Bank of Japan unfazed by yen weakness

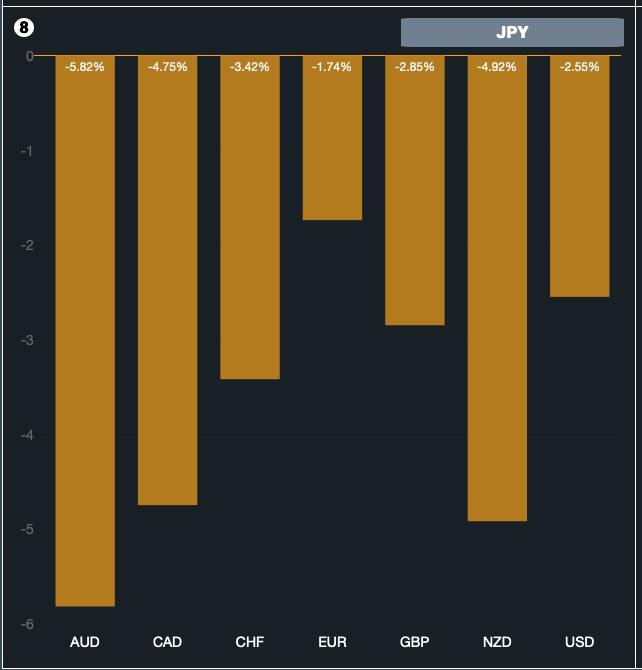

The one notable mover in October has been significant JPY weakness. This has been very marked. See below for the monthly snapshot on JPY weakness.

So, the one question that was crucial was, ‘Is the BoJ worried about this?’ The answer is ‘no, not at all. The BoJ is quite happy to see more JPY weakness. BoJ’s Governor Kuroda said:

-

JPY moving within the range of current fundamentals,

-

The yen has weakened a ‘small amount’.

With this major concern out of the way, the rest of the meeting was entirely unspectacular. The BoJ maintained policy settings with rates kept at -0.10% and the 10-year JGB yield target kept at around 0% as expected. Revisions were both made lower for core CPI and GDP. Core CPI was down to 0.0% vs 0.6% expected and GDP growth was down as well to 3.4% vs 3.8% previous. Consumer inflation was expected to rise, as even deflationary Japan shows vulnerability to inflation. The 2022 forecast for inflation is 0.9% and 1.0% for 2023.

