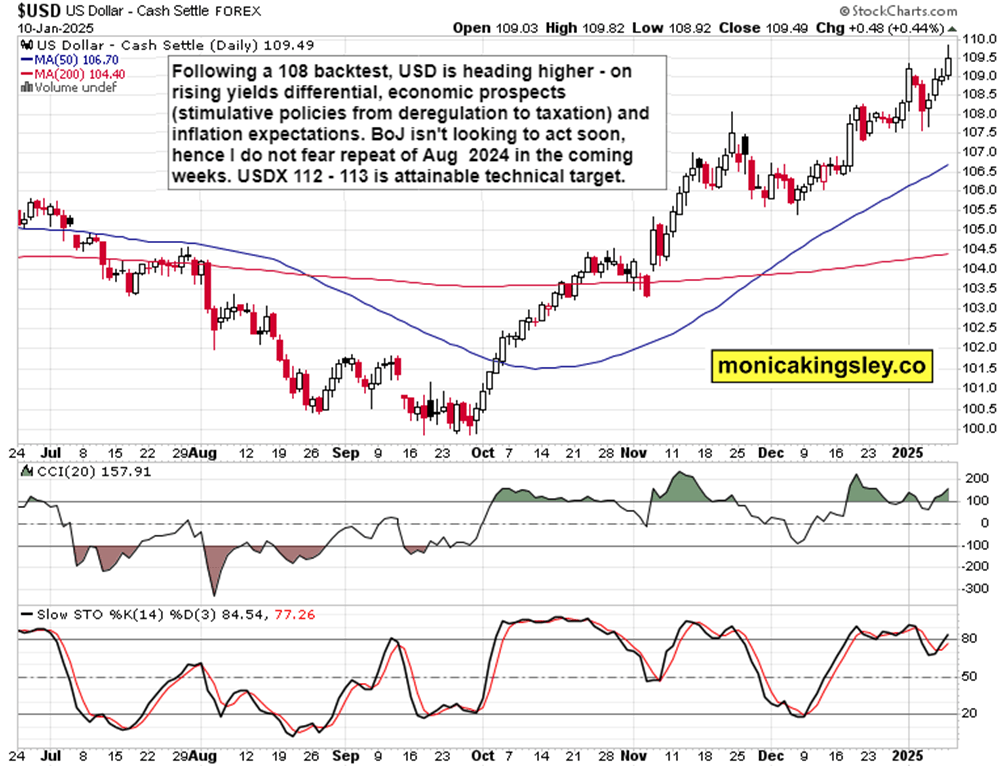

The bond market competition for equities is stark and getting stronger – and data such as Friday‘s NFPs (highlighting decreasing justification for the Fed to cut as per lofty expectations dating back to Sep 50bp emergency-feeling cut) further strengthen by not everything being rosy in the consumer land as per UoM consumer sentiment and inflation expectations, only highlights the risk of equities getting their Wile E. Coyotte moment(s) of getting doubts over earnings growth rate expectations, i.e. lofty valuations. Here and there, with force such as Friday.

Also, it‘s been weeks since I started complaining about first bearish divergencies, then outright negative readings in market breadth indicators (aka which sector is truly leading? Financials, tech, software at least?) - and now we have volume picking up and intraday rebounds (predictably) failing – and sooner rather than later, at that.

Looking at real assets, precious metals and commodities, it must be said (and I said so lately) that agrifoods got fine companions, there is relative strength emerging, and that‘s sending fine signals about market positioning/fears going into PPI and CPI (Tuesday and Wednesday).

These and more thoughts I shared Saturday with you in yet another video about the equities prospects accounting for yields, dollar and the pre-inauguration time – you remember my call back in Nov for a weak SPY start to 2025 (those poor Jan-Feb times for bulls, put mildly, and correction, put succintly).