The takeaway

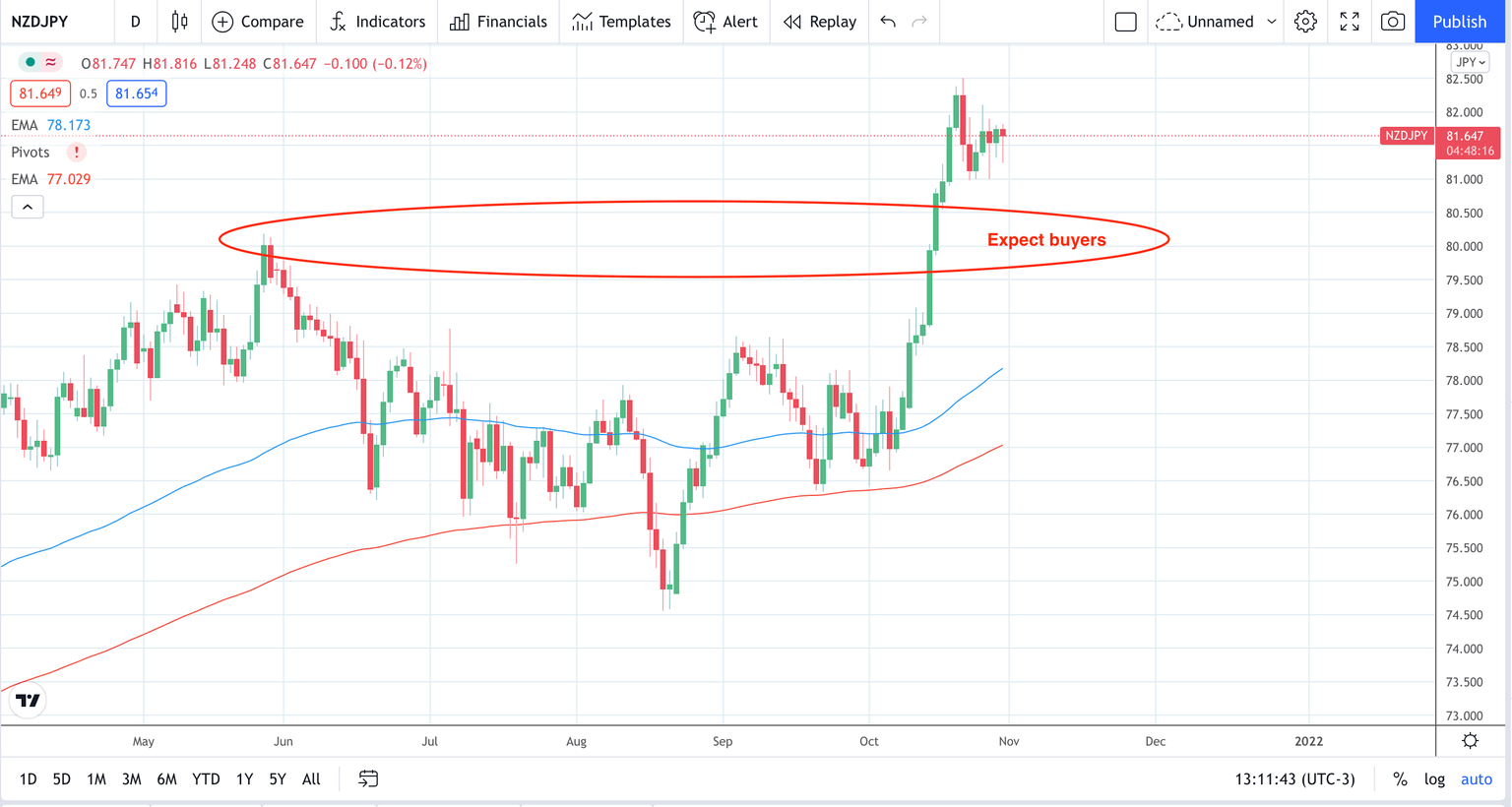

No inflation worries for the BoJ. No fears over the weak JPY. This means the JPY can remain a funding currency and is a great currency to pair with currencies set to raise rates. Dips in the NZDJPY remain medium-term buys and the BoJ meeting has done nothing to change that.

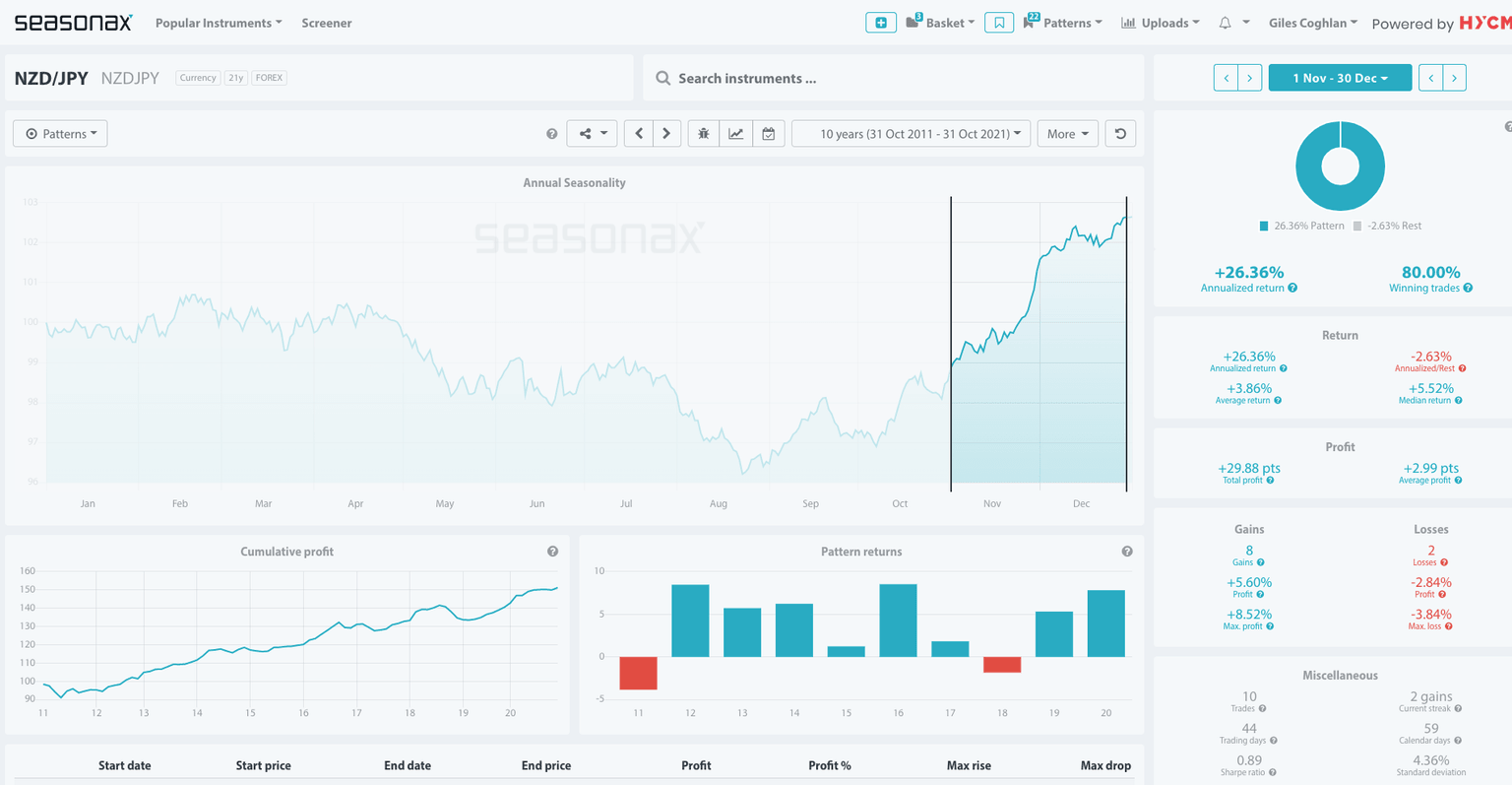

You can also note the strong seasonals that are ahead for NZDJPY as outlined below.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.