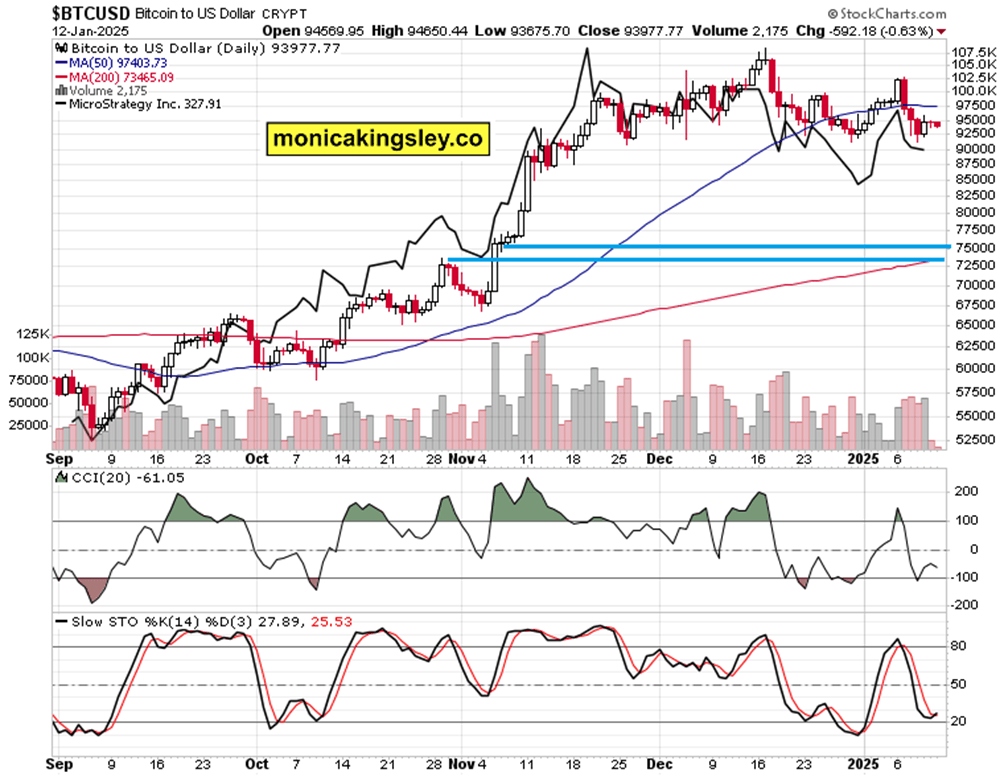

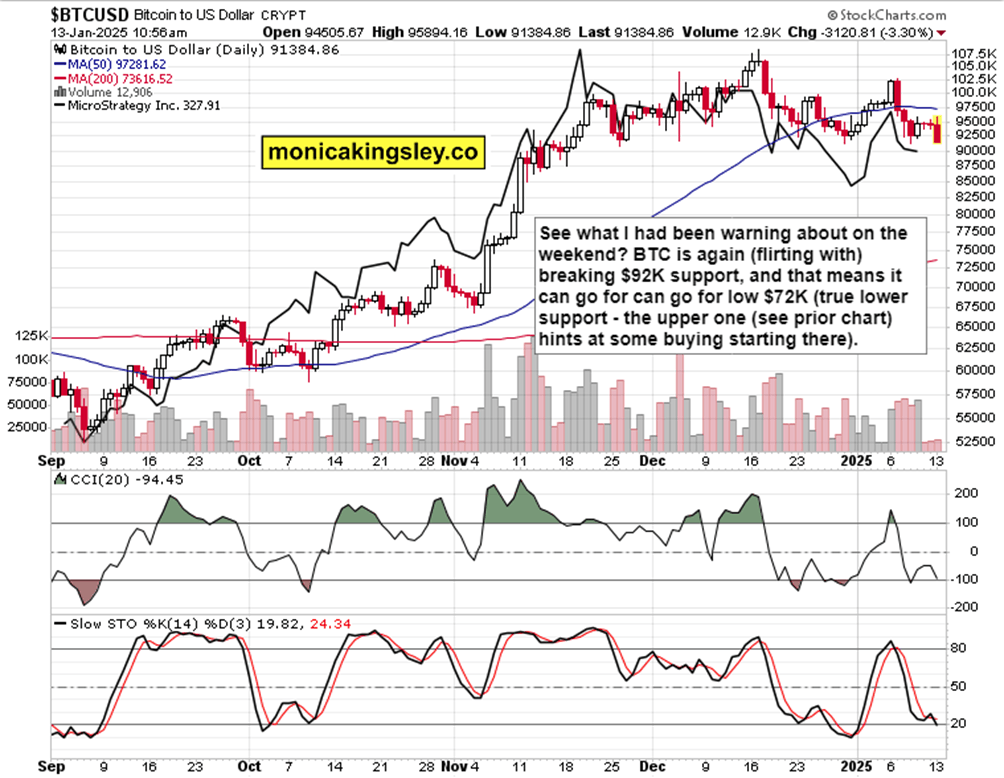

Thinking that Bitcoin holds above $92K? I can‘t be yet that certain and doubted resiliency expectations on the weekend – backtesting the low $70K area is still within the realm of possibilities no matter how well cryptos are holding for now, still. Check the Sunday chart, and then Monday premarket.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.